Considering how ubiquitous Amazon has become to online shopping, it’s rather refreshing when a brand comes along that isn’t affiliated with the mega marketplace. Or any other marketplace or retail middleman, for that matter. Direct to consumer (D2C) brands have been experiencing strong growth, especially during a period of extraordinary retail challenges. The path taken by successful digital disruptors can provide a roadmap for legacy brands looking to increase their ecommerce game.[quote]

In the U.S., D2C ecommerce sales are expected to increase 128 percent from $76.6 billion in 2019 to $175 billion by 2023, according to eMarketer. During the same period, digitally native D2C ecommerce sales are projected to grow 131 percent, from $19.3 billion to $44.7 billion.

Initials, a London-based marketing and advertising firm, says D2C is expected to grow 19 percent in 2021 alone. It also cites research that says 55 percent of shoppers prefer to buy directly from brands, while 40 percent say they will purchase from a D2C brand in the next five years.

“While the direct model has gained significant traction across sectors, studies suggest there is still considerable room for growth,” states Initials’ Annie Little, senior strategist, in a paper, “The Rise of D2C: What the Modern Shopper Really Wants.” “From our own proprietary research, we discovered that 82 percent of consumers currently have between zero and four D2C relationships. This finding shows that the market is still in its relative infancy. For legacy brands, there is now a massive opportunity to disrupt the status quo with a D2C offering that delivers on the expectations, values and desired experiences of modern consumers.”

The COVID-19 pandemic continues to change consumer shopping habits, making this a favorable time for brands to add or make improvements to their D2C channel. Consider that 52 percent of consumers are now browsing online for clothing ideas more than before the pandemic, according to Cotton Incorporated’s Coronavirus Response Consumer Survey, (Wave 7, August 6, 2021). Consumers had a lot of time on their hands during the pandemic, and most (66 percent) said they learned a lot about online clothes shopping.

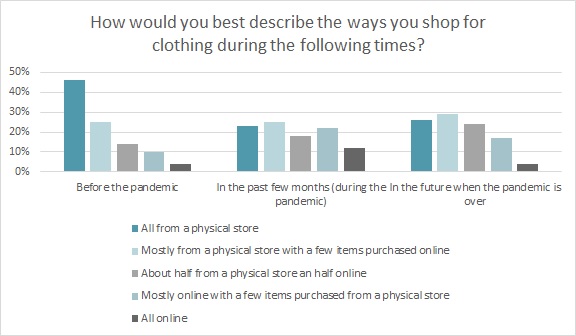

Before COVID hit, research from the Coronavirus Response Survey (Wave 7) shows 46 percent of shoppers purchased all their clothes from a physical store, while 25 percent bought mostly from a physical store with a few items purchased online. Another 14 percent bought half their clothes in-store and half online, 10 percent bought mostly online, and 4 percent got all their clothes from online sites.

But in the future when the pandemic is actually over, just 26 percent of consumers expect to buy all their clothes from a physical store, according to the Coronavirus Response Survey (Wave 7). Rather, the largest segment (29 percent) expects to buy mostly from brick and mortar stores with a few items purchased online, and 24 percent expect to buy half online, half in-store.

The reality is, nearly three-quarters of shoppers (70 percent) say that during the pandemic they’ve become used to shopping for clothes online, according to the Coronavirus Response Survey (Wave 7).

So, from a consumer perspective, D2C shopping makes sense, especially now. Direct brands offer convenience, ease of use, control over purchases and the ability to customize, Little says. Legacy brands need to build on those values and prove why they’re relevant, not merely launch a D2C channel.

For brands themselves, D2C represents fewer barriers to entry, higher margins and greater control over their brand, marketing and sales strategy, Little states.

But whether they know it or like it, D2C’s are competing with standards set by Amazon, stated eMarketer’s Jeremy Goldman, principal analyst at Insider Intelligence, during the “Think Like a D2C Disruptor” webinar. When consumers hold back from shopping with a D2C, they’re factoring in delivery times or costs (36 percent) and the inability to try/see products in real life (34 percent). There is also the inconvenience of returning products (21 percent) and concerns about data security (19 percent).

“Over time, the Amazons of the world have changed exactly what the average customer expects,” Goldman said. “These are things D2Cs have to work on if they’re going to continue to get market share.”

Brand discipline and focus on a specific niche helps direct brands go up against bigger companies that have more resources, Goldman said. Brand discipline translates into limiting choice and simplifying decisions, which ends up enhancing and enriching the customer experience. Data and testing, he says, are at the heart of good customer experience, so these brands are investing in and are being led by that data.

Data collection is more challenging though, now that Apple and Google restricted the ability to track users. But that’s what most users want: 76 percent of consumers say they don’t like companies tracking them online, according to the 2020 Cotton Incorporated Lifestyle Monitor™ Survey. At the same time, 70 percent say they would like brands and retailers to give them recommendations based on past purchase history and 66 percent say they wish apparel brands and retailers knew more about what they like and how they shop.

Gleaning customer information where they can is vital, though, as it will help brands maintain relationships with their customers. Goldman says D2C brands value customer retention more than acquisition, as “60 percent or so of the typical D2C brand’s revenue comes from customers who previously purchased from it, which means that retention is critical so they invest in recurring revenue models in order to make sure they can continue to grow.” Recurring revenue models include memberships, subscription boxes — both for recurring purchases (convenience) and discovery. Brands also need to diversify their advertising. Digital has become saturated, Goldman says, so brands are starting to move their ad spend to TV, direct mail, and experiential marketing that engages directly with the consumer.

ChannelAdvisor’s Link Walls, vice president of digital marketing strategy, also participated in the “Think Like a D2C Disruptor” webinar and said brands are getting smarter about employing shoppable media and giving customers a faster path to purchase, whether it’s through ads on Facebook, Instagram or anywhere else.

Little says D2C will “remain selective and hard-won” by the brands that are able to steadily justify their role in consumers’ lives.

“The brands that can build relevant, personalized and connected experiences that meet the wants and needs of a new generation of shoppers,” Little says, “will be the true winners in the D2C space.”