If only stocking a store were as simple as sending buyers to Fashion Week and letting them check off the outfits they like best.

[quote]While a good gut instinct for color and silhouette remains, retailers increasingly accept that big data analysis can tell them what they are doing right — and wrong — so they can give consumers a more holistic and customized shopping experience.

At tech giant Oracle, Mike Webster, senior vice president and general manager, Oracle Retail, says the biggest challenge facing retailers is breaking down existing siloed processes and data stores, as in information that is stored but not used day-to-day.

“Customers look at online, mobile and in-store as essentially one thing — the brand they are interacting with,” Webster says. “Retailers must align their business to meet this reality. Successful analytics initiatives require data from every part of the business that affects the customer experience. So it is not only online, mobile and in-store, but also supply chain and promotions.”

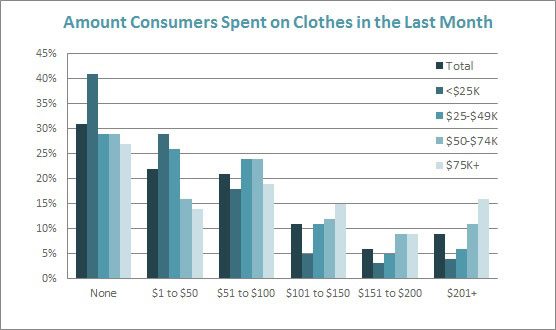

On average, consumers say they spend about $72 on clothes each month, a figure that drops to $43 for those making less than $25,000 and increases to $101 for those making $75,000 or more, according to the Cotton Incorporated Lifestyle Monitor™ Survey. With the many retail choices available to today’s consumers, harnessing those dollars becomes as much about understanding the stats as it is about offering what designers are showing.

“I think it’s right brain, left brain,” says The Doneger Group’s Tom Julian, director of strategic business development. “These numbers are forming the buy differently,” because a planner is now comparing data with what a buyer wants to stock.

Doneger’s Roseanne Morrison, fashion director, adds that data mining can quickly reveal what is not working. “The feedback where we talk about how many times consumers look and how many times it takes them to buy is very important,” she says. “If you’re getting a lot of hits on your site but people aren’t actually buying, something’s wrong.”

Webster echoes this, adding that data analysis can also provide a solution.

“As retailers move away from static reports and toward more flexible, real-time analysis, business users can drill down into the areas of the business most relevant to them. So, while analytics are being performed across a comprehensive data set, the results are tailored to a business need and presented in an easily understandable format that enables action.”

But today’s consumers are not easily pegged. They like to shop both in-store (twice a month) and online (one a month), according to the Monitor survey. Even though they prefer the traditional store experience, most (73%) have browsed web stores, and they spend, on average, 100 minutes shopping for clothes whether they are in-store or online.

Making matters harder for retailers is the fact that customers like to shop around. The Monitor shows 64% of shoppers are more likely to build an outfit by buying separate pieces from different stores than buying an entire outfit at one store. And those stores vary considerably: (62%) say they shop at mass merchants, followed by chain (57%), department (41%) and off-price (35%) stores.

The average consumer is also regularly influenced by retailer emails, online ads, catalogs, social “likes” and product reviews.

Sailthru, based in New York City, brings the many disparate data points about a customer (site, email, mobile, social, offline/in-store) under one roof in a complete user profile of every individual customer, says Cassie Lancellotti-Young, vice president of analytics.

“From there, we are able to transform the way that brands build relationships with their customers by automating the personalized marketing based on each unique individual’s preferences, including send time, send frequency, types of products shown, recommended products — even down to preferred colors, styles and more.”

Cotton Incorporated is looking to help brands and stores guide the direction of their offerings through its Customer Comments Project. To date, the project has analyzed more than 260,000 comments from 25 retail websites, resulting in a collection of reviews for more than 30,000 denim jeans, knit and woven shirts, dresses, pants and activewear.

Comments include the positive — “They are my go-to shirts for working out. I stay cool… and I love how comfortable it is” — and the negative — “I have been buying [brand] for years…. This is a company that has lost its way. I was very disappointed in this tee shirt and would not buy another one. Do not waste your money.”

Lancellotti-Young says such information is critical for crafting effective marketing strategies. Sailthru’s platform stores customer comments as a variable, so stores can easily query against it for sending custom campaigns and messages, as well as for assessing the lifetime value of customers based on the feedback they give.

“Our approach allows brands to operate on what is essentially a 1:1 marketing basis rather than a traditional campaign basis,” she says. “Think about this way: a customer buys something from a brand and is then prompted for product feedback, where she rates it a 1 out of 10 and writes a nasty review. Two days later, the brand sends the same user an upbeat business-as-usual email as though nothing negative ever occurred. The brand looks uninformed and insensitive, likely resulting in a lost customer for life.”