So many apparel brands and retailers have been cut off at the knees since the coronavirus pandemic began, it’s sometimes hard to fathom how the industry will come out of it. Amazon has continued its domination as the biggest company in the world, while others struggle, laying off employees or closing locations just to stay afloat. But the fashion industry is nothing if not resilient. So while the virus continues to flex its muscle, brands and retailers are doing all they can to adapt, with many turning to technology to help weather what’s normal now.[quote]

Nicole Leinbach Reyhle, founder of Retail Minded, co-founder of the Independent Retailer Conference and author of “Retail 101: The Guide to Managing & Marketing Your Business,” says stores looking to “survive and even thrive amidst and post-COVID-19 should have seamless technology integrating all of their consumer touchpoints and selling avenues,” according to the National Retail Federation’s Connected Commerce blog.

“This technology will help reveal where customers are originating, when customers are leaving their sites, what customers are buying and, of course, what they are not,” Rehyle said. “It will also bring clarity to which marketing efforts are more valuable than others, and ways to enhance store strengths and improve store weaknesses. Shifting inventory assortment will likely be a priority for many merchants as well, which will be revealed during this process. Additionally, having modern payment options that include Google Wallet and Klarna, for example, is essential. Contactless payments will become increasingly important, as will payments that can be made over time, such as Klarna offers with its installment payment opportunities.”

So much has changed in a matter of months. For instance, among those who plan to buy Back-to-School (BTS) clothes, 58 percent plan to buy in-store, down significantly from 71 percent last year, according to the 2020 Cotton Incorporated Lifestyle Monitor™ Survey.

Looking more broadly at all consumers, some 2 in 5 (40 percent) say they have less money to spend on apparel this year compared to last, according to the Monitor™ data. Another 45 percent say they have the same amount, while 15 percent say they have more.

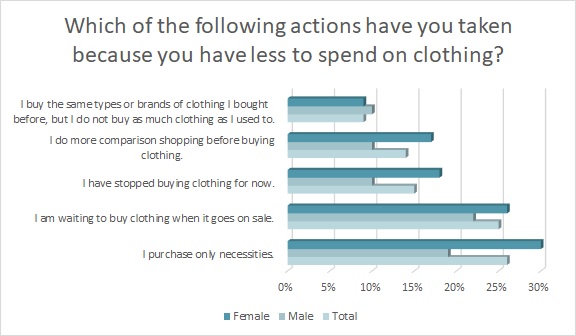

But of those who say they have less to spend, 38 percent say they are only purchasing necessities, followed by 25 percent who say they’ve stopped buying clothes for now and are waiting to buy apparel when it goes on sale (26 percent), according to the Monitor™ research.

The surge in COVID-19 cases is threatening the economic recovery, according to Bloomberg economist Eliza Winger. That of course makes it harder for the fashion industry to plan fall and holiday business. Despite being told to open on time with in-person classes or risk federal funding, schools and universities around the country have been announcing plans for online-only lessons, or a hybrid of in-person and virtual classes. This will likely affect the type and quantity of clothes consumers purchase.

Nearly 2 in 5 back-to-school shoppers (39 percent) say they plan to shop differently for Back-to-School clothing depending on whether their child/children goes back to school in-person versus virtually or online, according to the Monitor™ research. Further, 40 percent of those who need to do back-to-school shopping say the plans for reopening their child/children’s school haven’t been released yet. Either way, merchants need help planning for a number of scenarios.

Extreme Marketing’s Ryan Hall, manager of vertical solutions marketing for the software-driven networking solutions company, says curbside pickup was adopted early by Target, inspiring other retailers to take it up.

“No matter the type of environment or size of the business, to effectively achieve forward-thinking use cases like curbside pickup, retailers need a flexible, scalable, secure IT solution,” Hall says. “As part of the industry’s ‘new normal,’ technology adoption and digital transformation is accelerating.”

Hall also advocates Augmented Reality (AR) to help consumers overcome any challenges involved in online or mobile shopping. Even in-store, traditional fitting rooms, he says, are being replaced with virtual dressing rooms. He’s also a proponent of Electronic Shelf Labeling (ESL), which digitally displays product pricing on shelves. The prices are automatically updated and controlled from a central server, saving time for associates to perform other tasks. Finally, Hall sees robots as assisting in everyday tasks, as stores leverage robotic technology for fulfillment, inventory tracking, and monitoring out-of-stock items. They can also transmit data to inform employees when and where to restock items.

Euromonitor International is also on board with robotics, predicting they will significantly impact business during and post-COVID.

“Robotics, in particular, are seeing exponential growth to reduce human-to-human interaction,” states Euromonitor’s Michelle Evans, global head of digital consumer research. Already, at least one-third of connected consumers are comfortable interacting with robots, the firm says.

Euromonitor International also says technologies like cloud computing will accelerate — and make businesses more flexible at a time when they need it most.

Fit for Commerce says the recent adoption of digital shopping has redefined retail with “seamless and integrated shopping touchpoints” for the consumer.

“Even before the COVID-19 pandemic, services such as Buy Online/Pickup In-Store (BOPIS) and Buy Online/Return In-Store (BORIS) saw significant increases as retailers focused on meeting shopper demands for more options and greater convenience,” Fit for Commerce states. “The pandemic has forced retailers to quickly address areas directly related to digital commerce and convenience, accelerating implementations of technologies and processes that enable organizations to better serve customers through online shopping and contactless services” such as curbside pickup and contactless payment.

The Euromonitor’s Evans says the growing role of tech will be one of the most pronounced long-term impacts from the global pandemic.

“The coronavirus pandemic has underscored the important role technology plays in consumers’ lives as well as the role it serves for businesses that continue to adapt and operate under such conditions.”