At this point, the stories about how the coronavirus pandemic has impacted retail are plentiful, and most of them aren’t pretty: store closures, bankruptcies, furloughs, and a reduction in consumer spending like never before. But for those willing to dig, some good can be found amid the pile. From how people shop, to how they pick up their purchases and even how they pay, some shutdown behaviors might serve as lessons for retailers as we slowly move to the other side of COVID-19.[quote]

For starters, consumers have come to truly embrace ecommerce. Euromonitor International’s Michelle Evans, senior head of digital consumer, writes in her report “The Retail Ecosystem During COVID-19” that although consumers have been increasing their digital purchasing over the last decade, the lockdowns accelerated the practice.

“Consumer use of ecommerce could increase long term, with lockdowns serving as an introduction to many of these services for older cohorts,” Evans states. “An economic downturn could lead to continued cocooning, boosting spend through grocery retailers, too.”

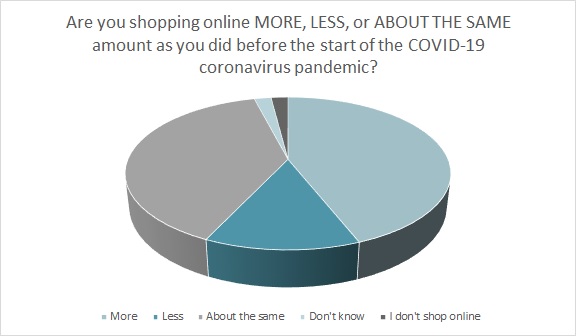

A majority of consumers (61 percent) say they “discovered new ways to shop” during this shutdown period, according to the Cotton Incorporated 2020 Coronavirus Response Survey (Wave 2 April 27-30). Close to half of all consumers (45 percent) are shopping online more than before the pandemic.

While 63 percent of consumers say they are using ecommerce more because so many physical stores had been closed, more than half (57 percent) say they just feel shopping online is safer, according to the Coronavirus Response Survey research. Another 50 percent say they’re online more often now and 42 percent say “shopping online is fun.”

Retailers should keep in mind that nearly 7 in 10 consumers (69 percent) say this experience will change the way they shop in the future, according to the Coronavirus Response Survey.

Euromonitor also found that the coronavirus sped up the trend toward buying online and picking up curbside. Amanda Bourlier, head of retailing research for the firm, said this aspect of omnichannel is one that many stores have been offering on but have had a hard time perfecting.

“Every player across the board has room to improve their omnichannel strategy,” she says in an online discussion titled “Key Themes in Retail Accelerating During the Coronavirus Pandemic.” Prior to the shutdown, a lot of companies treated omnichannel as something to add within the next 5 years, Bourlier says. But now, they have to prioritize it. “Features like buy online/pickup in-store (BOPIS) and seamless checkout have gone from ‘nice to haves’ to things you urgently need to have today. We’re going to see this partly because retailers can’t keep up with pure ecommerce demand, if you think about home delivery. Or at least they can’t do that and make it profitable. And also partly because consumers will prefer it. Click and collect rarely involves a service fee, and there’s no shipping fee the way you might see for home delivery.”

Target stores remained open during the pandemic, but many of its customers shopped online, and had their orders delivered or took advantage of curbside pickup. This led to first-quarter digital sales increases of 141 percent, and same-store sales gains of 10.8 percent, with revenue reaching $19.62 billion, according to a report from CNBC. However, the online demand necessitated more workers to select, pack and ship, or prep the item for curbside pickup. The increased wages, store cleaning and other pandemic-related expenses totaled $500 million. Unfortunately for the apparel sector, clothing sales were not part of the ecommerce surge, as Target reported the category was down by about 20 percent.

Such was not the case for Gap Inc., which expedited plans to use robots for its online orders. According to Reuters, the company had planned to triple the number of robots it uses in its warehouses to 106 by this fall. But the pandemic meant fewer people could safely work in the distribution centers. So the company asked Kindred AI, the firm that makes the robots, about sending them months earlier than planned. Each machine does the work of four people.

Bourlier says brands will find new ways to connect with shoppers, since consumers won’t be heading in-store as often. That means social commerce, livestream shopping, and partnering with delivery platforms. This might accelerate the growth of direct to consumer sales by brands, she says, as well as accelerate the shift of retail from an inventory-based business model to retail as a service business model.

Recently, Pinterest and Facebook revealed new shopping capabilities they’ve added to their platforms. In a Facebook Live presentation, CEO Mark Zuckerberg said 31 percent of small businesses “just stopped operating” because of the pandemic shutdown. Although Amazon already has 20,000 small businesses in its Storefronts section, Facebook launched Shops, which can be discovered through a business’ Facebook page or Instagram (also owned by Facebook) profile, so local stores can sell product directly through the site. Pinterest recently kicked off Shopping Spotlights, which offers a selection of items from fashion and home influencers, as well as curated pieces based on current Pinterest trends.

When the COVID-19 pandemic passes and more stores reopen, about 30 percent of customer feel they will have a stronger preference for buying clothes in a physical location, according to the Coronavirus Response Survey research. Another 23 percent feel they will prefer to shop online for apparel. And 40 percent think their preferences will remain the same as before the shutdown.

Even if consumers return to stores, retailers with brick-and-mortar locations should keep in mind that more than three-fourths of shoppers (79 percent) say they will “probably take extra measures to protect my health when going out (e.g. face mask, hand sanitizer) for some time,” according to the Coronavirus Response Survey research. This would be a good reason for more stores to incorporate contactless payment in their shopper experience.

Euromonitor’s Evans says retailers should expect contactless payments to be part of the changes happening in the near future.

“Even as economies open up, social distancing may become a way of life until there is a vaccine for COVID-19,” she says. “The longer such measures last, the more likely it is to fundamentally change consumers. “