States have been slowly reopening after the coronavirus pandemic saw stores, schools, work, and life in general shutdown months ago. For Gen Z and Millennials, COVID-19 marked yet another crisis that affected these younger generations. But it seems to have impacted them differently, and that may have an effect on how retailers reach out to their target customers.[quote]

Millennials and Gen Z can be forgiven if they feel shaken lately. After all, how many “once in a lifetime” crises hit during their formative years and kept right on coming: the dotcom meltdown, 9/11, the Great Recession, and finally, the coronavirus global pandemic? As if the virus itself and the shutdown that accompanied it weren’t anxiety-producing enough, the stock market took investors on a wild ride, including record drops in the Dow Jones Industrial Average and multiple episodes of halted trading.

Fears about the long-term effects on jobs and the economy wasn’t far behind. For Millennials, who were older during the Great Recession and personally felt its impact more, news of fresh financial instability seems to be hitting this generation harder than for Gen Z.

Recently, word came that a U.S. recession actually began in February, according to the National Bureau of Economic Research. Additionally, The Conference Board released a negative GDP outlook for 2020, predicting a -5.7 percent contraction for the year.

“Despite pockets of reopening, net consumer optimism has decreased,” says McKinsey & Co., in a June article. “And most consumers expect a long-lasting impact from COVID-19.”

To underline that point, the University of Michigan’s consumer sentiment was 72.3 in May, remaining close to the 8-year low of 71.8 in April.

Despite a previously inconceivable lockdown that lasted for months, the virus’ continuing presence and the lack of a vaccine have tamped down enthusiasm for reopening, especially among Millennials. Among those born between 1983 and 1998, 84 percent said they were “somewhat or very concerned” about the COVID-19 pandemic, according to the Cotton Incorporated 2020 Coronavirus Response Survey (Wave 2 April 27-30), with most (62 percent) falling into the “very concerned” range. Among Gen Z shoppers — those born between 1999 and 2012 — significantly less (78 percent) felt “somewhat or very concerned” about the virus, with markedly less (51 percent) feeling “very concerned.”

These concerns aren’t unfounded, as COVID-19 cases have increased in 22 of the reopened states.

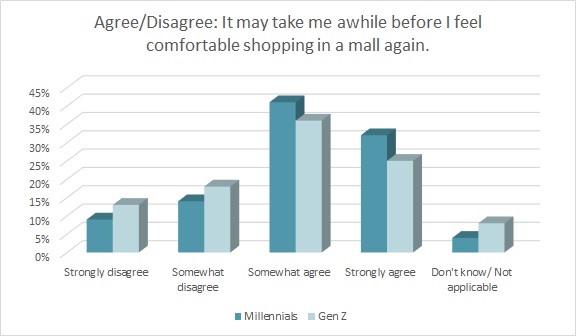

Most Millennial consumers (73 percent) say it may take them a while before they feel comfortable shopping again in a mall, according to the Coronavirus Response Survey data. The majority of Gen Z shoppers agree, but at 62 percent, it is significantly less than their older counterparts.

Now that the quarantine rules are lifting, a survey by YPulse, the youth consumer advisory firm, has found that both Millennials and Gen Z shoppers are feeling both nervous and happy that this crisis is ending. But the older generation of Millennials is experiencing higher levels of negativity. For instance, nearly half of all Millennials (46 percent) and 41 percent of Gen Z are feeling “cautious,” as quarantine ends. But Millennials are also feeling significantly more “anxious” than Gen Z about the prospect of states reopening (41 percent versus 29 percent). They also feel notably more “scared” (25 percent versus 17 percent), vulnerable (21 percent versus 15 percent), unprepared (19 percent versus13 percent) and panicked (16 percent versus 9 percent).

YPulse surveyed these younger consumers about cheerier sentiments, as well. Here, Gen Z leads in the more positive attitudes. For instance, Gen Z shoppers are more excited (35 percent) than Millennials (24 percent) about quarantine rules lifting. Gen Z is also happier (28 percent versus 25 percent).

A recent survey by Vesta, a marketing solution from Social Media Link, found that half the respondents said they planned to wait at home within the first two weeks of reopening, although Gen Z is “showing more of an eagerness to get back into a regular shopping routine,” according to an article in Adweek. The report said 27 percent of those surveyed think it’s too soon to reopen. Additionally, 37 percent are concerned about a resurgence of the virus.

YPulse’s research also found “fears over a second wave of COVID-19 are very real, and [our] data from early May shows that over half of both Gen Z and Millennials believe that coronavirus will still be a threat in six months or more. The majority say that they will still be afraid to be in large crowds of people even after social distancing ends, and that how often they go out in public has been permanently changed by COVID.”

Despite any lingering concerns, the Vesta survey also showed Gen Z is eager to shop for apparel and beauty/personal care product (71 percent), as well as entertainment items, while Millennials are more focused on shopping for baby products (28 percent), according to Adweek.

Cotton Incorporated’s Coronavirus Response Survey found that when stores reopen, 37 percent of Gen Z shoppers will have a stronger preference for clothes shopping in physical stores, significantly higher than those that will have a stronger preference for shopping online (25 percent). That compares to Millennials who said once the pandemic passes, they will have a stronger preference for shopping for clothes online (31 percent) versus in-store (30 percent).

YPulse says its data and research into young consumers’ post-COVID-19 outlooks and behaviors, “clearly indicates that brands need to be prepared for a slow return to normalcy — and that young consumers might never be ready to go back to the way things were after fear of infection has been so deeply instilled in them. Taking clear and conscious measures to help ease fears and protect consumers will be appreciated and likely necessary.”