During the pandemic, the fashion industry waxed poetic about taking a look at itself and the amount of clothing and number of deliveries it was pumping out. A few short years later, experts say much has stayed the same. But if fashion is to move to the future, these same authorities say sustainability must be at the forefront, which means moving away from synthetic, microplastic-producing textiles. And Plastic Free July might just be the opportune time to examine the benefits of moving toward natural fibers like cotton.

“Disrupting the stream of synthetic microfiber pollution starts right in our wardrobes…We have the ability to select fibers that originate from and return naturally to the earth, reinforcing the earth’s natural cycles rather than feeding a cycle of ongoing plastic pollution.”

Dr. Jesse Daystar, Vice President & Chief Sustainability Officer

Created by the Plastic Free Foundation in 2011, Plastic Free July is a global movement that is working toward a world “free of plastic waste.” Microplastic pollution, including tiny particles from synthetic textiles, is part of the problem the foundation says needs “drastic measures” to remedy.

Consider that this past July Fourth holiday, Earth recorded its hottest day on record. The United Nations says fossil fuels are “by far the largest contributor to global climate change,” as the greenhouse gases they emit blanket the planet and trap the sun’s heat, leading to global warming and climate change.

Yet, from high fashion to fast fashion, the industry continues to heavily rely on fossil fuel-based textiles like polyester, nylon, and acrylic — even though such fabrics are responsible for microplastic fiber pollution that takes up to 200 years to decompose. These fibers come from our clothes, especially during the laundry cycle, when nearly 730,000 synthetic fibers can wash out with the effluent into our waterways, where they enter our food and water supplies.

As it stands, it is estimated there at least 15 million tons of microplastics polluting the ocean. The tiny fibers are also raining down from the sky. And, when inhaled, microplastics can pose serious health risks, especially to our respiratory systems.

Despite all this, ChangingMarkets.org says there has been no significant change over the last five years by the fashion industry in its usage of synthetic fibers, despite its long-stated desire to be more sustainable. A combination of choices by consumers, retailers, and brands will be needed to stem the microplastic tide.

“Disrupting the stream of synthetic microfiber pollution starts right in our wardrobes,” says Cotton Incorporated’s Dr. Jesse Daystar, vice president and chief sustainability officer. “We have the ability to select fibers that originate from and return naturally to the earth, reinforcing the earth’s natural cycles rather than feeding a cycle of ongoing plastic pollution.”

Unlike petroleum-based textiles, cotton biodegrades relatively quickly because it is made of cellulose, an organic compound that is the basis of plant cell walls and vegetable fibers. The fibers break down naturally in landfills, similarly to other crops such as food and plants.

But since all clothes shed fibers during the laundering process, it becomes clear the more sustainable option is material that also biodegrades in water. Once again, cotton degrades far more quickly. When comparing cotton versus synthetic microfibers, research showed that after 243 days, cotton had 76 percent degradation, while polyester showed just 4 percent degradation. Additionally, cotton continued to degrade over time, while polyester’s degradation plateaued after the test time.

The majority of consumers (61 percent) feel it is very important for the clothing industry to improve garment end-of-life by designing clothes to biodegrade, recycle, or otherwise diver from landfills, according to Cotton Incorporated’s 2022 Denim and Sustainability Consumer Survey.

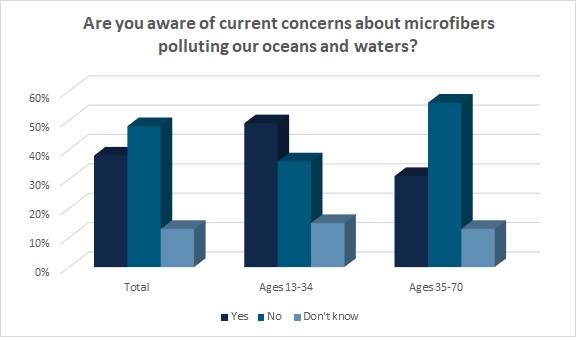

From a consumer perspective, concern about microplastic pollution is growing. Currently, 38 percent of consumers say they are aware of current concerns about microfibers polluting our oceans and waters, according to Lifestyle Monitor™ research. That’s up from 27 percent in 2018. Further, consumers under the age of 35 are significantly more likely (49 percent) to say they’re aware of this microplastic pollution concern.

Deloitte’s Karla Martin, global fashion and luxury leader, says there is a small but legitimate move toward less petroleum-based fabrics in the fashion industry, but it will take time.

“The analogy that comes to mind is organic food,” Martin says in an interview with Lifestyle Monitor™. “It used to be that sustainable farming with little/no pesticides was available in very small markets at a very high price. But over time, and once large mass grocers figured out how to provide better quality products at the price their customers could afford, organic food naturally moved from being a luxury item to a ubiquitous option for all consumers. Fashion retailers will get there. It’s just not a shift that can or will happen overnight. Right now, they are looking for ways to satisfy their broad consumer base — which means being able to either pass through the cost of sustainable fashion or get the cost way down.”

And price versus sustainability is part of the problem for the industry. See, over half of consumers (58 percent) say that sustainability influences their clothing purchases, according to the Cotton Council International (CCI) and Cotton Incorporated 2021 Global Sustainability Survey. When they were asked why, 64 percent of those consumers say that it is important to do whatever to improve the environment, and 63 percent say that it is because biodegradability of their clothing is important to them.

On the other hand, 83 percent of consumers say price is an important factor when buying new clothes. That compares to 63 percent who say “environmental friendliness” is important.

“Cost, of course, always plays a role,” Martin says. “Will the shift to more environmentally friendly fashion mean that apparel lasts a bit longer and costs a bit more to not only make but also purchase? Likely. And the reality many fashion retailers are facing is that while consumers often say they want sustainable products, when it comes down to it, they don’t want to or can’t pay the price. In fact, Deloitte’s Gen Z and Millennial Survey found that while six in 10 Gen Zs and Millennials are willing to pay more for sustainable products, more than half think it will become harder to do so if the current economic situation does not improve. So, fashion retailers are balancing a fine line of what consumers say they want and what their actions show.”

This is how a brand like Shein has grown so big, so fast. The online fast fashion retailer specializes in low-priced apparel, like a wedding gown for less than $50. On top of that, new users to the site get free shipping and 15 percent off, putting the synthetic fiber bridal purchase at $41.65. In May, the Wall Street Journal reported Shein was valued at $66 billion, down from $100 billion a year ago but still a powerhouse in the industry. For comparison, Business Insider recently reported H&M’s market cap was $20 billion while Zara’s was $117 billion. Shein states it uses “on-demand manufacturing technology to connect suppliers to our agile supply chain, reducing inventory waste and enabling us to deliver a variety of affordable products to customers around the world.”

However, most apparel on Shein is made of virgin fossil fuel-based materials like polyester. Shein itself states it adds 1,000 new styles daily. Good On You says this number could actually be between 2,000 and 10,000, leading to 5,000 to a million new garments daily. Other fast-fashion brands are producing 52 “micro-seasons a year.” This hectic pace has put pressure on mainstream and designer brands to pump out more product. That adds up to a lot of synthetics entering the apparel market — and contributing to microplastic pollution.

This glut of apparel means more garments are finding their way to landfills. The average American disposes of 70 pounds of textiles every year, according to the Council for Textile Recycling. Just 10 pounds are donated, and the remaining 60 pounds end up in garbage dumps. The U.S. Commerce Department’s National Institute of Standards and Technology says this translates to 85 percent of used apparel heading to landfills or incinerators. Just 15 percent gets reused or recycled.

In a study, the Massachusetts Institute of Technology reports synthetic textiles are a bigger problem than natural fibers when landfilled.

“Synthetic textiles, for example, commonly end up in landfills, but their fossil fuel-based process contributes to a bigger carbon emission footprint and higher consumption of abiotic (physical rather than biological) resources,” states the MIT report.

While fashion designers and brands are happy to push new product into the market, they haven’t had to deal with the end of a garment’s life. That may soon be changing as these mountains of discarded clothes are becoming such a problem, governments are starting to step in.

The EU and U.S. have proposed legislation that might not just curb overproduction, but discourage the use of petroleum-based fibers. The EU proposal would introduce labels on clothes that inform shoppers of how easily recyclable and environmentally friendly a garment is.

“As clothing comprises the largest share of EU textile consumption (81 percent), the trends of using garments for ever shorter periods before throwing them away contribute the most to unsustainable patterns of overproduction and overconsumption,” reads the EU Commission’s proposal. “Such trends have become known as fast fashion, enticing consumers to keep on buying clothing of inferior quality and lower price, produced rapidly in response to the latest trends. Moreover, the growing demand for textiles is fueling the inefficient use of non-renewable resources, including the production of synthetic fibers from fossil-fuels.”

In California, State Sen. Josh Newman introduced a bill earlier this year that would create a statewide collection and recycling program for textiles. Manufacturers of clothing and other textiles “would be required to implement and fund an extended producer responsibility (EPR) program that would enhance recycling and increase reuse in the sector,” reads the bill.

“The cost burden for managing unusable textiles has fallen on thrifts, collectors and secondhand markets, while producers keep making products with no plan for what to do with them when they are no longer wearable,” stated Doug Kobold, executive director of the California Product Stewardship Council at the bill’s introduction.

In New York, State Sen. Brian Kavanagh also introduced legislation this year that would require EPRs for the collection, reuse, recycling or “proper” disposal of textiles. By December 21, 2024, all manufacturers of apparel and other textile products will have to submit a plan for a collection program. Beginning July 1, 2025, no retailer, distributor or wholesaler can offer apparel products in the state unless the maker is participating in a collection program. Any entity found not in compliance is subject to civil penalties.

Although some brands and retailers might not welcome the long arm of the government, consumers may just embrace it. The majority of consumers (63 percent) who are aware of microplastic pollution realize much of this is caused by washing clothes made of synthetic fibers, according to the Monitor™ research. And more than 6 in 10 (63 percent) say they are bothered by brands and retailers that use synthetic fibers in their clothes. Further, two-thirds (66 percent) say their awareness of microplastic pollution will affect their future apparel purchasing decisions.

ChangingMarkets.org says there is encouraging news, as more than one-third of brands (34 percent) have decreased the volume of synthetics used in their collections.

Deloitte’s Martin also sees changes happening in the industry.

“Fashion retailers understand the role they play and are looking for solutions to become more sustainable and address pollution — such as tech-enabled tools that are helping to drive a more circular business model and reduce waste,” Martin says. “A recent report from Deloitte in partnership with Google Cloud discusses just how many major fashion retailers are using technology to boost their sustainability efforts.”