When the pandemic shutdown hit last year, like it or not, apparel merchants had to face that they weren’t essential retailers. Old Navy had more than 1,200 stores in North America and each had to close its doors. It was originally expected to be a two-week closure, but obviously COVID-19 had other plans for the U.S. and the rest of the world. Old Navy, of course, views clothes as a central product. And the shutdown posed a true sink or swim moment.[quote]

“We already had buy online/pickup in store for quite some time,” said Sarah Wallis, Old Navy’s head of ecommerce, during an NRF Retail Converge panel discussion. “So we implemented curbside pickup to give our customers the ability to simply drive up, call us to let us know they were there and we’d bring their order out to them. We stood that up in just a matter of a few weeks, which is incredibly quickly for a retailer of our size. Another thing that really responded to the change in customer behavior was adding a convenience spot, which was focused on quick pick-up for customers who wanted to dash in and out of the store. We also focused on contactless payments and alternative payments online.”

Such digital pivoting not only grew Old Navy’s online customer, but it helped the company evolve and prepare for retailing’s future. In a new report titled “Ecommerce Consumer Behavior,” Octane AI, a data marketing platform for Shopify, concluded online retailers and direct-to-consumer (DTC) brands will have to personalize and humanize their online shopping experiences to capture customer loyalty. The firm thinks this is especially pertinent since it found 52 percent of consumers think their shopping habits will change once COVID-19 is no longer a factor and they’ll return to physical stores.

“There’s a fight for consumers’ attention in a post-COVID world,” the report states. “By optimizing your brand’s CX (customer experience) now, you’ll be better equipped to engage with and nurture a solid customer base when consumers shop more often at retail locations.”

Of those consumers who plan to shop less for clothing online, one-third (36 percent) say it is because they enjoy the experience of shopping in physical stores, according to Cotton Incorporated’s Coronavirus Response Consumer Survey, (Wave 6, May 19, 2021). Consumers also say they’ll shop online less because they enjoy shopping with family and/or friends (33 percent), shopping in person is more convenient (33 percent), they often need to return clothes they purchase online (32 percent) and they like the customer service they receive when shopping for clothes in-store (31 percent).

In the U.S., COVID-19’s Delta variant may put the kibosh on plans to “return to normalcy,” as cases and hospitalizations are surging once again. That may have consumers continuing to shop online longer than perhaps they’d planned. Either way, brands that saw their ecommerce businesses gain traction or significantly grow in the last year-and-a-half will want to be ready for whatever curves the virus may throw.

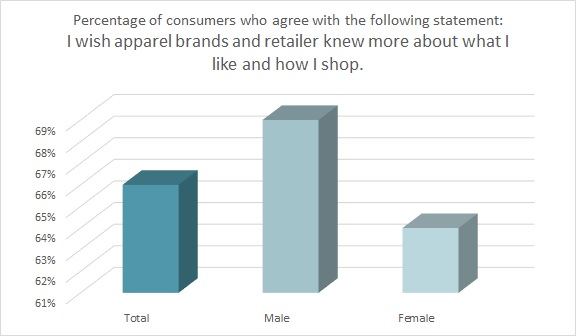

That means web stores need to put in the hard work of learning more about their customers. Two-thirds of consumers (66 percent) say they wish apparel brands and retailers knew more about what they like and how they shop, according to the 2020 Cotton Incorporated Lifestyle Monitor™ Survey. And nearly half of all consumers (46 percent) say they would like apparel brands to use information from their purchase history to personalize their shopping experience and give them recommendations on what to buy.

But before brands can delve into shopper data, they first need to be discovered by shoppers. The Octane AI report found the majority of brands are found through online search (88 percent).

“This tells us brands should prioritize building their online discoverability,” the report states. “A few tactics that can be used to drive discoverability include SEO, influencer marketing, reviews, paid ads (social and search), consistent organic social media posting, and sponsored posting with popular forums or digital media.”

Octane’s report says shoppers are also heavily influenced by the recommendations they receive from peers (84 percent), adding that affiliate, influencer, and loyalty programs are beneficial to drive more authentic recommendations from consumer-to-consumer. The report also found 84 percent of apparel consumers have purchased and are open to purchasing new products online from brands they’ve never used before.

“Having a delightful experience with the brand, with high-quality products that customers love so much they want to tell their friends, combined with a strong SEO strategy and site speed is key for 2021 and beyond,” said Alli Burg, partner manager at Shopify Plus, which contributed to Octane’s “Ecommerce Consumer Behavior Report.” “The iOS 14 update on privacy settings… will have an inevitable impact on ad targeting, with many industry experts thinking it could take an immediate toll on performance marketing and drive up paid ad costs.”

More than three-quarters (76 percent) of consumers say they don’t like companies tracking them online, according to the Monitor™ research. Yet they want stores to have a better idea of what they’d like to purchase. Consumers also seem to have a lot of clothes shopping in mind in the days ahead. Even though about half (49 percent) purchased clothes online during the past year, 41 percent plans to continue doing so in the future, according to the Coronavirus Response Survey (Wave 6). About one-fifth (21 percent) plan to shop for clothes online a few times per month, while 17 percent plan to do so a few times per week. Further, 45 percent expect to spend more on clothing in the upcoming year.

To keep the connection strong with customers, Octane’s report points brands toward a mode of communication that might seem old school: email communication. It’s the most preferred method of connecting (53 percent). Further, customers are willing to share zero-party data if it means getting personalized offers and recommendations. “Zero-party data” describes personal information a customer intentionally shares with a brand, including preferences, shopping habits and other personal contact information details.

Octane AI’s Matt Schlicht, co-founder and CEO, says that with consumer preferences for privacy, the smart tech companies and brands are already shifting their marketing strategies from a cookie-tracking approach to zero-party data.

“Instead of relying on third-parties, brands should give customers the choice to share meaningful personal information proactively in order to build a relationship based on deep personalization and trust,” Schlicht says in Octane’s report. “Ecommerce quizzes are a great way to enable zero-party data collection, and our goal at Octane AI is to help brands provide personalized shopping experiences, supporting their customers with discovering the best products for their preferences, needs, tastes and pain points.”

After the initial contact, Octane says brands can fortify their reputations by providing the type of experiences that matter most to shoppers, including: free shipping, product reviews, high-quality images showing products and providing live chat with customer support.

Kelsey Clutter, content marketing manager at Okendo, a customer marketing platform and an Official Google Reviews partner, also took part in the Octane report, saying today’s shoppers crave personalized experiences from the stores they prefer.

“They want to be served products they’re interested in without too much effort on their behalf. Using key customer and product attributes, you can segment your audience and deliver hyper-personalized messaging. This can be done in the form of product recommendations or email campaigns to engage with customers and encourage future purchases with your brand.”