Back in the ’80s, Tom Cruise, “Cocktail” and clubbing were all the rage. Cut to 2017, and Tom Cruise is still around, but people are more likely to mix craft cocktails at home while binge-watching three of his movies in a row. Americans like staying home these days, and soft, casual apparel and home furnishings make all the comforts of home even more enticing.[quote]

A trend survey from YPulse, a youth and Millennial market research firm, found 72 percent of all Millennials and teens would prefer to stay in on the weekends than go out at night. The figure rose to 79 percent among those 21-to-24 years old. They would rather log some quality screen time than hit the bars and clubs.

It comes down to a variety of factors, money being one of them. YPulse cites the wine app Vivino, which found almost 6 out of 10 Millennials say cost outweighs all other influences when deciding what to drink. “That means drinking at home and avoiding the price tag hikes of bars and nightclubs is more appealing than ever.”

They may also be saving up to furnish their apartment or home. HGTV reported last year that its weekly viewers age 21-to-34 increased 16 percent to 4.5 million weekly. And while making one’s home look like a modern rustic farmhouse is fun, it takes money. And Apartment List, a rental market research company, reported 2016 U.S. rents reached an all-time high.

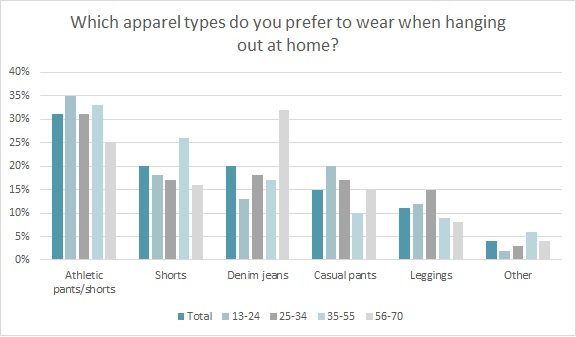

So, between the lure of the screens and money being tight, it’s understandable why there’s been a rise in comfortable athleisure apparel and interest in comfortable home furnishings. Almost 1 in 3 consumers (31 percent) prefer to wear athletic pants/shorts when they are hanging out at home, followed by shorts and denim jeans at 20 percent each, according to the Cotton Incorporated Lifestyle Monitor™ Survey.

Almost 1 in 3 consumers (31 percent) prefer to wear athletic pants/shorts when they just want to be comfortable, followed by denim jeans at 23 percent, according to Monitor™ data. And compared to clothing made from manmade fibers, more than 8 in 10 consumers say cotton clothing is the most comfortable (87 percent), sustainable (85 percent), trustworthy and soft (both 85 percent), authentic (83 percent), and reliable (81 percent).

“I think staying in speaks to what a lot of people are doing,” says Molly Bedell, co-owner with husband Tom of Two Old Hippies, in Nashville, TN. She spoke of her own plans for last weekend. “I have girlfriends coming over, and we’ll light a lot of candles, sit on pillows on the floor. That’s kind of cozy. And the apparel is definitely denim driven with cozy tops — depending on the seasonality, of course.

“People have to dress for work, so when they’re off work, they’re looking for comfort,” Bedell says. “And it’s definitely more comfortable and less expensive to stay in than go out.”

Two Old Hippies is a complete lifestyle store, with a full selection of men’s, women’s and children’s apparel, footwear, home goods — as well as a guitar center that hosts live music performances.

Consumers appreciate brands and stores that offer a curated mix of product with a particular point of view. In a world where shoppers are bombarded with online, in-store, pop-up and mobile options, customers will gravitate toward a brand that appeals to their personal sensibility. The 2013 Nielsen Global Survey of New Product Purchase Sentiment found 60 percent of consumers with internet access prefer to buy new products from a familiar brand, rather than switch to a new brand. The survey found brand familiarity is one of several key characteristics that resonate strong with consumers worldwide.

“Innovating on established brands that are already trusted by consumers can be a powerful strategy,” said Rob Wengel, senior vice president, Nielsen Innovation Analytics. “Companies spend millions of dollars on new product innovation, yet two out of every three new products will not be on the market within three years. Marketers and retailers can deliver successful new products by ensuring they uncover unmet consumer needs, communicate with clarity, deliver distinct product innovations and execute an optimal marketing strategy.”

At 43 percent, store displays top the list of inspiration sources for towels, sheeting, and bedding purchases, followed by retailer websites (25 percent) and friends or family (21 percent), according to the Monitor™ data.

And while department stores have long offered both apparel and home goods — albeit, in different departments or on separate floors — chains like Urban Outfitters and Anthropologie are growing their home offering — in an aesthetic that melds with the rest of the store offerings. In fact, Anthropologie launched its largest home collection ever last fall. And it is more than doubling the floor space at key locations to accommodate full-scale rooms of furniture and home decor. In an earnings call last spring, David McCreight CEO, said the store’s customers spend the same amount of money, if not more, on home as apparel.

The rewards are enticing, drawing independent apparel designers like Erin Fetherston and Steven Alan to launch or expand home collections bearing their names.

At Two Old Hippies, Bedell says the mix of apparel and home merchandise is helpful to both the customers and to the shop itself.

“Our store is a lifestyle brand,” she says. “It’s how we live. And what we carry is a reflection of our lifestyle. Everything goes hand in hand. You can get jeans and a shirt, and then throw blankets that are festival driven — the kind you can throw on the ground and wash later — but they obviously work for a cozy night in. This mix, though, absolutely helps us, businesswise. Our gift and market section has grown a lot — and there’s no size required.”