Buzzfeed has a fun quiz that lets people know if they’re a Millennial or Gen Z based on the clothes they like. Bucket hat? Gen Z. Skinny jeans? Millennials. To the casual reader, it might seem silly. To fashion marketers, knowing which trend appeals to which generation is key to reaching them and selling product. Yet when it comes to Gen Z, the pandemic has highlighted differences within the group as well as discrepancies between what they want and what is available — presenting an opportunity in this younger market.[quote]

Statista registers Gen Z, which numbers 67 million in the U.S., as having birth years that range from 1997 to 2012. The oldest members of Gen Z are 24 years old this year, while the youngest are in third grade. Jason Dorsey, president of the Center for Generational Kinetics (CGK), a Millennial and Gen Z research consultancy, says COVID-19 is such a generation-defining moment, it could split the generation in two, with the older members experiencing a different and largely economic impact.

“In our ‘Solving the Remote Work Challenge Across Generations’ study, we discovered that during the summer of 2020, almost half (45 percent) of Generation Z have seen their work hours decreased, over one-third (37 percent) are not able to work or get paid and over one-fourth (26 percent) have filed for unemployment in the past 30 days, Dorsey wrote in MarketWatch. “What’s more, 25 percent of Gen Z feels that they will be worse off when the pandemic is over.”

Having already watched their parents and older siblings deal with the Great Recession, it may not be surprising that the pandemic is affecting Gen Z’s outlook, especially when it comes to money choices. “Our research shows Gen Z is much more focused on saving and getting a great value for the money they spend rather than spending frivolously,” Dorsey writes. “In addition, they were comparison shopping for the best deals and driving meaningful growth at thrift stores — all pre-pandemic.”

A year into the pandemic, 46 percent of Gen Z consumers say they think the pandemic will change the way they shop for clothes in the future, according to the Cotton Incorporated Lifestyle Monitor™ Survey (Gen Z 2021). Already, 47 percent say the pandemic has caused them to buy more of their clothes online. And the online retailer they’ve turned to the most is Amazon. More than two-thirds (68 percent) shop Amazon either to browse or purchase.

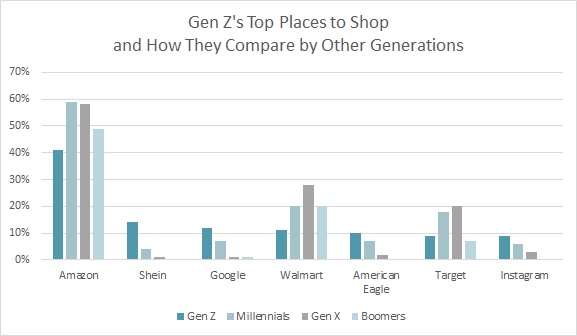

Even more, 41 percent of Gen Z shoppers name Amazon as their top site for buying clothes online, according to the Monitor™ survey. That’s trailed by fast-fashion ecommerce retailer Shein (14 percent), Google (12 percent), Walmart (11 percent), American Eagle (10 percent), and Target and Instagram, (both 9 percent), among others.

It’s clear most of the top websites for young shoppers are price driven. The Monitor™ survey finds a little more than 4 in 10 Gen Z shoppers (42 percent) say “cheaper/better prices” are the reason they buy clothes online. That’s actually in line with Boomers (45 percent).

But the surplus of fast-fashion garments that top their list are out of sync with the 43 percent of Gen Z shoppers who say they “actively look” for products or companies that have sustainable or environmental practices or reputation, according to the Monitor™. That’s slightly less than Millennials (45 percent), but significantly more than Gen X (27 percent) and Boomer (29 percent) shoppers. A third of Gen Z shoppers (40 percent) say they “always/usually” buy sustainable apparel, while 44 percent say they do “sometimes.”

CGK’s “State of Gen Z 2020 Consumers” study found that 47 percent of Gen Z consumers say they would respect a company more that supports environmental protection. And they would be willing to pay $14.30 more on a $50 purchase if a company supports protecting the environment.

But Gen Z also helped companies like Shein enjoy solid growth in 2020. Despite the pandemic, Molly Miao, Shein’s chief marketing officer, last month told WWD the company “had a great 2020.” This after it reportedly saw revenues hit $2.8 billion in 2019. The company began in 2008 as Sheinside.com but was acquired by CEO Chris Xu who, in 2015, changed the name to Shein, according to Forbes. The company targets Gen Z and reaches them through influencers on Instagram and TikTok. To keep interest high, the site uploads hundreds of new products every week, including things like an $8 dress.

But an article in Euronews Living, a digital platform for the independent, pan-European news channel, cited Fashion Revolution, a global movement promoting more sustainable and fair fashion production, in saying the merchant’s prices are deceptively low.

“Cheap prices make us believe they bring about savings for consumers,” Fashion Revolution stated. “This may appear true in the short term… but all of us, as global citizens, will ultimately end up paying the external cost, the true cost for the unsustainable consumption and production of cheap clothing.”

In a December report, Edited’s Kayla Marci says the time is now for fast fashion to start acting responsibly.

“Retail experienced a much-needed slowdown at the pandemic’s peak, with fast fashion arrivals declining 11 percent between January to April,” Marci says. “Younger consumers may be dubbed the activist generation, yet a paradox has long existed with Gen-Z fueling demand for throwaway culture while pioneering sustainable change. This is shifting as consumers fall out of love with fast fashion — 46 percent of U.S. brands reported a decrease in consumer purchases this year.”

That sales decrease is in part reflecting the fact that just 53 percent of Gen Z consumers who bought clothes online were satisfied with garment quality, according to the Monitor™. Satisfaction dropped to 43 percent when it comes whether or not the clothes they bought were the color they expected. And only 25 percent were satisfied with whether or not the clothes they bought would even fit them.

“Retailers need to align themselves with new consumer values and reset to focus on investing in the right products in limited SKUs,” Marci states. “In the long run, the traditional cycle of flooding the market with newness will only negatively impact the environment as well as retailers’ bottom line.”