Already this season, Thanksgiving was largely disrupted because of COVID. Now people across the U.S. are bracing for the same over the winter holidays. News of forthcoming vaccines is welcome. But nine months of working from home, self-isolation, shutdowns and curfews have taken a toll on the U.S. consumer. Marketers for brands and retailers will have to take that into consideration as we gladly wave good riddance to 2020 and look ahead to 2021.

An unwelcome side effect of living through this global pandemic has been the emergence of coronaphobia. According to the National Center for Biotechnology Information’s (NCBI) article “Understanding coronaphobia,” this new phobia stems from a “fear of catching COVID, stress about personal and occupational loss, increased reassurance and safety seeking behaviors, and avoidance of public places and situations, causing marked impairment in daily life functioning.

“The triggers involve situations or people involving probability of virus contraction, such as, meeting people, leaving house, travelling [sic], reading the updates or news, falling ill or going for work outside,” according to the NCBI research paper, “Understanding Coronaphobia.”

Gartner’s Kate Muhl, vice president, analyst, speaking at the virtual Gartner Marketing Symposium/Xpo 2020, said, “How long consumers think it will take to get back to normal isn’t at all material to how long the pandemic will last, but it is an important metric for marketers thinking about what’s on consumers’ minds and what they’re getting mentally ready for.”

[quote]

Gartner’s 2020 Consumer Behaviors and Attitudes Survey confirmed that most people feel they’re at risk of exposure in public places, and 77 percent say socializing the way they did pre-pandemic is no longer comfortable. “Now is the time for marketers to lean into the aspects of their brand values that support consumers’ self-protective instincts,” Muhl said.

The majority of consumers (65 percent) are very concerned personally about the COVID-19 pandemic, according to Cotton Incorporated’s November 2020 U.S. Coronavirus Response Survey, wave 4. The survey showed 37 percent of consumers currently work or attend school remotely/virtually on a full-time basis. Another 20 percent are virtual at least some of the time. And 20 percent do not work outside of the home or go to school.

Since early fall, 45 percent of consumers have been shopping online more than they did previously, according to the November Coronavirus Response Survey. The majority of these shoppers (56 percent) say they feel it’s safer to purchases items online rather than go into a physical store. Another 43 percent say they have more time and they’re online more often. And 40 percent say many physical stores either aren’t open, offer limited services or don’t have the sought-after product in stock.

This continued preference for shopping online correlates with the surge in COVID cases that began in September, according to Reuters. Now, after millions of people traveled over the Thanksgiving holiday, Dr. Anthony Fauci, director of the National Institute for Allergy and Infectious Diseases, says the U.S. is likely to experience “a surge upon a surge,” according to the ABC News story on November 29.

As such, Kantar Retail expects there to be a drop in new store openings, and instead growth in remodels by stores like Target and Walmart. However, discounters and shopping clubs will probably expand to underpenetrated markets in the U.S. The big question lies with ecommerce. Kantar says the unexpected and unprecedented growth seen in 2020 will leave online shopping at a permanently higher level in 2021 and beyond.

Additionally, Kantar expects online growth to continue in the coming years since so many retailers invested in delivery and store pickup options. However, as COVID wanes, the firm expects a deceleration in growth for online shopping. For the time being, though, the apparel sector should continue to enjoy sales growth online. As social distancing eases, though, Kantar advises stores that their services will play an important role in attracting shoppers and finding growth.

“Department stores, convenience and even mass retailers are well positioned here,” explains Kantar’s Timothy Campbell, director, U.S. consulting division.

But for now, 72 percent of consumers say they feel uncomfortable shopping for clothes in a brick-and-mortar locations due to COVID-19, according to the November Coronavirus Response Survey.

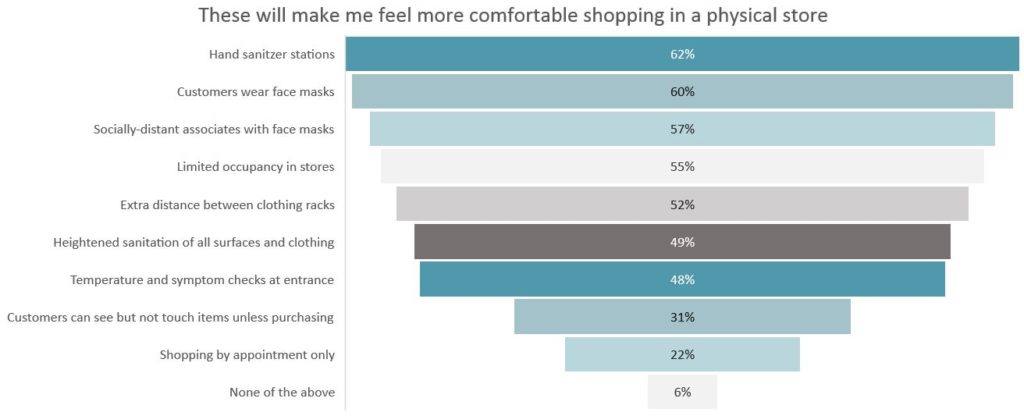

Consumers say they would feel more comfortable shopping for clothing in a physical store if there were hand sanitizer stations (62 percent) and if face masks were worn by all customers (60 percent), according to the November Coronavirus Response Survey.

Shoppers would also feel better if sales associates would all wear face masks and stay socially distant (57 percent), if retailers limited occupancy (55 percent), if there was extra distance between the clothing racks (52 percent), if there was heightened sanitation of all surfaces and clothing (49 percent), and if stores had temperature and symptom checks at the entrance (48 percent).

The prospect of a vaccine helps with consumer outlook, but there are still a lot of reservations, according to the November Coronavirus Response Survey. While nearly 6 in 10 consumers (59 percent) say they’re likely to take the vaccine as soon as possible, 76 percent say they’ll continue to observe COVID precautions such as wearing face masks and social distancing.

Such reservations ensure online shopping is bound to remain favored for the foreseeable future. But consumers feel like stores could make this process even safer. For customers that like to buy online with either in-store or curbside pickup, 44 percent say they would like to see safety precautions taken by associates at the pickup through items like face masks and Plexiglas, according to the November Coronavirus Response Survey. That’s followed by 37 percent of consumers who would feel more comfortable with curbside/contactless pickup options that have options like lockers for the purchase pickup or staff placing the items in the car. As well, 36 percent of shoppers would like to have curbside/contactless returns. And 34 percent would like stores to offer dedicated parking spots for pickup.

The National Retail Federation predicts livestreaming will grow during 2021, as it may be “the closest many retailers and brands have been able to come to physically connecting with their customers during the pandemic.” Additionally, the NRF admits malls “became an industry-wide punching bag in 2020,” but the association believes shoppers would feel more prone to returning to them if they were “reimagined from multi-level boxes anchored by department stores to more enticing, smaller environments in sync with consumers’ needs.”

The NRF also expects to see touch-free technology like contactless payments become the norm and augmented reality, such as virtual fitting rooms, to grow as retailers look to reduce return rates.

Finally, Gartner believes brands and retailers can connect with consumers by acknowledging the impact the social justice movement had on consumers in 2020. In fact, “equality” beat “loyalty” as the new No. 1 consumer value. The firm advises marketers to “review brand and communication strategies and realign themes to leverage consumers’ increased focus on social justice and civic engagement. Marketers should also emphasize the aspects of their brand values that speak to social justice or empower consumers’ participation in civic dialogue and expression.”

Although it’s impossible to see what the future will bring, after a year like 2020, it doesn’t hurt to take a breath and realize what actually went right. And then buckle in for 2021.