New York Fashion Week is right around the corner and all eyes will be on the catwalk to see what’s trending for Fall/Winter 2020. Designers would do well to keep in mind that many, if not most, of those watching show coverage need clothes that go above the average runway model size of 0-to-4.[quote]

Yes, fashion is supposed to be fun and fantasy, but the reality is the product needs to sell. After the holidays, stores like Macy’s, Kohl’s, and JC Penney reported same-store sales declines. One problem could be that most clothes sold in department and chain stores run small to XL, or stop at size 12. But the average American woman wears size 16-to-18, according to the International Journal of Fashion Design, Technology and Education.

The fashion industry has been very slow to respond to the needs of the now-average American, especially considering more than two-thirds of adults are considered to be overweight or have obesity, according to the National Health and Nutrition Examination Survey. Among women, 67 percent are considered overweight or obese, with 40 percent falling in the obese range.

Bit by bit, some brands have added extended sizes to their permanent mix: Nike, Abercrombie & Fitch, Vineyard Vines, American Eagle, Athleta, Veronica Beard.

One of the biggest success stories comes by way of Old Navy. Not only is the retailer bucking the depressing trend of store closures and bankruptcies, it announced last fall that it plans to open 800 new stores and eventually reach $10 billion in annual sales. Sure, it has won customers with pricing that’s lower than its sister brands Gap and Banana Republic. But in 2018, after offering plus sizes for more than a decade online, it added extended sizes to its brick and mortar locations.

“As the body positive movement continues to challenge available size options for shoppers, brands like Old Navy are redefining what sizing actually means,” says Ronen Luzon, the CEO of MySizeID, a retail measurement tech company, that works with stores on ways to democratize sizing options. “Becoming more inclusive and carrying all size options starts with closing inclusion gaps. There are various ways to achieve that, whether it’s offering free shipping or incentives to groups of people that often feel excluded in fashion.”

If this entire segment of women feels snubbed, it can have enormous repercussions. Consider that the average non-plus woman spends $992 each year on clothes, according to the Cotton Incorporated Lifestyle Monitor™ Survey. Then note that the average plus-size woman spends $643 annually on apparel. That’s 35 percent, or more than one-third, less. And that’s an amount that could be very meaningful to any fashion brand or retailer.

In 2018, the women’s plus-size market was valued at $22.8 billion, according to Statista. That’s up from $20.4 billion in 2016 and $17.4 billion in 2013, according to Statista. The firm says the plus-size business is projected to grow to $24 billion this year.

However, the fashion industry has its work cut out for itself. In general, women looking for larger sizes don’t like shopping as much as their counterparts with 52 percent saying they “love or enjoy shopping” compared to 65 percent of non-plus consumers, according to Monitor™ research. That translates into less shopping overall: 1.76 times per month versus 2.1 times for non-plus shoppers.

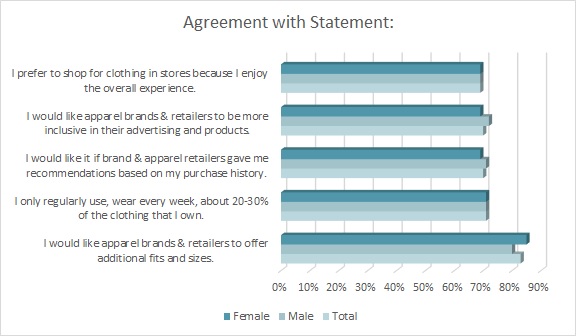

Overall, more than 4 in 5 U.S. consumers (83 percent, up significantly from 71 percent in 2018), say they would like brands and retailers to offer additional fits and sizes, according to Monitor™ research.

Fit (81 percent) is the top factor when plus-size women are making an apparel purchase, according to Monitor data. That’s followed by comfort (75 percent) and then price (70 percent). And among Boomers (78 percent), price is significantly more important.

Luzon says plus shoppers are often put off by merchants that charge more for sizes above the “standard” 12 or 14.

“The issue of charging consumers more for plus-sized clothing isn’t a new one,” Luzon says. “While it’s a ‘tough’ decision for many retailers, as it can affect their bottom line, it’s clear that Old Navy values each individual customer, treats them equally and goes above and beyond to make sure consumers feel they are being appreciated by the brand.”

The industry argument has long been plus garments need more fabric therefore they cost more money. However, petite clothes aren’t priced lower just because the items require less fabric. This pricing difference can lead to feelings of discrimination among larger women.

Jay Hakami, CEO of Skypad, a retail insights and trends platform currently working with 1,500 luxe brands across the globe including Theory, Prada and Fendi, says democratizing sizing options starts with getting rid of price disparities.

“The average woman in America wears a size 16 — so why are brands still struggling to fairly price plus-size clothing?” Hakami asks. “Old Navy is doing the right thing by evening the playing field. All consumers really want is a hassle-free retail experience, and more brands should want to reach the millions of customers they aren’t properly catering to. This opens the doors for consumers and retailers, which is a win-win situation.”

Shipping can be another point of friction during the purchasing process. Since most stores don’t carry a full selection of plus-size apparel, Ronen says many brands only offer extended sizes online. This, he says, is why Old Navy’s free shipping incentive is key.

“This makes plus-size customers feel valued, and alleviates the hassle of having to rifle through clothing racks,” he says. “Not every brand has to offer free shipping, but it is a service to bring to customers. It’s important to note that brands should utilize a technology platform to stop consumers from potentially abusing this system, as returning and shipping for free too many times can potentially be a blow to a retailer’s bottom line. It’s all about appeasing the consumer, making them feel valued and creating a more positive retail experience, while protecting the retailer as well.”

Hakami agrees.

“It’s crucial to compensate for the lack of in-store options by providing free shipping,” he says. “Not all brands have to offer this incentive if they don’t have the means to do so, but the consumer knowing that their needs are being accounted for is always a plus.”