“For of those to whom much is purchased, much is returned.”

— Every Retailer

One of the big takeaways from the holidays was that online shopping again saw double-digit increases, climbing almost 19 percent over last year, according to Mastercard Spending Pulse. While that’s impressive, the United Parcel Service (UPS) expected a 26 percent increase in returns on Jan. 2, what the delivery service has dubbed “National Returns Day.” That was just one day during the holiday period. But it’s become clear that the way returns are handled can greatly impact both the customer experience and a store’s bottom line.

UPS’s Kevin Warren, chief marketing officer, said retailers should be factoring returns into their business plans.[quote]

“Gone are the days where returns were isolated to January,” he said, prior to the holidays. “Today’s empowered consumers will be sending packages back to retailers all season long.”

Research from Statista shows the number of packages returned in the U.S. on National Returns Day has nearly doubled in four years, from 1 million in 2016 to 1.9 million in 2020. Over the course of this year, the research firm has predicted U.S. return delivery costs will reach $550 billion. Apparel and footwear see the highest return rates, at 30-to-40 percent, according to CNBC. It reports that 5-to-10 percent of in-store purchases are returned, a figure that increases to 15-to-40 percent for online purchases. Nearly half of all consumers (48 percent) engage in “bracketing,” or buying multiple sizes online, keeping what fits and returning the rest, according to a study from Narvar Inc., a customer experience platform.

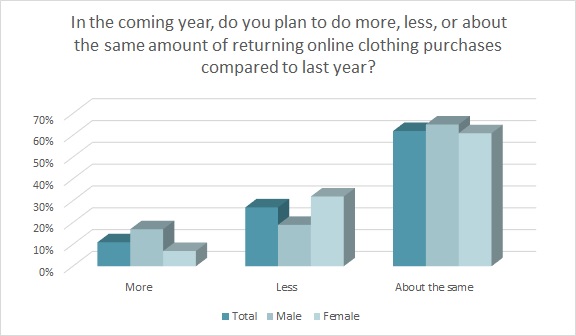

It’s reached the point that consumers seem to think of returns as part of their shopping experience. Consider that nearly three-fourths (73 percent) of all consumers say this year they did plan to return online apparel purchases more or the same amount as they last year, according to the Cotton Incorporated Lifestyle Monitor™ Survey. Additionally, more than 3 in 5 shoppers (61 percent) say they won’t buy clothes online if it can’t be returned for free.

JDA’s Jim Hull, senior industry strategy director, says the company is using artificial intelligence and machine learned to help stores with their returns forecasting.

“Essentially, you can start to figure out what a customer returned from what they purchased and make probability guesses,” he states. “Customers will order two sizes up or down from their average size, and they’ll get it in a couple of different colors. They’ll take the one or two they want and everything else goes back. You can feed this information into a fulfillment tool. So let’s say this person shopped in a particular demographic and was going to return to a certain store. I, as a retailer was going to send one of these items to that store some time in the next month. But I could choose not to send it unless that store was running out. I can wait to see if the customer returns the item to the store location. If she doesn’t within the return window, I can ship a replenishment and all is good. If she does return it and it’s in sellable condition, you can turn it right into sellable product. In this case, you didn’t send the extra piece from the DC (distribution center), you avoided overstock and avoided waste.”

Hull says this model helps with waste reduction and sustainability overall. “It optimizes margins, minimizes clearance sales, works for the customer and works for the retailer.”

In its own research, JDA found consumers have an increased focus on returns, and they stated their biggest inconveniences are paying to return packages by mail (30 percent), requiring a receipt (17 percent) and narrow returns windows (15 percent).

Almost one-quarter of all consumers (24 percent) and 29 percent of Gen Z shoppers are more concerned about return policies when online shopping compared to a few years ago, according to the Monitor™ research. And less than one-third (32 percent) are comfortable returning an online purchase.

Shoppers may also be more concerned about return policies since some retailers have begun pushing back on what they viewed as return abuse. L.L. Bean ended its “lifetime” return policy. Amazon has taken to banning shoppers who return too many items. And Asos will deactivate a serial returner’s account. The Retail Equation offers software that alerts retailers to consumers who have excessive returns and sometimes, the company states, a transaction is stopped because of it. Newmine, a retail consulting and technology firm, told WWD that other reasons for excessive returns could be due to compulsive shoppers who soon feel remorse; wardrobers who wear an outfit for a special occasion before bringing it back; and social media wardrobers who buy clothes merely to take an “outfit of the day” picture before returning the haul.

But returns aren’t always an automatic negative for stores. Newmine says returns are an opportunity to gain product feedback through data mining and can help determine what the customer really wants. And in a study by Narvar, 38 percent of consumers said it was easier to return an online purchase to a store location, though only 10 percent of them actually went that route for their last return. Narvar also says stores would do well to offer service stations devoted to online returns, or train associates on how to quickly return and exchange products — so customer don’t have to wait in long lines.

Salesforce’s Rob Garf, vice president of industry strategy and insights, says an in-store return represents another retail opportunity.

“Our studies show that about two-thirds of shoppers will go to a store to buy one thing and pick up an additional item — and the same can happen with returns,” he says. “When someone goes into a store for a return, there’s an opportunity for an upsell. In fact, I was at a sporting goods retailer over the holiday with my wife to return a product and we got a coupon from the register with a discount that was good for 90 minutes. So they were really urging us to buy something from the physical store in a way that was advantageous to both us and the store.”

UPS found that 73 percent of shoppers said the overall returns experience impacts their likelihood to purchase from a retailer again.

“If retailers want to be considered a ‘Returns Rockstar…” said Warren, “they will need to be prepared to offer a seamless, hassle-free returns experience to consumers.”