When consumers think “fast fashion,” their first thought might not be sustainable fabrics. But after years of hearing about how they are peddling “throwaway” apparel, leading retailers of low-price, trendy clothes are changing their approach. And to consumers, ecologically (and economically) balanced apparel is attractive.

The global retailer H&M is committed to using sustainable cotton; its goal is to grow its usage from 11.4% to 100% by 2020, says Catarina Midby, H&M’s head of fashion and sustainability communications.

[quote]”The way we see it, fashion is not that fast anymore,” Midby says. The company’s Conscious program includes apparel collections made from sustainable materials, as well as a range of green initiatives. “Neither do trends change very fast nor do we produce our collection very fast. We focus on quality and personal style. Our greener materials are organic, recycled or cellulosic (derived from plants). We have goals and strategies for energy, water, chemicals and much more.”

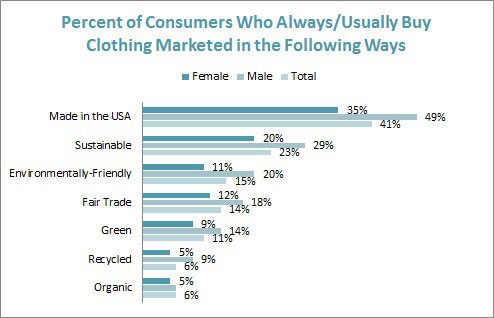

But sustainability still remains a grey area for consumers, who expect it but are not always willing to pay more for it. Because while more than half (57%) of all shoppers say “sustainability” claims are influential to their apparel purchase, just 23% “always or usually” buy clothes marketed that way, according to the Cotton Incorporated Lifestyle Monitor™ data and the Cotton Incorporated 2013 Environment Survey. Even fewer (15%) buy apparel positioned as “environmentally friendly.”

And just 26% are willing to pay more for clothes labeled as sustainable or environmentally friendly, according to Monitor data, though 51% say environmental friendliness is an important factor in their apparel purchase decisions, according to the Environment Survey.

And just 26% are willing to pay more for clothes labeled as sustainable or environmentally friendly, according to Monitor data, though 51% say environmental friendliness is an important factor in their apparel purchase decisions, according to the Environment Survey.

However, consumers are willing to pay more for better quality apparel. And when asked what “good quality” means when shopping for apparel, 64% said “durable/long lasting,” Monitor data reveal. Additionally, when asked what “sustainable” means, 31% said “lasts a long time,” while 19% said “durable,” according to the Environment Survey.

Patagonia’s Todd Copeland, environmental product specialist, says durable products are more responsible in their utilization of raw materials and labor resources — something his company strives to make.

“But people change their wardrobe when fashion changes, or when they get bigger or smaller, or when they get tired of wearing the same thing,” says Copeland, who also works in collaborative groups like the Sustainable Apparel Coalition and the Textile Exchange. “So clothing is still somewhere between a ‘durable’ product and a ‘disposable’ product.”

The Sustainable Apparel Coalition, which includes Cotton Incorporated as a member, is a trade association representing more than a third of the global apparel and footwear industries, formed to address current social and environmental challenges to the industry. Last summer, it unveiled the Higg Index, a tool to measure sustainability. It focuses on water use and quality, energy and greenhouse gas, waste, chemicals and toxicity.

Target, which has had numerous high/low fast fashion collaborations, adopted the Higg Index within parts of its supply chain. Upon the Higg Index’s debut, Target’s Scott Lercel, director of social responsibility and sustainability, said, “This tool allows our teams to make better decisions, improve our supply chain and, most importantly, reduce our impact on the global environment.”

Inditex Group, the parent company of Zara stores, has a strategic environmental plan that aims reduce CO2 emissions by 10% in 2015, and by 20% in 2020 when compared to 2005. It also intends promote eco-friendly alternatives in the development of new products and ancillary materials.

All of these corporate initiatives are significant. Because even though just 33% of consumers are even likely to seek out environmentally friendly clothes, 69% would be bothered if they found out an apparel item they purchased was not environmentally friendly, according to the Environment Survey. And 40% of consumers say they would blame the manufacturer if they purchased apparel and then found out it was produced in a non-environmentally-friendly way.

Midby says H&M understands that.

“We don’t really promote sustainability, but we do have long term plans and visions for a sustainable fashion future.”

H&M’s overall goal is to have all the cotton it uses to be sustainably produced by 2020. It has also partnered with WWF to implement holistic water stewardship and set new industry standards. And its Long Live Fashion initiative encourages shoppers to return old clothes to its stores. From there, a sorting facility determines if they can be re-worn, reused by being converted to something like cleaning clothes or recycled. And in the aftermath of the deadly factory collapse in Bangladesh that killed more than 1,100, H&M and other companies who manufacture apparel there also signed a factory safety pact, vowing to overhaul health and safety measures.

Copeland says the recession accelerated the move from “throwaway” fashion. In fact, the average shopper spends $70 each month on clothes, the Monitor finds, but these days, 67% prefer to skip trendy pieces and instead buy clothes that are higher in quality.

“With less disposable income, purchases are more deliberate,” Copeland says. “This buying practice can influence more responsible production of goods, but it remains to be seen whether this is a long-term behavioral change.”