When it comes to sustainability and transparency, the fashion industry has taken its share of hits. While older generations may not have known about or paid attention to issues like factory conditions, processing pollution, or the decomposition time for synthetic fibers, younger generations are taking note. Now, the conversations that were started by Millennials are being taken up and acted on by Gen Z.[quote]

In its 2018 “Report on Young People and Social Change,” DoSomething Strategic, a social impact consultancy, said Patagonia was named by respondents as a top purpose-driven brand. Not only did Patagonia encourage consumers to hold off on buying new apparel and instead send them in for repairs, but it also created a marketplace for reselling pre-worn clothes. Patagonia also created a digital platform to connect consumers to causes. None of this has hurt the company’s bottom line, as DoSomething Strategic notes that the apparel company has doubled revenue in the last eight years.

The global nonprofit Business for Social Responsibility’s (BSR) Elisabeth Best, manager, sustainability management, points out that Millennials and Gen Z consumers are creating this demand for sustainable products. She also points out that Cone Communications found that among Gen Z shoppers, 94 percent said companies should address urgent social and environmental issues. This compares with 87 percent of Millennials.

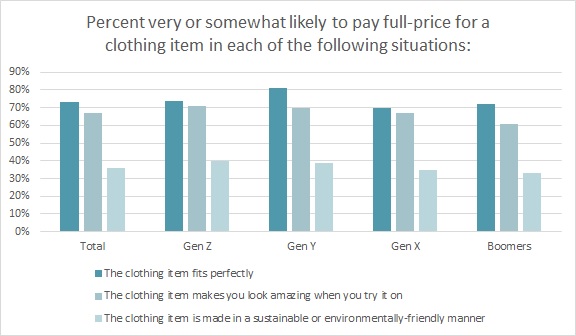

More than 1 in 3 consumers (36 percent) say they’re “very or somewhat likely” to pay full price for a clothing item that is made in a sustainable or environmentally friendly manner, according to the Cotton Incorporated Lifestyle Monitor™ Survey. That figure increases among younger generations, to 39 percent of Millennials and 40 percent of Gen Z shoppers.

Gen Z, those born between 1996 and 2010, make up a quarter of the U.S. population and a study from the IBM Institute for Business Value puts their current buying power at $44 billion. By 2020, they’re expected to account for 40 percent of all consumers, according to research from MNI Targeted Media. MNI describes Gen Z as “driven by values, with 68 percent identifying that doing their part to make the world a better place is important to them, and this directly impacts their buying behavior.”

Millennials are older and more established. Born between 1980 and 2000, they account for about 80 million Americans and spend $600 billion annually in the U.S., according to Accenture. By 2020, the firm expects their spending to grow to $1.4 trillion annually and represent 30 percent of total retail sales.

Gen Z consumers were born as digital natives and raised during the era of non-stop social media, where memes are presented as facts and intentionally fabricated news stories have run rampant. UK-based Sustainly, a sustainability consultancy, says the young people of this generation demand honesty and authenticity from brands because they’ve “come of age in this crisis of trust.

“Major brands know they must adapt to Gen Z’s needs but that can be a slow and difficult process,” Sustainly stated in its “Twenty for 2020: The Gen Z Breakthrough Brands and Why They Love Them” briefing. “While these legacy brands struggle to find their purpose, new Gen Z-friendly brands and start ups are taking the lead — creating sustainable, authentic and transparent products and services that address the concerns and aspirations of Gen Z and build trust for the future.”

Among the Twenty for 2020 profiles in its apparel and fashion category, Sustainly includes New Zealand-based Kowtow, which uses fair trade cotton; second-hand clothier DePop; closed-loop T-shirt maker For Days; and MUD jeans, which leases its denim, offers free repairs and, when the lease is up, recycles up to 40 percent of the material into new products.

Despite their relative youth (they’re currently 8-to-22 years old), Gen Z consumers say they would feel more connected or loyal to brands that offer clothes made of natural fibers such as cotton, wool, etc. (38 percent), according to Monitor™ research. Another 38 percent would feel connected to brands that offer sustainable clothing. That’s similar to Gen X (40 percent) or Boomers (38 percent), but still less than Millennials (55 percent).

More than three-quarters of Millennials (77 percent) and 75 percent of Gen Z consumers say cotton is their favorite fabric to wear, according to the Monitor™ survey. This eclipses every other fiber, including polyester (4 percent), silk (2 percent), wool (1 percent), and rayon (0.5 percent). Compared to manmade fibers, more than 8 in 10 Millennials and Gen Z consumers say cotton is the most sustainable. More than 7 in 10 (78 percent) say it’s the most trustworthy.

Both Millennial and Gen Z consumers are interested in quite a number of social and environmental issues. But it’s notable how much concern is shown by the younger generation. The Monitor™ research shows water quality tops the list for 91 percent of Gen Z and 75 percent of Millennials. This is followed by concerns with global warming and climate change (91 percent versus 70 percent), loss of rural farmland (91 percent versus 64 percent), extinction of animals and/or plants (91 percent versus 75 percent), and the depletion of natural resources such as oil or minerals (82 percent versus 71 percent).

In a survey by Greenmatch, a renewable energy consulting agency, 72 percent of Gen Z respondents said they are willing to spend more money on goods and services produced in a sustainable fashion. And almost half (49 percent) have stopped purchasing or boycotted a brand because they stood for something or behaved in a way that is against their values.

Young people are open about their desire to align with brands that reflect their values. The DoSomething Strategic survey found more than half of the 13-to-25 year olds surveyed are influenced by a brand’s reputation and values. And nearly 30 percent actively seek out socially or environmentally responsible brands.

“Businesses must balance profits and purpose,” DoSomething Strategic’s report states. “And this only happens if brands are as committed to and innovative around doing good as they are about increasing sales. Customers aren’t just revenue centers, but potential partners in the greater mission.”