In casual conversations with folks who don’t work in the apparel industry, many seem surprised to hear that apparel retailers didn’t fare well during the COVID-19 shutdowns since they could still sell merchandise online. But apparel and accessories sales dropped 51 percent in March in year-over-year comparisons, according to the U.S. Census Bureau, and a staggering 89 percent in April. And while apparel sales improved in July, they were still down 23 percent.

That’s a lot of unsold merchandise. The problem was two-fold: consumers had no reason to buy anything new, and prior to the pandemic the majority of shoppers (69 percent) preferred to purchase clothes in-store, according to the 2020 Cotton Incorporated Lifestyle Monitor™ Survey.[quote]

As states and stores reopened, all the unsold merchandise has had to go somewhere to make way for new deliveries, be it a storage facility, a discounter, or a resale site. But it’s not like the U.S. doesn’t already have a surplus of clothing. In 2017, the Environmental Protection Agency estimated roughly 17 million tons of clothing and footwear end up in the country’s landfills. That’s one garbage truck of textiles going to the dump every second, according to the San Francisco Goodwill. The agency adds that if nothing changes, by 2050 the fashion industry will use up to a quarter of the world’s carbon budget.

Annie Gullingsrud, chief strategy officer with EON, an Internet of Things platform, and author of “Fashion Fibers: Designing for Sustainability,” sits on the SF Goodwill board. She says a circular approach to fashion is key to the planet’s future.

“This approach supports the development of safe, sustainable materials, clean production and energy, fair labor and continuous product and material loops through reuse, refurbishing, and recycling back to virgin quality materials that go into new fashion,” she told SF Goodwill.

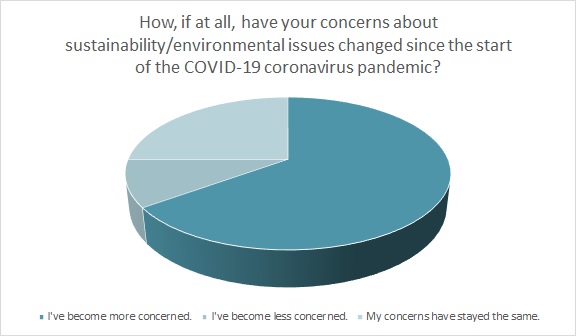

Since the start of the COVID-19 pandemic, 65 percent of consumers have become more concerned about sustainability/environmental issues, according to Cotton Incorporated’s 2020 Spring U.S. Coronavirus Response Survey. The majority are somewhat/very concerned about unreliable food safety/hygiene (65 percent), water quality (66 percent), pollution or waste in our oceans (67 percent), depletion of natural resources other than water (64 percent), waste management/landfills (64 percent), air pollution (65 percent), global warming/climate change (61 percent), population growth (58 percent), and water scarcity (55 percent).

Additionally, 50 percent say they are “somewhat or very motivated” to take sustainable/environmentally friendly actions, according to the 2020 U.S. Coronavirus Response Survey. However, just over half (56 percent) say sustainability/environmental friendliness has had moderate or great deal of influence on their clothing purchase.

A further look at consumer behavior finds shopper actions can be quite different than their intent. Other than recycling (68 percent), purchasing appliances that conserve energy (59 percent) and recycling their clothes (58 percent), the 2020 Spring U.S. Coronavirus Response Survey finds the majority of consumers actually don’t put in a lot of effort to protect the environment. Just 49 percent reduce consumption of goods or buy less, and 45 percent buy used/second-hand appliances or cars. That’s followed by those who purchase organic foods (39 percent), check corporate environmental policies before patronizing a company or brand (36 percent), buy used/second-hand clothes (36 percent), check corporate environmental policies before patronizing a company or brand (35 percent), and buy clothes made from sustainable, environmentally friendly, or natural materials (35 percent).

In Sourcing Journal’s webinar entitled “Recycling: Circularity’s Weak Link,” Cotton Incorporated’s Melissa Bastos, director, corporate strategy and insights, said despite consumer interest in eco-friendly apparel, when it comes to actually purchasing new clothes, most consumers aren’t looking for circularity or sustainability.

“Historically, when we talk to consumers about their main purchase drivers, comfort, fit, quality, durability, style, and price are at the top,” Bastos said. “But there are external factors that we really have to think about. Right now, one of the big ones is economic uncertainty and how that’s going to play a role in their purchasing decisions. We anticipate consumers will approach apparel purchasing, as more of a long-term investment. We’ve actually seen some increases in our data in those who say quality and durability are even more important.”

Since the pandemic began, most 2020 Spring U.S. Coronavirus Response Survey respondents are concerned about more economical issues, including public health (75 percent), healthcare access (71 percent), their own finances (68 percent), public education (59 percent) paid sick leave (57 percent), and buying less/overconsumption (55 percent).

Bastos added that Cotton Incorporated surveys around the COVID-19 situation show comfort has taken an even more important role in what consumers are buying these days. “Consumers tend to associate cotton with the most comfortable types of clothing,” she stated. “It’s kind of like this love affair that’s been rekindled.”

Edited adds that the pandemic likely helped fast fashion — long held as a culprit in the overproduction of cheaply made, synthetic apparel — slow down. In a report, the retail data firm cites the United Nations Alliance for Sustainable Fashion, which says the apparel industry is responsible for 8-to-10 percent of the world’s greenhouse gas emissions. When worldwide shutdowns occurred during the early days of the pandemic, skies cleared — to the point that emissions in China fell by nearly 25 percent. The firm advises that this would be a good time for retailers to “push capsule wardrobes, focusing on the concept of ‘buy less, buy better.'”

Edited’s team also feels that post-virus, consumers “will seek out brands that they align with morally more than ever before, with an emphasis placed on conscious products. Eco-friendly loungewear is a fail-safe way to invest.”