This is going to take a while. COVID-19 was so seismic in its intensity, recovery won’t be instantaneous. Americans are known for their impatience, but the virus forced everyone to slow down and change their habits. Incredulity over being told to quarantine in our homes turned into fear of leaving them. Eventually, though, restlessness set in and a steady beat began for reopening and “getting back to normal.”[quote]

But rising cases in states that have reopened serve as a reminder that normalcy may just be different for a while. And that’s forcing apparel marketers to revamp their priorities not just for the coming months, but heading into 2021.

“Is it possible the worst of the coronavirus pandemic is behind us?” asked the National Retail Federation’s Jack Kleinhenz, chief economist, in the June issue of the NRF’s Monthly Economic Review. “Maybe, but we are not out of the woods yet, and uncertainty abounds. Predicting what will happen is even more challenging than usual. While history often helps guide us, previous downturns offer little guidance on what is likely to unfold over the next six to 12 months. There is no user’s manual in which government, businesses or consumers can find precise solutions for what we are going through.”

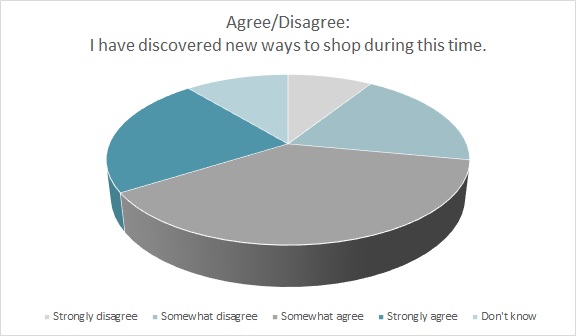

The pandemic meant routines went out the window, in more ways than one. Besides working, schooling and Zooming at home, more than half of all consumers (61percent) said they found new ways shop, according to the 2020 Cotton Incorporated Coronavirus Response Survey (Wave II). For instance, 26 percent tried ordering online for in-store or curbside pickup for the first time. And 15 percent tried product recommendations based on their browsing and purchasing habits. Further, 44 percent of shoppers said they were shopping online more than before COVID-19 hit.

Going forward, 69 percent of consumers say the coronavirus experience will change the way they shop in the future, according to the Coronavirus Response Survey research. The problem for retailers is that the virus isn’t like a hurricane or snowstorm, where recovery begins as soon as the storm passes. COVID-19 is still unfurling — and continuing to affect consumers at multiple levels: physically, emotionally, and financially.

McKinsey & Company determined six trends in changing consumer behavior:

- Despite pockets of reopening, net consumer optimism has decreased, and 70 percent in hard-hit nations anticipate adjustments to their routines for four months or more.

- As incomes decline, consumers are spending on essentials, not discretionary categories.

- Consumers are shifting to online and digital solutions, as well as reduced-contact channels for goods and services.

- Even though stay-at-home regulations are lifting, consumers are still pulled toward a “homebody economy.”

- Consumers want extra reassurance to resume activities outside their homes.

- Consumers want an ongoing emphasis on cleaning and safety.

These changes in behavior have both pluses and minuses.

Ecommerce saw astounding leaps in year-over-year April purchases due to being in lockdown, according to Bluecore, a retail marketing technology firm. Traditional chain stores saw an 80 percent increase in online purchases, while traditional department stores saw an increase of 44 percent and digital natives experienced a 53 percent jump.

As beneficial as all that digital shopping was, Forrester predicts 2020 global retail sales will drop -9.6 percent, for a loss of $2.1 trillion. The U.S. should expect sales to fall by $321 billion, a -9.1 percent decrease from 2019. Forrester expects offline non-grocery sales will contract by 20 percent, while ecommerce remains flat.

“Retail categories like grocery and essential consumables are performing well, while other categories like fashion, beauty and cosmetics are seeing a marked decline in consumer spend,” said Forrester’s Michael O’Grady, principal forecast analyst. “In 2020, there will be a significant decline in global retail sales, particularly with non-essential items sold offline, which will be a big challenge for brick and mortar retailers. Online sales, however, will be more resilient. To navigate the crisis, retailers need to manage their costs, and drive their ecommerce sales and services as much as possible.”

This makes sense as 71 percent of consumers say it may take a while before they feel comfortable shopping in a mall again, according to the Coronavirus Response Survey research. And 79 percent say that for some time, they will take extra measures to protect their health when going out.

This may mean connecting differently with consumers, says SmarterHQ’s Kara Holthaus, vice president of client services. But knowing the right time and place to engage might be tougher than ever.

“Consumers were distracted before the crisis,” she said in a recent webinar. “Now, they’re probably even more distracted with everything that’s going on in the world and their lives. Customers are interacting with your brand across so many different channels, it can be really hard but you must pull all the data together and understand how someone might need to be nurtured, how you might need to engage post-purchase or how you might be able to reactivate them, especially if the channel they used to shop for your product isn’t available right now.”

Holthaus says collecting and taking action on consumer data sets will be imperative for now-crucial predictive personalization. Customer data platforms (CDP) will be key to automating in-the-moment messages for customers who may be actively browsing, shopping, disengaging or re-engaging. And brands can get the biggest bang for their buck, she says, by using personalized behavioral content. Take push notifications: stores can send customers “back in stock” notifications, as well as suggestions that can be substituted. Retailers can also leverage customer “wish lists,” telling customers when their desired piece has “low inventory,” or when it will be on sale. Stores can also advise customers that their item of choice is back in their favorite location, and can be picked up in-store or curbside.

“Changes can be very difficult at this time,” Holthaus says. “Even so, look at what you’re doing today, see where you can tweak. And do this every week. See how your customers are changing week over week. How might you adjust your current personalization strategy and campaigns? And what do you need to change that can actually have a big impact in engagement and conversion over time?”