These days, consumers have fast fashion assortments turning at lightning speed, social media messages all day long on what’s hot internationally and attention spans that are less than that of a goldfish. Designing clothes that people will want beyond next week might seem like a fool’s errand. But tech companies say they can help designers sort through the noise so that they’re not just “going with their gut,” but rather traversing the fashion landscape with solid direction. And, they say, it’s direction that won’t replace designer creativity.[quote]

“We have to use predictive analytics,” said Crystal Slattery, president of the Cinq à Sept and LIKELY labels at an Editions panel discussion presented by Edited, a retail technology firm. “We’re kind of old school. We have a lot of great qualities like being fast to market, going with our instincts, going with our gut, and leveraging our relationships to make decisions. But we have to use every single tool we can possibly get our hands on. Probably 30 percent of our business is the same dress over and over again from size 00 all the way up to a size 14. So to have somebody manually sit there and try to figure out how many weeks of supply we should have on a size 8 is not a good use of human energy. There are a lot of tools out there that can help us forecast better and we want to give our teams every possible advantage.”

While some may think of data and predictive analytics are antithetical to the creativity that is fashion’s hallmark, design houses, manufacturers, and retailers have always engaged in analysis, albeit perhaps not in a formal sense. However, reviewing what has sold well previously, researching the history of a brand to inform future styles and staying on top of such things as color trends are all basic analytics that come as second nature to designer teams and merchandisers. The newer role of data is meant to give more developed insight into what consumers want.

“EDITED is a retail technology company that helps retailers and brands around the world make sure they have the right product at the right time for the right price,” said Katie Smith, retail analysis and insights director for the analytics company. Among other things, it creates dashboards where execs can compare not only their own successes and failures from the previous season, but that of their competitors. Planning toolkits also helps companies set up trend parameters, identify key growth areas, and the subcategories that drove that business.

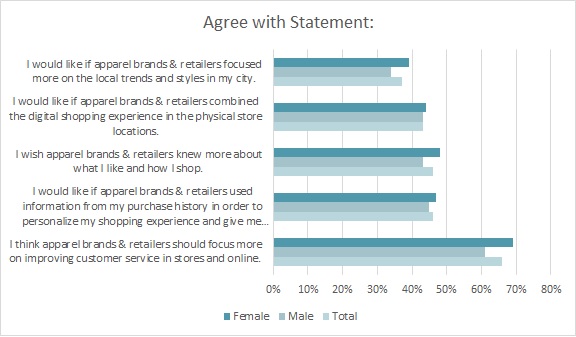

Each bit of data can help brands develop a closer relationship with their customer. Consider that nearly half (46 percent) of all consumers would like apparel brands and retailers to use information from their purchase history in order to personalize their shopping experience, according to the Cotton Incorporated Lifestyle Monitor™ Survey.

Additionally, 46 percent of consumers say they wish apparel brands and retailers “knew more about what I like and how I shop,” according to Monitor™ research. And more than one-third (37 percent) say they would like it if brands and retailers “focused more on local trends and styles in my city.”

“The more you really understand what your customer wants, the easier it is to design into the future,” said Chris Benz, creative director at Bill Blass, during the Editions panel discussion.

Benz said data can be a guide when he feels creatively stifled because an item is doing so well that he feels he has to keep repeating it. Alternately, he says sometimes his team will think the data is pointing out something new and different they should try, even if that’s not the case.

“Sometimes we’re like, ‘People must want a navy blue shoe because there aren’t any navy blue shoes in the market.’ And then someone else will say, ‘No, there’s a reason there are no navy blue shoes in the market and that’s because ain’t nobody want it,'” Benz said, drawing audience laughs. “So it’s incumbent upon the creative minds and designers to drive what will be trends in a way that pings the data in meaningful ways.”

Whether shopping online or in-store, 40 percent of consumers use apparel brand and retailer apps on their smartphones or computers to shop, according to Monitor™ research. And 54 percent of consumers say they would be more likely to buy clothes from a store that offered personal clothing collections based on previous purchase history and preferences.

This is the type of data that brands and merchandisers can mine for future collections. Tableau Software, based in Seattle, says fashion retailers are using embedded analytics to validate orders for certain styles, size, and color to avoid incurring additional manufacturing costs for small production run sizes.

Fashion Snoops is another forecasting agency that works with companies to act on future trends. Lilly Berelovich, co-founder and chief information officer, says the new perspective is looking at the consumer and understanding that how they live, what’s happening politically, what people are eating and listening to, and where they’re traveling are all beacons of information that set tone and intention on product that will serve and resonate with them. One of the things her company does is identify cultural macro and micro trends using news articles and social media. They follow the trends throughout the year and then help inspire design themes based on that. This includes color, texture, shape, and material.

“Because no one really needs another anything,” Berelovich said in a Fashion Snoops webinar. “We’re really looking for emotional connections. And connecting to your consumer through that emotional connection is really the only way.”

For brands and retailers, having these various data points will help take the guesswork out of how best to reach consumers.

“That’s the beautiful thing about data,” says EDITED’s Smith. “The more you look, the more you see.”