COVID-19 & Consumer Concerns in the U.S.

June 3, 2021

COVID-19

& CONSUMER CONCERNS IN THE

For More Information Contact: Corporate Strategy & Insights at [email protected]

Sources: Cotton Incorporated’s COVID-19 Consumer Response Survey, a survey of 500 U.S. consumers

conducted on Mar 2020 (Wave 1), Apr 2020 (Wave 2), Sep 2020 (Wave 3), Nov 2020 (Wave 4), Mar

2021 (Wave 5), May 2021 (Wave 6). AMERICA’S COTTON PRODUCERS AND IMPORTERS.

Service Marks/Trademarks of Cotton Incorporated. ©2020 Cotton Incorporated.

THINGS TO KNOW ABOUT...

U.S.

WAVE

SIX

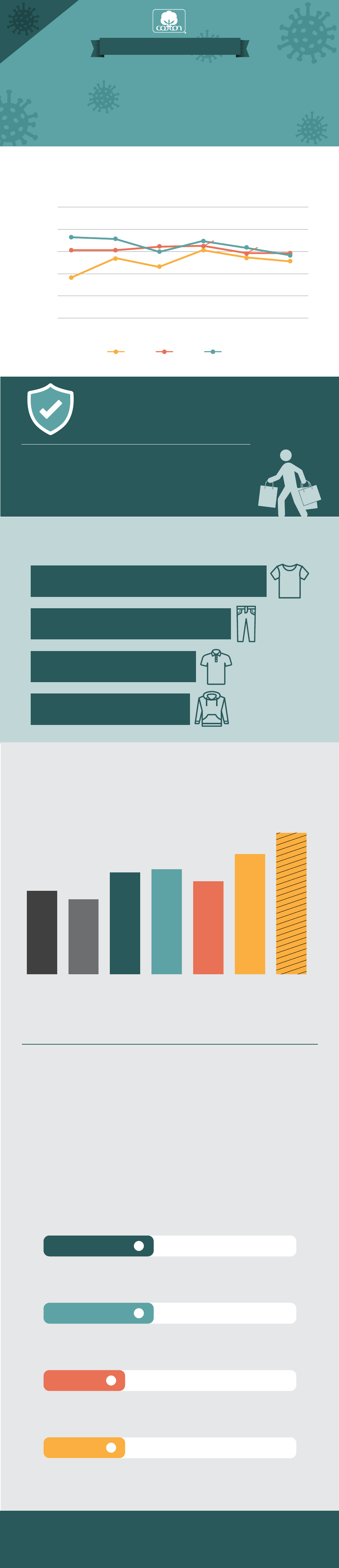

Percentage who are very concerned about the

COVID-19 coronavirus pandemic (by age):

100%

80%

60%

40%

20%

0%

73%

71%

59%

69%

63%

56%

61 %

37%

Wave 1 Wave 2 Wave 3 Wave 4 Wave 5 Wave 6

54%

61 %

64%

65%

58%

58%

46%

61 %

55%

51 %

14-24 25-44 45+

Consumers plan to purchase casual

clothing in anticipation:

40%

34%

28%

26%

T-Shirts

Denim Jeans

Casual Shirts

Activewear

Consumers Expect to Spend More

say pandemic

experience will

change the way they

shop in the future:

% spending more on clothing since the

start of the pandemic

45%

27% 45%

W1 W2 W3 W4 W5 W6

Before the pandemic: After the pandemic:

Expect in

‘21*

*Percentage of consumers expecting to spend more in 2021.

70%

will be more purposeful, only buying

what they will use

Shop for half or more of clothing online:

53%

45%

62%

6 3%

56%

72%

84%

45%

will take better advantage of sales

34%

will look for different styles of brands

34%

will buy higher quality clothing

feel safe resuming

normal, pre-pandemic

activities.

53%

87% have purchased or plan to

purchase clothing to resume normal

activities.