It used to be consumers all pretty much shopped the same way: if they needed something, they went to the store to get it. These days, there is still Point A, where the shopper needs an item, and Point B, where the item is procured. But like in a close relationship, consumers don’t want their favorite brand or store to treat them like “everyone else.” Today, consumers want to feel special by virtue of what they’re offered online, exclusive product launches, targeted sales and promotions, and rewards. Without that, a brand or retailer stands to lose.[quote]

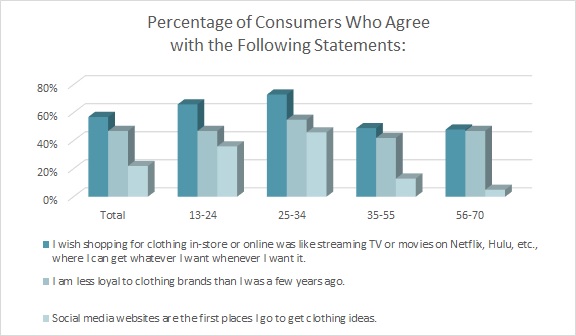

The 21st century conveniences that have made it easier to do so many things — like order a car service or your favorite food with the tap of a phone screen, or immediately watch missed episodes of favorite TV shows — have bred very demanding consumers. They want everyone to intuit their needs as quickly and as easily as possible. For instance, more than half of all apparel consumers (57 percent) say they wish shopping for clothes in-store or online was like streaming TV or movies on Netflix, Hulu, etc., “where I can get whatever I want, whenever I want it, ” according to the Cotton Incorporated Lifestyle Monitor™ Survey. That percentage jumps to 73 percent among those aged 25-to-34.

This shopping frustration could be why nearly 1 in 2 consumers (47 percent) say they’re less loyal to clothing brands compared to just a few years ago, according to the Monitor™ research. That sentiment increases significantly to 55 percent among Millennial shoppers age 25-to-34.

Retailers with physical locations could do more to attract and satisfy their customers, according to a recent study by Oracle NetSuite, Wakefield Research, and The Retail Doctor, a New York-based retail consulting firm. The study found that despite clear differences in expectation among shoppers of different generations, almost half of all retailers (44 percent) have made no progress in tailoring the in-store shopping experience.

“We have seen decades of diminishing experiences in brick and mortar stores, and the differences identified in these results point to its impact on consumers over the years,” said Bob Phibbs, CEO, The Retail Doctor. “Retailers have fallen behind in offering in-store experiences that balance personalization and customer service but there’s an opportunity to take the reins back. The expectation from consumers is clear and it’s up to retailers to offer engaging and custom experiences that will cater to shoppers across a diverse group of generations.”

For instance, the retail study found Gen Z and Millennials (43 percent) are most likely to do more in-store shopping this year, followed by Gen X (29 percent) and Boomers (13 percent). However, Gen Z values in-store interaction the least, while their older counterparts would welcome more in-store interactions.

At the Gartner Marketing Symposium/Xpo 2019 earlier this year, attendees were advised to view personalization in two ways:

— “Prove you know me.” Prove you know who the customer is, what’s important to them and tailor communications to them, such as with an email wishing a customer a happy birthday.

— “Help me.” Make it easy for customers to get what they want and need, reassure them they’ve made the right purchase, teach them something new, direct them and reward them.

Gartner contends the “Help me” approach is more effective in building relationships because it provides a clear benefit to the consumer, helping them to feel good about their purchases and to make new purchases that will meet needs. On the other hand, “Prove you know me” personalization can go wrong because it doesn’t consider consumer needs. For instance, a consumer might visit a brand website to learn how to return a product with which they were dissatisfied. They then see ads for that product each time they browse, so that rather than direct them toward a useful product, they are reminded about the purchase they did not like. Thus, when thinking about personalization, Gartner advises marketers to focus on ways to help consumers rather than simply proving their knowledge level of information about them.

Thinking about what would be helpful in their shopping journey, almost half of all consumers (46 percent) say they would like if apparel brands and retailers used information from their purchase history in order to personalize their shopping experience, and give recommendations on what to buy, according to Monitor™ research.

Further 55 percent of Gen Z and Millennial shoppers would be more loyal to apparel brands and retailers that utilized a virtual assistant, according to Monitor™ research. That compares to 34 percent of their older counterparts.

And 56 percent of all shoppers say they would likely buy clothes from a store that has the ability to match a picture of an outfit seen online through Pinterest, Instagram, or other outlets to a similar outfit offered at that store. Again, the percentage increases significantly to 68 percent among 13-to-34 year olds.

During a panel discussion at the recent Project NY men’s wear show, Moda Operandi’s Josh Paskowitz, fashion director, pointed out that another type of personalization involves the actual product.

“People are wanting products that are personalized, like the DIY stuff,” he said. “Things that are one-of-a-kind, ripped and repaired, embellished in store or customized on site. Those are all things that probably started with NikeID but have proliferated to such a degree, particularly in the luxury and designer space. Democratizing the decision about what you wear to a small degree, I really encourage that and I think has a big opportunity to grow in the future.”

That could also restore allegiance to a brand. Most consumers (70 percent) say they would be more loyal to clothing brands and retailers that let shoppers customize their clothing, according to Monitor™ research. That figure increases to 77 percent among Millennials and Gen Z consumers.

Further, more than half of all shoppers (54 percent) would be likely to buy clothes from a store that offers a personalized shopping experience with collections pulled together based on previous purchases and preferences, according to the Monitor™ research. That figure rises to 63 percent among 13-to-34 year olds.

“After all the talk about brick and mortar stores being dead, it’s interesting to see that ‘digital natives’ are more likely to increase their shopping in physical stores this year than any other generation,” said Oracle NetSuite’s Greg Zakowicz, senior commerce marketing analyst. “Stepping back, these findings fit with broader trends we have been seeing around the importance of immediacy and underlines why retailers cannot afford to make assumptions about the needs and expectations of different generations. It really is a complex puzzle and as this study clearly shows, retailers need to think carefully about how they meet the needs of different generations.”