There are officially 10 shopping days left before Christmas, which, to a procrastinator, is plenty of time – even if they’re buying online. Retailers, while ever grateful to those prone to postponing things, know that the stakes are higher as the holidays approach. Stocks run lower, hot items sell out, free shipping is slower, and that can all affect customer satisfaction. But now that online shopping has become more commonplace, e-commerce stores should be more prepared to deal with the end-of-season crush, which could have long-lasting benefits going forward.

SAP’s Lori Mitchell-Keller, global general manager, consumer industries, says providing the optimal consumer experience is always crucial. But during the holidays, increased demand offers more opportunities to impress shoppers and earn brand loyalty.

“To ensure a successful holiday season, retailers should look to implement solutions designed to enhance all processes of their businesses, including customer service, product offerings, inventory visibility, manufacturing, delivery times, and more,” Mitchell-Keller says. “For example, Burberry recently invested in technology to create a more convenient and personalized shopping experience. Their mobile app allows consumers to easily transition between the online and offline world, providing curated product offerings, recommended items, and an easy-to-use tool to purchase goods at any time – even during the hectic holiday season.”

And hectic it is. On Cyber Monday alone, retailers racked up $6.6 billion in online sales, according to Adobe, a 16.8 percent jump over last year and a $2.5 billion increase since 2014. And companies like Burberry are wise to invest in their mobile experience, as Adobe reports that mobile accounted for 33 percent of Cyber Monday revenue, a 39 percent increase over 2016. Additionally, Shopify reports mobile buying accounted for 64 percent of Cyber Monday sales among merchants using Shopify’s e-commerce platforms — a 10 percent jump from last year.

[quote]

But Cyber Monday wasn’t the only day holiday shoppers took to the web. Online sales on Thanksgiving Day broke records, totaling $2.9 billion, an increase of 18.3 percent from last year and beating expectations of $2.8 billion, according to Adobe. Black Friday online sales also saw a spike, jumping 16.9 percent and chalking up $5 billion for the day.

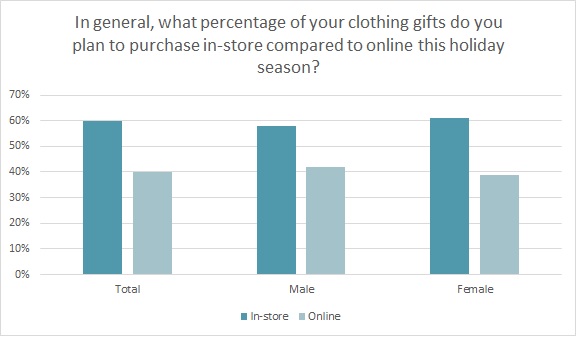

Apparel is still a top holiday item, as 60 percent of shoppers plan to gift it this holiday season, according to the Cotton Incorporated Lifestyle Monitor™ Survey. Stores should keep in mind that while most (60 percent) intend to buy their apparel presents in-store, 40 percent of shoppers plan to buy it online this season. Overall, consumers expect to spend $199 on apparel gifts, out of the $570 they plan to spend for all their holiday presents. And about 65 percent of shoppers say they’re going to be spending the same on clothing gifts this year as last year, versus 19 percent say they’ll spend more and 15 percent expect to spend less.

The perpetual concern for retailers is the Amazon threat. More than half of all consumers (54 percent) say they plan to either browse or buy their apparel gifts on Amazon, according to Monitor™ data. And a lot already have, as Amazon announced that Cyber Monday was its biggest shopping day worldwide in company history, ringing up more sales than its Prime Day last July. Without releasing sales data, Amazon said customers ordered “hundreds of million of products” between Thanksgiving and Cyber Monday. And small businesses and entrepreneurs who do business on Amazon’s platform sold nearly 140 million items. While electronics like the Echo Dot, Nintendo Switch and Apple AirPods were top sellers, this is clearly the time for all other retailers to step up their online game.

ShopGate’s Casey Gannon, vice president of marketing for the mobile commerce platform says easy checkout can help retailers compete with the shopping giant.

“Retailers must add digital wallet capabilities with expedited checkout options to their mobile apps this holiday season, especially if they hope to compete for busy consumers’ dollars,” Gannon says. “Most mobile shoppers have zero patience for ‘hunt-and-peck’ credit card requirements or complicated, finicky data entry fields.”

Anodot, the real time analytics and anomaly detection system, reports online glitches during the holidays can cost retailers “thousands if not millions of dollars” in revenue. To avoid expensive mistakes, the company recommends going beyond tracking customer activity on retailers’ own sites, and monitoring third-party data like competitor advertising and bids, as well as social media, which is key in keeping up with customer feedback and product demand.

Mitchell-Keller says stores like Under Armour, Burberry, Brooks Brothers, Benetton, and The Rockport Group are using SAP Fashion Management technology for valuable insights. Among other things, the technology automatically analyzes large volumes of data to provide a comprehensive overview of products, including those that have sold, as well as those left in stock. Mitchell-Keller explains this provides insight into which items are selling out fast during the holidays, helping retailers determine if they should either initiate production, or accurately notify consumers of a potential wait time prior to purchase.

Some 44 percent of shoppers like to browse in-store but actually prefer to buy online, according to the Monitor™ data. And as the season progresses, many consumers prefer ordering online rather than facing traffic and risking not getting their desired item at all. However, to ensure they have what they want on time, many consumers (59 percent) plan to take advantage of ship to store options.

With data that provides proper inventory visibility, Mitchell-Keller says retailers can present shoppers with purchase options — whether it’s picking the item up at a nearby store or having it shipped to their home — at their moment of need.

During the holidays, Mitchell-Keller emphasizes, “it’s important that retailers do what they can to ensure they don’t disappoint consumers.”