Things to Know About COVID-19 & Consumer Concerns in the U.S. (Wave 9)

Things to Know About COVID-19 & Consumer Concerns in the U.S. (Wave 9)

January 11, 2022

COVID-19

& CONSUMER CONCERNS IN THE

For More Information Contact: Corporate Strategy & Insights at [email protected]

Sources: Cotton Incorporated’s COVID-19 Consumer Response Survey, a survey of 500 U.S. consumers conducted on Mar 2020 (Wave 1),

Apr 2020 (Wave 2), Sep 2020 (Wave 3), Nov 2020 (Wave 4), Mar 2021 (Wave 5), May 2021 (Wave 6, n=1,000), Aug 2021 (Wave 7),

Oct 2021 (Wave 8), Dec 2021 (Wave 9).

THINGS TO KNOW ABOUT...

U.S.

WAVE

NINE

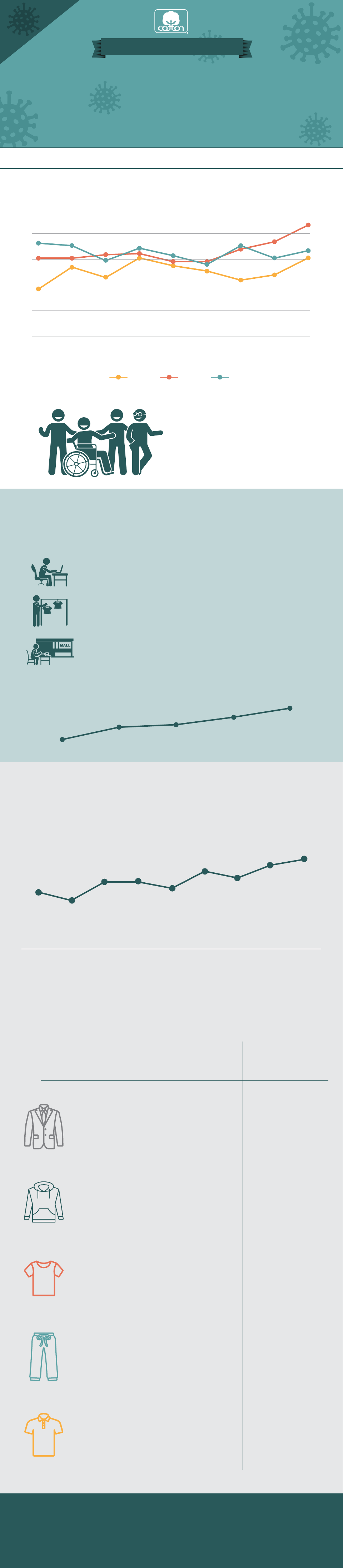

Percentage who are very concerned about the

COVID-19 coronavirus pandemic (by age):

AMERICA’S COTTON PRODUCERS AND IMPORTERS. Service Marks/Trademarks of Cotton Incorporated. ©2022 Cotton Incorporated.

CONSUMERS EMERGE FROM QUARANTINE EVEN AS CONCERN SPIKES

Wave 1

(Mar ‘20)

0

20

40

60

80

Wave 2

(Apr ‘20)

Wave 3

(Sep ‘20)

Wave 4

(Nov ‘20)

Wave 5

(Mar ‘21)

Wave 6

(May ‘21)

Wave 7

(Aug ‘21)

Wave 8

(Oct ‘21)

Wave 9

(Dec ‘21)

89%

61 %

67%

16-24 25-44 45+

Go to work or school

in person

Percent of consumers who currently

do the following:

Shop for clothing in

physical stores

Hang out at the mall

Percentage of consumers dressing up more:

32%

60%

27%

49%

12%

39%

say they are restless to be

out among people again

70%

Wave 6

(May 2021)

Wave 9

(Dec 2021)

W5

14 %

29%

32%

41%

48%

W6 W7 W8 W9

Loungewear

(Sweats,

Leggings)

Clothing Spending Climbs

As Consumers Look to Dress Up

and Go Out, Comfort Remains

a Priority

Percent spending more on clothing since

the start of the pandemic

37% 56%

44% 53%

50%

52%

49% 52%

Activewear &

Athleisure

36% 51%

W1 W2 W3

W4

W5 W6 W7 W8 W9

Dress Pants,

Shirts or

Blazers

Most Worn

in Nov.

Plan to

Purchase

T-shirts &

Denim Jeans

Casual Tops

& Bottoms

53%

45%

62%

63%

56%

72%

66%

77%

80%