Even though a surge in COVID-19 cases and post-election stress didn’t exactly make for a holly, jolly Christmas season, American consumers pushed holiday retail sales to a 3 percent increase over 2019 in the period running from October 11 through December 24, according to the Mastercard SpendingPulse. Additionally, online sales leapt 49 percent over last year. Unfortunately, the number of returns was enough to leave retailers with a post-holiday headache.[quote]

After all the bows and boxes were strewn, it was expected that consumers would be returning $101 billion in merchandise, or about 13.3 percent of items sold during the 2020 holiday season, according to a report from the National Retail Federation and Appriss Retail. The NRF forecast holiday sales during November and December would total between $755.3 billion and $766.7 billion.

Mastercard SpendingPulse found apparel experienced a 19 percent decrease year-over-year, while electronics and appliances saw an increase of 6 percent overall. The findings also show department stores experienced a 10 percent sales decrease, although their online sales strengthened by 3 percent.

In all of 2020, the retail industry saw an increase in returns as the pandemic lead more consumers to shop online. That comes with drawbacks, though: the NRF and Appriss Retail report found 5.9 percent — or $25.3 billion — of 2020’s returns were fraudulent. As difficult as it can be to deal with such a surge of returns and the accompanying issues, experts say it doesn’t have to be all bad.

“Retailers view the return process as an opportunity to engage with customers, as it provides additional points of contact for them to enhance the overall consumer experience,” says Mark Mathews, NRF’s vice president of research development and industry analysis.

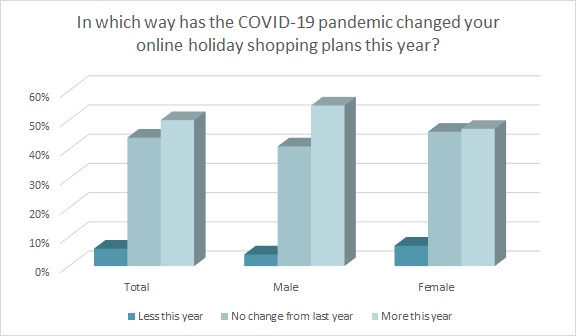

By that logic, retailers may have ended up engaging with a lot of people who had been avoiding stores. Half of all shoppers (50 percent) said they planned to do more holiday shopping online this year, according to the 2020 Cotton Incorporated Lifestyle Monitor™ Survey. Twenty percent of consumers were planning to skip brick-and-mortar locations in 2020, and the majority of those planning to skip (65 percent) said it was because they felt it was safer to shop online during the pandemic, followed by 45 percent who said they just prefer to shop online.

The hitch for apparel retailers is that clothing accounts for 21 percent of returns among all online orders, according to Statista. That compares to shoes (12 percent), electronics (8 percent), handbags and accessories (6 percent), books, movies, music and games (5 percent), and sports and outdoor products (3 percent).

Ronen Luzon, CEO of MySize Inc., the developer of smartphone measurement solutions, says the immediate problem for retailers is the dramatic increase in the number of consumers buying clothes online. His company has developed a proprietary measurement technology based on several algorithms that can calculate and record body measurements in a variety of novel ways — without using the phone’s camera. The company explains that users move the phone along their body and the MySizeID app uses sensors within the phone to take measurements. Such technology could make a significant difference for merchants.

“Before Covid-19, a retailer may have been suffering from 40 percent returns when only 20 percent of their consumers were buying online,” Luzon explained in an interview with the Lifestyle Monitor™. “Now they are suffering from the same 40 percent but from 80-to-90 percent of their consumers. The total number of returns has increased dramatically.”

To head off droves of people standing on long lines either in- or outside stores, or just reduce the amount of people in their locations during the pandemic, Reuters reported stores stepped up their options for returns. Walmart and Target let customers bring rejected gifts to FedEx and United Parcel Service drop-off sites. Others, like Nordstrom and Dick’s Sporting Goods, offered curbside returns for the first time. Customers were able to stay in their vehicles, and text their arrival and designated parking space so an associate could come right to the car to gather the return. Such measures can come at a cost to the bottom line.

“Aside from the fact that the number of returns has increased, the handling of the returns has changed as well,” Luzon said in the interview with the Monitor™. “Some items require special handling or they need to be disinfected. So the returns process has become even more expensive.”

Luzon says as more consumers shop online, his platform can help stores avoid dealing with clothes that didn’t fit, or returns from those who buy multiple sizes and keep the one that fits best.

“We have about 100 retailers to date that are using our solution on their site,” he stated in the Monitor™ interview. “They have seen a big impact on various parameters, especially when it comes to decreasing returns. For example Levi’s branches that use MySize reduced their returns by 47 percent, and Penti (a Turkish-European franchise) has increased its average order value (AOV) by three times.”

However, not all consumers are comfortable making online clothing purchases. But about 4 in 10 (39 percent) say they would feel more comfortable doing so if they were provided detailed fit information, according to Cotton Incorporated’s November 2020 U.S. Coronavirus Response Survey, Wave 4.

Going forward, almost 7 in 10 consumers (69 percent) say they will buy more clothing online in the future, according to the November Coronavirus Response Survey, Wave 4.

Luzon says technology can help brands avoid overproduction and retailers steer clear of a glut of product.

“The primary concern of many retailers — unless you are Amazon — is the percentage of returns,” Luzon stated in his interview with Lifestyle Monitor™. “MySize sends reports to the retailer that helps it know and understand consumers in terms of their actual measurements, body shapes, location. And this helps them plan future production and avoid overstocking. Technology that can help to decrease the number of returns is the highest priority for just about every retailer out there.”