Right now, it’s the season of “no more pencils, no more books,” but the coming days will see Back-to-School (BTS) shopping kicking into high gear. And this season, despite any residual inflation jitters, it should translate into an increase in BTS apparel sales.

The National Retail Federation’s Matt Shay, president and CEO, says the association’s research shows U.S. consumers are eager to start their Back-to-School and college shopping early. It’s predicting spending will reach a record $41.5 billion, up from $36.9 billion last year and the previous high of $37.1 billion in 2021. The NRF forecasts Back-to-College spending to reach $94 billion, which is about $20 billion more than last year’s record.

Inflation is clearly compressing discretionary spending in U.S. retail, and we expect some of that compression to carry through to BTS, even if many parents view the majority of BTS spending as nondiscretionary or ‘non-negotiable.’

John Mercer, Head of Global Research & Managing Director of Data-Driven Research, Coresight Research

The NRF conducts its annual survey with Prosper Insights & Analytics. Prosper’s Phil Rist, executive vice president of strategy, says despite the anticipated record spending, shoppers are looking for deals.

“Consumers are stretching their dollars by comparing prices, considering off-brand or store-brand items, and are more likely to shop at discount stores than last year,” Rist says.

The reason is nagging worries about inflation, says Coresight Research’s John Mercer, head of global research and managing director of data-driven research, referring to the company’s U.S. Back to School 2023 research report.

“Inflation is clearly compressing discretionary spending in U.S. retail, and we expect some of that compression to carry through to BTS, even if many parents view the majority of BTS spending as nondiscretionary or ‘non-negotiable’,” Mercer says in an interview with the Lifestyle Monitor™.

To be sure, the majority of consumers (81 percent) say inflation will impact their BTS spending, according to Cotton Incorporated’s 2023 Back-to-School Survey. While nearly half of consumers say they plan to spend more overall on school items, 36 percent say they will buy fewer items while spending the same amount. Another 25 percent say they will buy more used clothing and 23 percent say they will spend less on clothes to make up for higher overall costs.

Nearly 9 in 10 shoppers (89 percent) plan to purchase BTS clothes, according to Cotton Incorporated’s 2023 Lifestyle Monitor™ Survey. Almost 8 in 10 (79 percent) plan to buy shoes. About three-fourths (73 percent) will be buying school supplies. Half (50 percent) expect to buy food/snacks. One-third (33 percent) say they will be buying electronics, and 32 percent expect to purchase accessories.

Although most consumers expect to be purchasing clothes, they say they expect to spend less than they did last year: $378 this season versus $520 a year ago, according to the Monitor™ research.

“Some 71 percent of consumers in our survey indicated inflation [will] limit how much they buy/how much they spend for their BTS shopping,” Mercer says. “Furthermore, our recent monthly survey on inflation (conducted on May 29, 2023) found that 73 percent of U.S. consumers are noticing price increases in retail.”

These inflation concerns were cited despite the U.S. Labor Department announcing earlier this month that inflation dropped for 12 consecutive months to 3 percent in June, its lowest level since March 2021.

Mercer says the overall expected increase in Back-to-School spending will conceal “meaningful differences” between key categories. For instance, he says, with shoppers having spent abundantly on electronics in some prior years, “we expect electronics spending to be down — and for that to drag down total growth in BTS spend. Clothing and footwear spending is likely to be up modestly in nominal terms, with deflation easing in this category (to 3.1 percent in June).”

The top BTS apparel items are expected to be socks, shirts/tops (8 of each); undergarments (7 of each); jeans and pants (5 pairs); shorts, leggings, activewear, and sweaters (4 of each); outerwear (3 pieces); and pajamas and dresses (2 of each), according to Cotton Incorporated’s 2023 Back-to-School Survey.

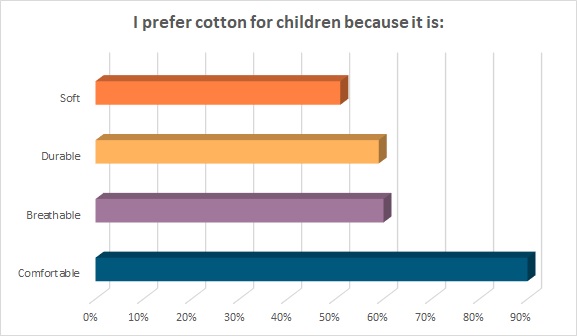

Both parents (79 percent) and teens/young adults (75 percent) list comfort as the top feature they look for in their BTS apparel, according to the 2023 Back-to-School Survey. More than three-quarters of all adults (76 percent) say they prefer their children to be dressed in cotton clothes. And 90 percent say that is because cotton has all the traits of being comfortable: breathable (60 percent), durable (59 percent), and soft (51 percent).

Most Back-to-School apparel (59 percent) will be purchased in brick-and-mortar locations, according to the Monitor™ Survey. That compares to 27 percent that will be bought online.

And since parents will be looking for deals, it should come as no surprise that mass merchant stores (66 percent) are expected to be the top shopping venues, according to the 2023 Back-to-School Survey. That is followed by Amazon (56 percent), off-pricers (48 percent), chain stores (41 percent), specialty stores (38 percent), and department stores (35 percent).

“Price-competitive general merchandisers always rate well for BTS purchases,” Coresight’s Mercer says. “Walmart, Amazon, Target, Dollar Tree/Family Dollar and TJX are the top retailers that BTS shoppers expect to purchase from. Walmart tops the charts of BTS retailers by a comfortable margin, with 60.2 percent of consumers planning to shop there, which is 11.4 PPTs more than plan to shop at the second-most-popular retailer, Amazon. The top three most popular retailers — Walmart, Amazon and Target — all see substantially higher penetration among parents with older children.”

Although shoppers will be looking for value, Coresight’s research found shoppers still want their children to look fashionable when they return to school (44 percent), an increase from 32 percent last year.

When it comes to labels, Coresight expects activewear brands like Nike, Adidas, and Under Armour to see the strongest performances this season. As for style, athleisure will continue to be strong with the school-going set. A comfortable choice for all that reading, writing and arithmetic that’s right around the corner.