Are women are buying more fitness apparel because they are determined to get in shape, or because ath-leisure fits the U.S. mindset at the register and on the runways? Whatever the reason, it’s a trend with (strong) legs.

Athleta’s Hannah Franco, designer, says there has been a “huge shift” in customer shopping priorities.

[quote]”Comfort, and more importantly, function are taking the wheel, ” Franco says. “We are seeing activewear become her go-to choice for outfitting throughout her entire day. So we have to fulfill her need for fashion, too. Women have such creativity and an amazing sensibility when putting together their looks for the day. We provide elevated, versatile pieces so that she doesn’t have to choose between function, comfort or fashion.”

Women’s activewear saw a 9% increase in sales in the last 12 months, making it a $14.5 billion business in the U.S., according to The NPD Group. That compares to $14.2 billion in men’s, which saw an 8% increase.

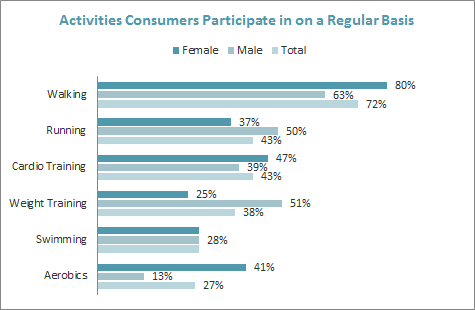

Walking is by far the most popular fitness activity for women (80%), according to the Cotton Incorporated Sports Apparel and Lifestyle Monitor™ surveys. That’s followed by cardio training (47%), aerobics (41%), running (37%), dancing (34%) and yoga (33%). Most women (47%) like active apparel for its comfort, followed by fit (22%), flexibility (17%), breathability (13%) and moisture wicking (11%). And the majority (71%) prefers that it’s made of cotton and cotton blends.

Walking is by far the most popular fitness activity for women (80%), according to the Cotton Incorporated Sports Apparel and Lifestyle Monitor™ surveys. That’s followed by cardio training (47%), aerobics (41%), running (37%), dancing (34%) and yoga (33%). Most women (47%) like active apparel for its comfort, followed by fit (22%), flexibility (17%), breathability (13%) and moisture wicking (11%). And the majority (71%) prefers that it’s made of cotton and cotton blends.

The NPD Group’s Marshal Cohen, chief industry analyst, says a combination of factors is fueling the fitness apparel movement.

“Number one, the American consumer is wearing activewear everywhere: travel wear is active; it’s in the workplace; it’s worn in the gym, and before and after the gym. It’s the go-to item to dress in a hurry or run an errand. When pajamas and a robe aren’t acceptable, activewear is. Women have taken to buying this product for a lifestyle rather than simply to work out. In fact, more than 9 in 10 women (93%) say they wear athletic apparel for purposes other than exercise according to Cotton Incorporated’s Sports Apparel Survey.

“Number two,” Cohen continues, “has everything to do with lifestyle change. For 14 years, when I’ve asked consumers about their New Year’s resolutions, the top response was food and diet — they wanted to eat better. This year, for the first time, health and fitness beat food and diet. Part of that is looking and dressing the part.”

Men’s wear may also be playing into the surge. “The young male consumer is wearing a hoodie with a blazer, and women are matching the look to say ‘I’m casual but adding a touch of dress up,'” Cohen says.

Women’s activewear is attracting attention from all fronts: Tory Burch will be entering the market, Trina Turk just launched her line at retail; Adidas has already attracted Stella McCartney, and it’s adding Pharrell Williams with an upcoming capsule collection “for everyone.” These designers join powerhouse brands like Nike, Reebok and Under Armour, not to mention Champion and Puma. Meanwhile, Nordstrom and Macy’s have expanded their activewear offerings, Lorna Jane continues to grow and, despite its controversies, Lululemon remains a serious billion-dollar player.

Meantime, Athleta is being viewed by analysts as a company that is ready to roar. In a note to stockholders, Jennifer Black, CEO and president of Jennifer Black & Associates, says Athleta is one of Gap Inc.’s “secret weapons,” with the potential to grow its retail stores internationally.

“Athleta is still in its infancy, but the product offering is growing in popularity for not only its technical features, but also for the beautiful style and design, and the feminine, fashionable touches,” Black notes. “We love how the email alerts grab your attention with the introduction of new arrivals and the company showcases a complete ensemble. She wants that…she wants to know how to put together a complete outfit. We continue to love the product offering and the summer merchandise is no exception.”

As Franco explains, making activewear an easy, everyday choice is by design.

“We want to make her clothing work hard for her so she can focus on her busy life – whether she is working out or going out.”

Women definitely wear their gym clothes at places besides the health club. The Sports Apparel survey finds women wear them around the house (86%), to run errands (69%), shopping (46%), out to eat or to a movie (14%) or to school/class (14%).

Franco says women also want pieces that work for different workouts — yoga or cross training — and beyond.

“They go for a run Monday, do yoga Tuesday and on Wednesday do Cross Fit,” she explains. “If her clothing isn’t versatile, it holds her back from getting creative with her workouts. Now, she wants these performance elements in the layering and fashion pieces she wears after the gym throughout the rest of her day. Don’t be surprised if you see bonding on a street jacket. Her sensibilities challenge us to always keep innovating.”

The lines may blur more as 52% of women say they wear a “mix” of apparel when exercising — both activewear and clothes not designated as athletic apparel, according to the Sports Apparel survey.

Of course, Cohen points out, with the newest activewear, “Women are being given the ability to buy an affordable product that’s really comfortable.”

And, Franco says, “If your favorite pants are your yoga pants, you’re more likely to decide to drop in to a class. You’re already dressed!”