A revolution in the U.S. activewear market is being driven by the convergence of several consumer and retail trends.  According to Cotton Incorporated’s 2014 Sports Apparel Survey, more than 9 in 10 consumers say they wear athleticwear for activities other than exercise. Increased consumer demand has prompted U.S athletic apparel sales to grow at double the rate of non-active apparel sales for several years. Strong sales growth has convinced mass merchants, fast-fashion retailers, and luxury brands to enter or increase offerings in this $33 billion dollar market1, previously dominated by a smaller cadre of outdoor and sports apparel retailers and brands.

According to Cotton Incorporated’s 2014 Sports Apparel Survey, more than 9 in 10 consumers say they wear athleticwear for activities other than exercise. Increased consumer demand has prompted U.S athletic apparel sales to grow at double the rate of non-active apparel sales for several years. Strong sales growth has convinced mass merchants, fast-fashion retailers, and luxury brands to enter or increase offerings in this $33 billion dollar market1, previously dominated by a smaller cadre of outdoor and sports apparel retailers and brands.

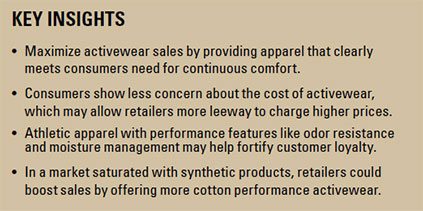

While price ranks as the third most important factor when shoppers purchase clothing in general, price is the sixth most important purchase driver among consumers buying active apparel. Less price sensitivity may allow retailers and brands to charge higher prices for active clothing items and reap the benefit of larger profit margins on these clothing items. The ability to sustain a thriving and lucrative activewear line that appeals to consumers will require attention to comfort, fashion, and performance.

COMFORT MATTERS

Regardless of demographics, exercise frequency/intensity, or sports activity, comfort (42%) is the top factor consumers like most about their favorite activewear item, followed by fit (16%), breathability (15%), and style (14%). In fact, 73% of consumers who have adopted the athleisure trend of wearing active apparel for purposes other than exercise say comfort is the reason. More consumers describe cotton activewear as the most comfortable (53%), when compared with active clothing made from synthetics like polyester (10%) and nylon (11%). Consumers report that the top reason they avoid polyester activewear is that it is uncomfortable (35%).

like most about their favorite activewear item, followed by fit (16%), breathability (15%), and style (14%). In fact, 73% of consumers who have adopted the athleisure trend of wearing active apparel for purposes other than exercise say comfort is the reason. More consumers describe cotton activewear as the most comfortable (53%), when compared with active clothing made from synthetics like polyester (10%) and nylon (11%). Consumers report that the top reason they avoid polyester activewear is that it is uncomfortable (35%).

Regardless of demographics, exercise frequency/intensity, or sports activity, comfort (42%) is the top factor consumers like most about their favorite activewear item, followed by fit (16%), breathability (15%), and style (14%). In fact, 73% of consumers who have adopted the athleisure trend of wearing active apparel for purposes other than exercise say comfort is the reason. More consumers describe cotton activewear as the most comfortable (53%), when compared with active clothing made from synthetics like polyester (10%) and nylon (11%). Consumers report that the top reason they avoid polyester activewear is that it is uncomfortable (35%).

Cotton Incorporated’s Customer Comments Research™ study reveals that synthetic activewear is significantly more likely than cotton activewear to have customer complaints about irritation related to itching, scratching, and chaffing, as well as odor and durability issues like pilling and snagging. In contrast, consumers report issues with cotton activewear shrinking, fading, and stretching—all concerns that can be minimized during textiles processing and with clothing care education. Addressing customer reported issues about comfort, durability, and odor could play a significant role in bolstering stronger sales growth for activewear.

LIFESTYLE AND FASHION DRIVERS

With competition intensifying as a result of additional retailers and brands offering athletic apparel lines, the development of targeted strategies to reach shoppers is vital for success. Some outdoor activewear retailers have started initiatives to engage with their customers around clothing care and sustainable manufacturing practices. Customer outreach efforts appeal to about 4 in 10 consumers, and these programs hold even more appeal for millennials. Millennials, who will account for one-third of total retail spending by 20202, say they are more likely than older generations to buy activewear from a store or brand that sponsors athletic events or group exercise (39% versus 28%) and provides opportunities to connect with other athletes through events or social media (34% versus 22%).

Fast-fashion and specialty retailers and brands’ emphasis on offering more fashionable athletic apparel may help further catapult sales in this clothing category. Comfortable and fashionable activewear should command more interests among the estimated 210 million Americans (67%) who participate in different sports or fitness activitiesand the 80 million non-active consumer group. Notably, non-active consumers spend similar amounts on activewear, when compared with active consumers ($33 and $37 on average per month, respectively). Significantly, both active and non-active consumers say that cotton activewear is the most fashionable (37%), compared with polyester activewear (12%) and nylon activewear (18%).

PERFORMANCE SAFEGUARDS

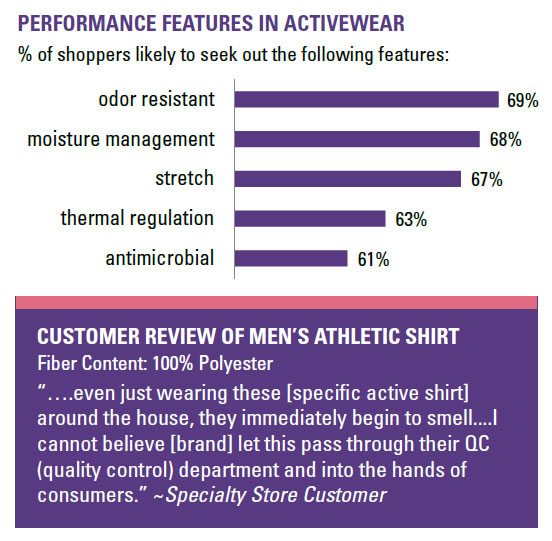

Attracting customers and earning their loyalty in the rapidly diversifying activewear market may require that retailers  and brands seize opportunities to improve product performance. The majority of consumers (52%) say they are more likely to shop at a store offering athletic apparel that can be worn all day long. The ability of athletic apparel to integrate into a consumer’s daily routine depends on comfort and a variety of performance factors. More than 6 in 10 consumers say they are very or somewhat likely to look for odor resistant, moisture management, stretch, and thermal regulation features in their athletic apparel. Shoppers may recognize that these features can help improve the comfort and fit of their active clothing.

and brands seize opportunities to improve product performance. The majority of consumers (52%) say they are more likely to shop at a store offering athletic apparel that can be worn all day long. The ability of athletic apparel to integrate into a consumer’s daily routine depends on comfort and a variety of performance factors. More than 6 in 10 consumers say they are very or somewhat likely to look for odor resistant, moisture management, stretch, and thermal regulation features in their athletic apparel. Shoppers may recognize that these features can help improve the comfort and fit of their active clothing.

More than 6 in 10 shoppers say that washing clean is very important in their decision to purchase athletic apparel. Among those who experience odor issues in activewear, lingering odors have caused 8 in 10 consumers to re-wash their activewear using the same or different methods. Re-washing garments costs customers time and money, can accelerate the degradation of performance technologies on clothing, and negatively impacts the environment. Cotton t-shirts have a demonstrated odor resistance advantage over polyester. A recent study revealed that washed polyester t-shirts had more than three times the amount of acids that contribute to underarm odor than cotton tees3. Retailers and brands offering cotton performance activewear can meet customer needs for everyday athletic apparel that does not hold odor, washes clean, and delivers on comfort and style.

ABOUT THE RESEARCH

Cotton Incorporated’s Sports Apparel survey is a consumer study that tracks shoppers attitudes and behaviors about athletic apparel purchases. In the 2014 study, 1,500 consumers were surveyed, 50% male and 50% female, ages 13 to 70, and representative of the U.S. population based on ethnicity, income, education, and geography.

Additional Sources: Cotton Incorporated’s Lifestyle Monitor™ survey and Cotton Incorporated’s Customer Comments Research™ study.

External Sources: Sports & Fitness Industry Association1, Accenture Plc2, and The University of Alberta3.