Now that about one-third of Americans are fully vaccinated, businesses are considering when to bring office employees back to the workplace. But after more than a year that saw COVID-19 give new meaning to “business casual” — sales of pajamas more than doubled last year over 2019 — employees and retailers alike are wondering what will be the new definition of professional attire. Hint: Casual and comfortable will play major roles.[quote]

Ford Motor Company is planning to offer 30,000 employees a hybrid option to work from home, only coming to the office as each employee deems necessary for projects or team-building activities. That’s where the work wear question gets sticky.

“I’m not sure we’ll see pajamas,” Ford’s Kiersten Robinson, chief of human resources, told CBS Sunday Morning. “But I certainly do expect a more relaxed dress code, absolutely.”

Euromonitor International’s Benjamin Schneider, fashion and luxury analyst, says since consumers increasingly chose relaxed athleisure styles during the pandemic, the line between fashion and activewear will continue to blur.

“Consumers increasingly chose casual, comfortable items like loungewear and other [activewear] items over more formal or trend-driven products,” Schneider says. “While more fashion-forward items like dresses, skirts and jeans will certainly see a bounce back from the record low sales of 2020 as consumers are now finding opportunities to wear these items again, the long-term outlook for non-sports apparel is not as optimistic as it is for [activewear]. As hybrid work becomes more common, in-office dress codes will relax even further as companies try to attract remote workers who have gotten used to working from home in a uniform of T-shirts, sweatpants and hoodies.”

The number of consumers who say they’re wearing comfortable clothes more now than before the pandemic has increased from 63 percent when the pandemic began to 74 percent this year, according to Cotton Incorporated’s Coronavirus Response Consumer Surveys (Wave 1, March 20, 2020 and Wave 5, Feb. 28, 2021).

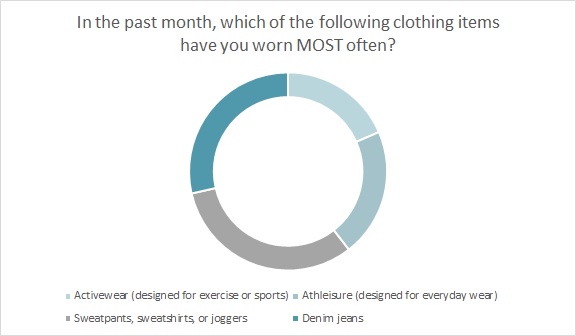

Recently, consumers have named T-shirts (47 percent) as the apparel item they’ve worn the most during the pandemic, according to the Coronavirus Response Survey (Wave 5). That’s followed by sweatpants, sweatshirts or joggers (38 percent), denim jeans (34 percent), leggings, jeggings or yoga pants (29 percent), athleisure shirts, pants or shorts (25 percent), and activewear/athletic shirts, pants or shorts (22 percent).

Edited, the retail market intelligence firm, says the global lounge and sleepwear markets are expected to see $19.5 billion in growth from 2020-to-2024 and a CAGR of 9 percent.

“Hoodies, tees and co-ord sets were ever-present in designer’s collections on the Fall 2021 runway, and men’s loungewear was recently added to the UK’s inflation basket, which attaches a weight to items based on consumer spending behavior,” states Edited’s Krista Corrigan, fashion and retail analyst. “These recent events, alongside several other factors like increased product investment and sell outs, indicate the lounge category is alive and well.”

Corrigan notes that in women’s wear, sweatpants saw the most significant increase (72 percent), due to fast fashion retailers quickly jumping on the comfort trend. Leggings in ribbed knit, split hem, and seamless styles have moved well, too. In men’s, Corrigan says arrivals increased 34 percent over 2020, with graphic tees, sweatpants, and hoodies serving as the dominant trend.

The majority of consumers (84 percent) agree that wearing comfortable clothes helps them feel better right now, according to the Cotton Incorporated Coronavirus Response Survey (Wave 5). Additionally, compared to clothes made from synthetic fabrics like polyester and nylon, 84 percent of consumers say cotton apparel is the most comfortable as well as the softest, according to the 2021 Cotton Incorporated Lifestyle Monitor™ Survey. And the overwhelming majority says cotton is the best for T-shirts (89 percent), casual clothing (76 percent), and activewear (52 percent).

This preference for cotton in a number of apparel categories stands to reason, considering nearly 4 in 5 consumers (79 percent) say cotton is their favorite fiber to wear, according to the Monitor™ research. This is remarkably more than consumers’ next choices: polyester (3 percent), or rayon (1 percent).

More than 2 in 5 consumers say they’re bothered by brands that would substitute synthetic fibers for cotton in their T-shirts (45 percent), denim jeans (42 percent), and casual apparel (42 percent), according to the Monitor™ research. Another 39 percent don’t like synthetic substitutions in their activewear, followed by their business and dress clothing (36 percent). Further, the majority of shoppers say they’re willing to pay more to keep cotton from being substituted with lower-priced manmade fibers in their T-shirts (60 percent), casual clothing (56 percent), denim jeans (51 percent), and activewear (51 percent).

Carla Buzasi, CEO and president of WGSN, the trend forecasting company, says brands should be thinking about how they can offer comfort and reassurance to today’s pandemic-scarred consumers.

“We’re looking at opportunities from clothes to interiors, texture and materials – they’re going to be so important when people are making purchase decisions,” Buzasi said during the recent Retail Connected 2021 digital event. “I think if we take away anything from this, we should think about the connections that people will want to make to you, your brand and your products, as well as connections to those around them. And if you can be the catalyst in the middle of this, then I think you and your brands will have a very bright future.”