The turnaround in the U.S. housing market has resulted in stronger home textile sales, but quality issues threaten to  hamper future sales potential. Eight of the top 10 U.S. home textile retailers reported positive sales this year1 and U.S. home textile expenditures, amounting to $42.6 billion in 2013, are projected to grow 2-3% each year through 20202. However, the experiences of customers, who are paying higher prices for lower quality, less cotton-rich home items, could thwart projected growth, according to Cotton Incorporated’s Customer Comments Research™ study.

hamper future sales potential. Eight of the top 10 U.S. home textile retailers reported positive sales this year1 and U.S. home textile expenditures, amounting to $42.6 billion in 2013, are projected to grow 2-3% each year through 20202. However, the experiences of customers, who are paying higher prices for lower quality, less cotton-rich home items, could thwart projected growth, according to Cotton Incorporated’s Customer Comments Research™ study.

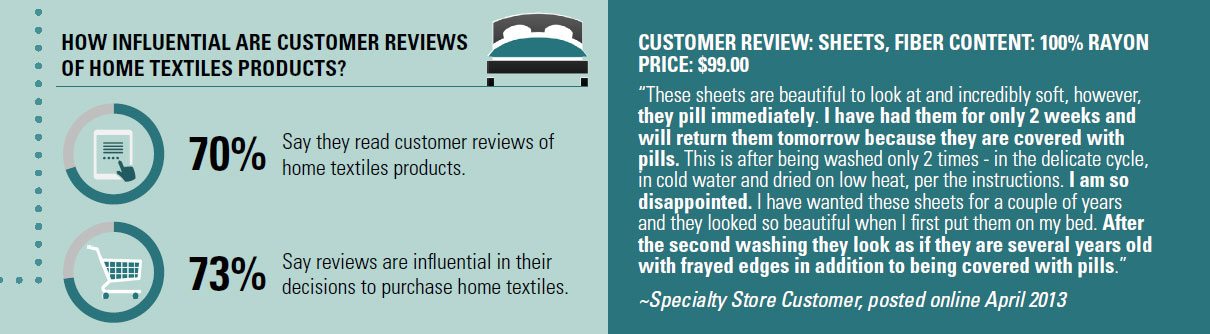

Consumers have higher durability expectations for home items, like bedding and sheeting, than they have for their clothing purchases, which can result in a greater degree of customer dissatisfaction when products underperform. As only 2% of consumers say home textiles are their favorite item to shop for, they will likely spend their discretionary money elsewhere, if their value expectations are not being met. In order to meet or exceed projected sales growth in the home textiles market, retailers and brands must understand consumers’ expectations, the issues that negatively impact customer loyalty, and develop tactics to solve reported issues.

PERFORMANCE EXPECTATIONS

Bedding and sheeting, one of the largest home textile categories, accounts for about a quarter of U.S. home textile sales on a dollar basis1 and approximately one-fifth of consumers’ home textile purchases. Given that average prices for bedding ($159) and sheeting ($81) are two to four times greater than average apparel prices ($38), today’s price-conscious shoppers are seeking home products that will meet their quality expectations. The majority of U.S. consumers say durability and longevity are very important in their bedding and sheeting purchase decisions. In fact, consumers expect their bedding items to last six to eight years and their sheeting to last about four years. Consumers evaluate the performance of sheeting during the nine days that they use sheets before washing them and after the estimated 162 launderings that occur within four years. Unfortunately, analysis of over 48,000 customer reviews of products offered by 10 key retailers indicates that some consumer expectations of home offerings are not being satisfied.

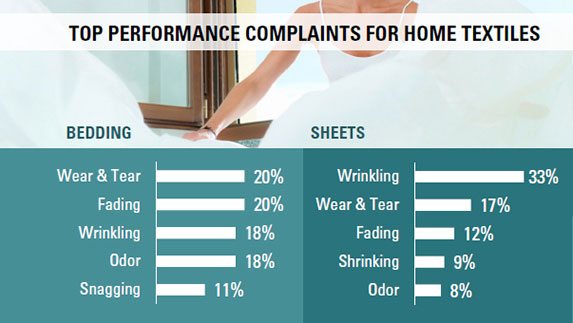

Increased price pressures forced home textile brands and retailers to pursue various cost-cutting measures such as changing fabric weights and finishes, eliminating construction elements, and substituting man-made fibers for cotton in bedding and sheeting. While cotton remains the dominate fiber in the major home textile product categories, there has been notable fiber substitution away from 100% cotton bedding and sheeting towards 100% polyester offerings. While cotton’s share of bedding and sheeting imports is rebounding3, the cost-cutting measures that the home textile industry implemented, specifically fiber substitution away from cotton, have resulted in a number of performance issues identified by consumers in their customer reviews. Analysis of customer reviews reveals that many of the most damaging performance issues that negatively impact customer satisfaction are experienced with products made from man-made fibers.

CUSTOMER FEEDBACK

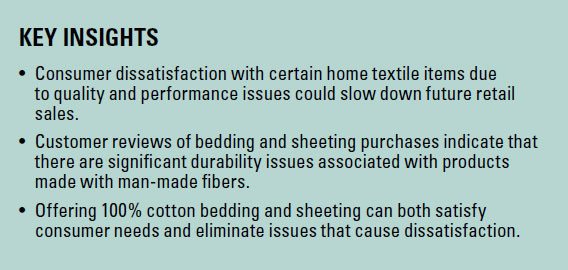

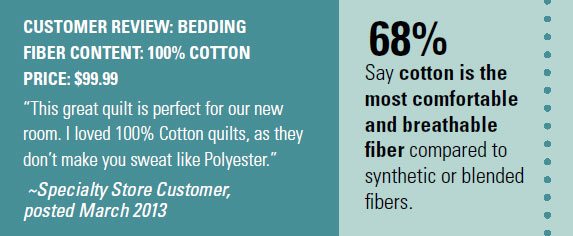

The top performance complaints in both bedding and sheeting were wear and tear (e.g., holes, tears, or an item falling  apart), wrinkling, and fading. In both product categories, wrinkling issues were most common in 100% cotton offerings, while snagging and wear and tear issues were most common in 100% polyester offerings. In sheeting alone, pilling and wear and tear issues were most common in 100% rayon fiber offerings. While wrinkling and fading are some of the most prominent performance issues in bedding and sheeting, they have a negligible impact on customer satisfaction when analyzing customer star ratings. However, research indicates that customer dissatisfaction nearly triples when shoppers experience polyester and rayon-related issues like wear and tear and pilling in sheeting and dissatisfaction nearly quadruples when shoppers experience polyester-related issues like wear and tear in bedding. Consumer reactions to man-made fiber related issues that degrade product durability is not surprising given that consumers rate cotton as the most comfortable, breathable, durable, and sustainable fiber and about eight in 10 prefer cotton-rich bedding (75%) and sheeting (81%).

apart), wrinkling, and fading. In both product categories, wrinkling issues were most common in 100% cotton offerings, while snagging and wear and tear issues were most common in 100% polyester offerings. In sheeting alone, pilling and wear and tear issues were most common in 100% rayon fiber offerings. While wrinkling and fading are some of the most prominent performance issues in bedding and sheeting, they have a negligible impact on customer satisfaction when analyzing customer star ratings. However, research indicates that customer dissatisfaction nearly triples when shoppers experience polyester and rayon-related issues like wear and tear and pilling in sheeting and dissatisfaction nearly quadruples when shoppers experience polyester-related issues like wear and tear in bedding. Consumer reactions to man-made fiber related issues that degrade product durability is not surprising given that consumers rate cotton as the most comfortable, breathable, durable, and sustainable fiber and about eight in 10 prefer cotton-rich bedding (75%) and sheeting (81%).

THE WAY FORWARD

Consumer identified performance issues uncovered through this analysis potentially represent about 1.3 billion home  textile products at retail. More than two-thirds (68%) of consumers say that they are very or somewhat likely to refrain from purchasing an item, if there were negative reviews. This figure noticeably increases when shoppers read product reviews that indicate an item fell apart, a common complaint for bedding and sheeting made from man-made fibers. Proper textile processing can help retailers and brands avoid non-fiber specific issues like fading and shrinking, while returning to 100% cotton offerings is an effective solution to avoid wear and tear, snagging, and pilling issues. As cotton prices are again competitive with man-made fiber prices, returning to 100% cotton bedding and sheeting offerings is a cost effective solution to prevent man-made fiber related issues from damaging the bottom-line, brand equity, and sales of retailers and brands.

textile products at retail. More than two-thirds (68%) of consumers say that they are very or somewhat likely to refrain from purchasing an item, if there were negative reviews. This figure noticeably increases when shoppers read product reviews that indicate an item fell apart, a common complaint for bedding and sheeting made from man-made fibers. Proper textile processing can help retailers and brands avoid non-fiber specific issues like fading and shrinking, while returning to 100% cotton offerings is an effective solution to avoid wear and tear, snagging, and pilling issues. As cotton prices are again competitive with man-made fiber prices, returning to 100% cotton bedding and sheeting offerings is a cost effective solution to prevent man-made fiber related issues from damaging the bottom-line, brand equity, and sales of retailers and brands.

*Bedding includes all top of bed items such as bed in a bag, bedspreads and bedspread sets, comforters and comforter sets, coverlets and coverlet sets, duvets and duvet sets, quilts and quilt sets, etc.

ABOUT THE RESEARCH

Cotton Incorporated Lifestyle Monitor™ survey is a monthly online research study that gauges the attitudes and behaviors of U.S. consumers regarding clothing, appearance, fashion, home furnishings, fiber selection, and other topics.

Cotton Incorporated’s Customer Comments Research™ study includes analysis of over 300,000 customer reviews, posted from 2010 to 2013, on over 35,000 U.S. apparel and home textiles products.

External Sources: Home Textiles Today1, Euromonitor International2, and OTEXA3