For some people, it’s just not the holidays without curling up with a favorite blanket and enjoying the guilty pleasure of Hallmark and Netflix Christmas movies. They offer a comforting escape to places that look impossibly cozy and homey, whether the lead character inherits an inn, rescues her hometown holiday parade or needs to win a gingerbread contest to open the bakery of her dreams. Before pondering too long why this writer knows so many plots from this particular movie genre, consider that the comforts of home may be more important than usual to consumers this season, as the homebody economy continues to play out.

The Centers for Disease Control (CDC) has released guidelines for gatherings during the upcoming holidays. And the nation’s leading infectious disease expert, Dr. Anthony Fauci, has said his Thanksgiving is going to “look very different this year” since his own children will not be joining him and his wife. With rising COVID-19 cases in the U.S. and second waves of the virus escalating around the world, he advised Americans to rethink their traditional holiday plans. The prospect of Zooming Thanksgiving, Christmas and Hanukkah is bound to send consumers looking for comfort wherever they can find it.

A recent McKinsey & Company survey (U.S. consumer sentiment during the coronavirus crisis, Oct. 7) found 4 out of 5 Americans haven’t returned yet to pre-COVID-19 levels of comfort with “normal” out-of-home activities. On the positive side, the numbers who are not engaging out of their homes has decreased to 64 percent, from 73 percent in July. However, this survey took place before virus cases started ticking upward again.

McKinsey says this shift toward a homebody economy is one that will have “a lasting impact.”

The global home decor market was valued at $616.6 billion in 2019, and is forecast to reach $838.6 billion by 2027, or a compound annual growth rate (CAGR) of about 4 percent, according to Allied Market Research. In the U.S., consumers spent $66.4 billion on home textile products in 2019, according to Cotton Incorporated’s 2020 Home Textiles survey.

A drop in spending due to the COVID-19 pandemic is expected in 2020 but the market is projected to recover by 2022 and show a five-year growth of 8.3 percent with $72 billion spent in 2024, according to 2020 Euromonitor International Economies and Consumers Annual Data.

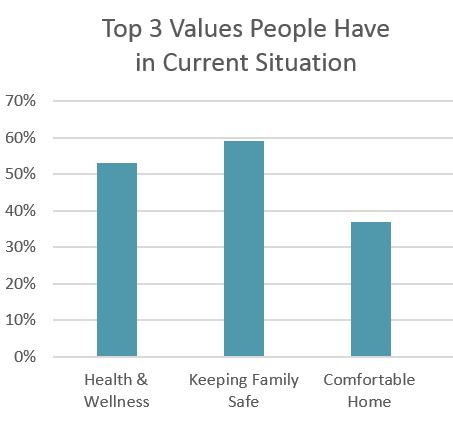

The current situation with COVID-19 has prompted Americans to think about their values and “a comfortable home” (37 percent) falls in the top three, just behind “keeping my family safe” (59 percent) and “health and wellness” (53 percent), according to Cotton Incorporated’s September 2020 U.S. Coronavirus Consumer Response Survey, wave 3.

This makes sense as home has also become, for many, a place for school and work. Since the start of the pandemic, 27 percent of Americans say they work the majority of their work hours from home, according to the September Coronavirus Response Survey. Another 24 percent say their hours or pay have been reduced, while 12 percent say they’ve lost their job altogether. The survey also found 9 percent who have been furloughed, as well as 16 percent who say their school has moved online.

All of this time at home working, schooling or just stressing has led to nearly 7 in 10 consumers (69 percent) saying they “just want to curl up in a cozy bed/blanket right now,” according to the September Coronavirus Response Survey. For 86 percent of consumers, quality sheets and bedding aid in better sleep, according to the 2020 Home Textiles survey. And 73 percent say 100 percent cotton is important in home textiles, as they see the role fiber plays in softness, quality, function and comfort. Further, 78 percent of consumers are willing to pay more for quality.

Retailers that are in the business of selling comfort have seen these categories sell through first hand. Wayfair posted a $274 million profit on sales that increased 84 percent to $4.3 billion, according to The Wall Street Journal.

Additionally, Bed Bath & Beyond saw a 6 percent sales increase in Q2 2020, it’s first growth since Q4 2016. The jump was driven by a striking 89 percent increase in ecommerce sales, offsetting a 12 percent drop in same-store sales.

Interestingly, neither Wayfair nor Bed Bath & Beyond attributed their sharp rises in sales to housebound customers who were feathering their nests.

Instead, Wayfair’s Niraj Shah, CEO and co-founder said in a recent Goldman Sachs webinar that his company had been seeing an average annual growth rate of 40 percent for the last half-dozen years, and attributed growth to various initiatives that advanced customer satisfaction, behavior and repeat rates.

“You’ve seen a one-way shift towards ecommerce,” Shah said. “That big burst of 10 or 15 points… more of that will stick than just the couple points we would have gotten.”

Likewise, Bed Bath & Beyond’s Mark Tritton, president and CEO, attributed the company’s improvement to omnichannel purchasing options like buy online/pickup in-store (BOPIS) and curbside pickup during the shutdown.

“The marked improvement in our second quarter financial results reflects the potential of our digital-first, omni-always transformation and our efforts to build a modern, durable platform for success,” Tritton stated.

Whether it was the lure of ecommerce or the fact that people wanted to console themselves with movies and a warm bed, 33 percent have browsed and 38 percent have purchased sheets and bedding, according to the Cotton Incorporated’s April 2020 U.S. Coronavirus Consumer Response Survey, wave 2. Consumers also plan to buy home textile gifts for the upcoming holiday season (16 percent), spending about $224 on blankets, sheets, towels, etc., according to the Cotton Incorporated Lifestyle MonitorTM Survey.

And considering 75 percent of consumers buy a gift for themselves when doing their holiday shopping, according to the MonitorTM research, it’s hard to say just how many throws and comforters shoppers are buying as comfort gifts for themselves — and their holiday movie bingeing.