Cotton, Apparel & Inflation

October 18, 2022

INFO: [email protected] LIFESTYLEMONITOR.COTTONINC.COM

All content sourced from Cotton Incorporated’s 2021 Online Shopping Survey, a survey conducted with 1,000 U.S. consumers,

April 2021. Additional Sources:

2

Census Bureau.

3

Cotton Incorporated's 2021 Coronavirus Consumer Response Survey, Wave 6,

a survey conducted with 1,000 consumers May 2021. ©2021 Cotton Incorporated.

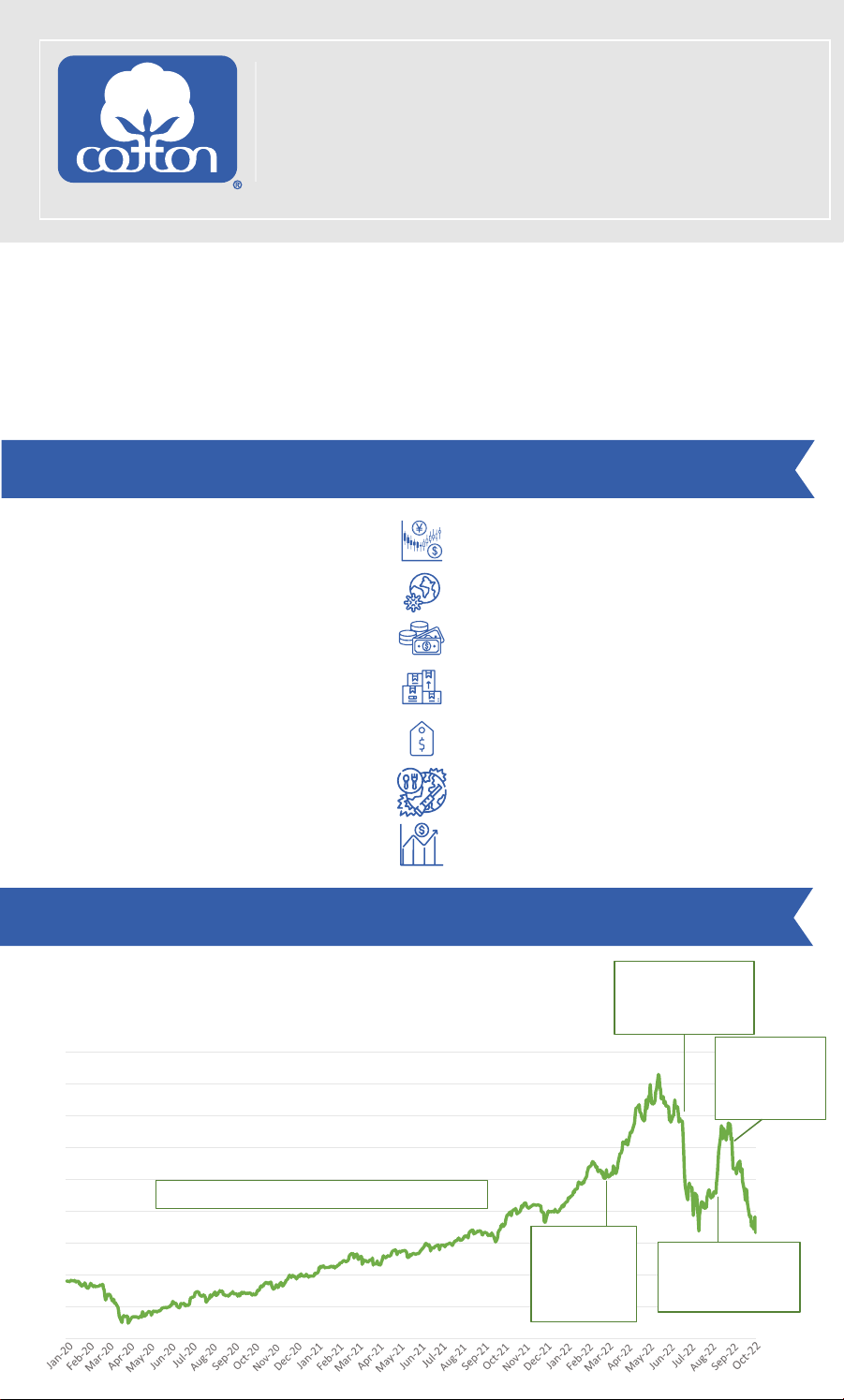

After the trade dispute realigned trade

flows, orders were slashed with COVID.

A surge in consumer demand with

stimulus made it difficult for retailers to

keep shelves stocked, especially with

the shipping crisis.

Elevated order volumes that were

placed to keep up with consumers and

to compensate for shipping issues are

arriving in ports while concerns about

consumer demand are flaring.

Trade dispute & tariffs

COVID & lockdowns

Stimulus & spending surge

Shipping crisis

Inflation

War in Europe

Higher interest rates & slower growth

Contributing to Volatility in the Cotton Market

COTTON INCORPORATED’S

SUPPLY CHAIN INSIGHTS

COTTON, APPAREL,

& INFLATION

50

60

70

80

90

140

NY/ICE December futures in cents/lb

130

120

110

100

USDA drops US

crop forecast

-20%

Cotton is part

of sell-off in

commodities

Outbreak

of

war in

Europe

Flooding in

Pakistan,

macro

concerns

Everything rally, recovery from COVID

After decades of relative price stability, consumers are grappling with

a surge in inflation after COVID and the war in Ukraine. While prices

for apparel have not moved far beyond their pre-COVID levels,

budgets available for spending on clothes are being impacted by

price increases for non-discretionary goods and services.

IT HAS BEEN A VOLATILE WORLD

Inflation in prices for other

spending categories may

sap income available for

clothing purchases.

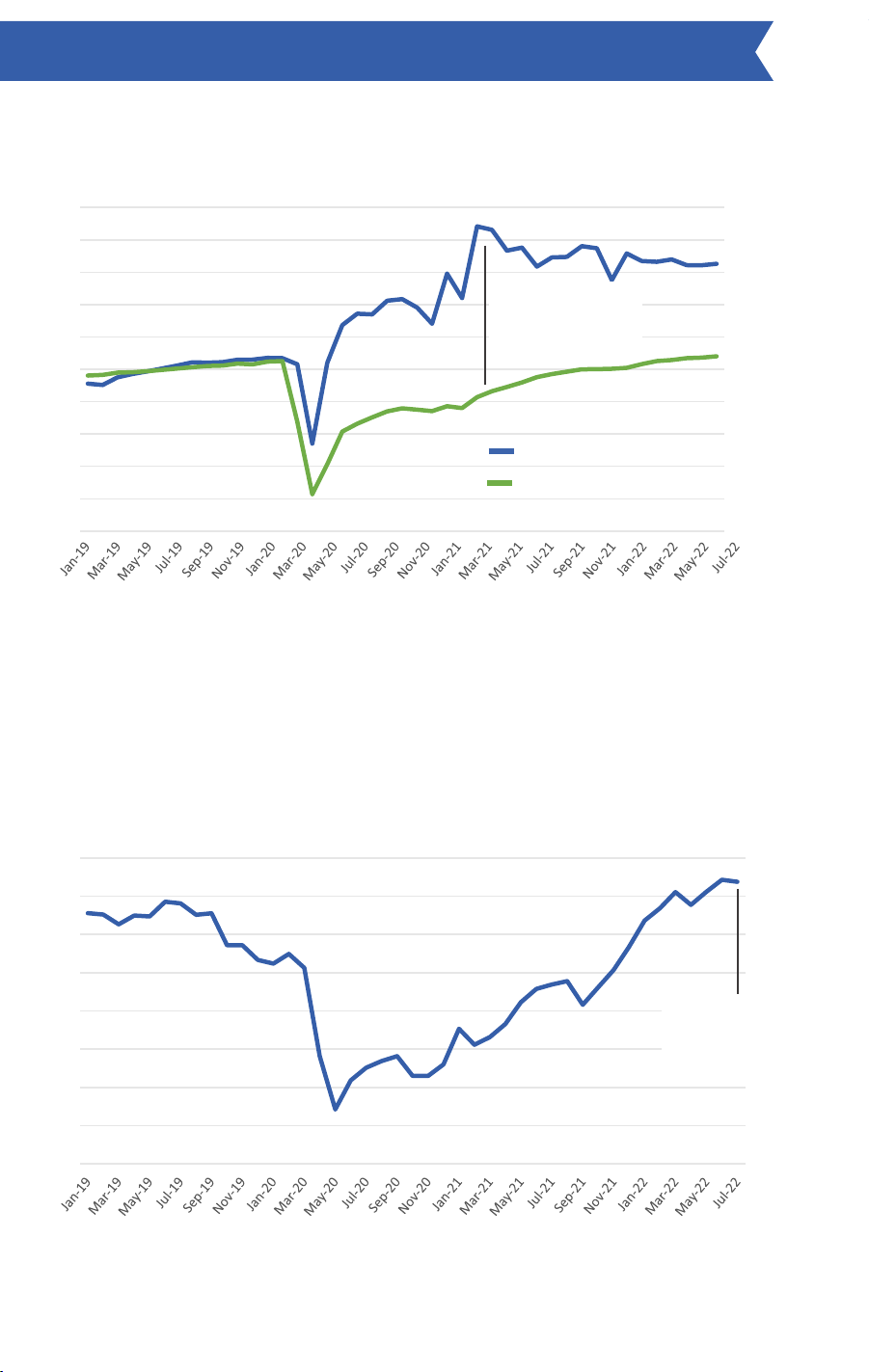

Rebalancing Downstream Demand

Consumer spending

patterns have

changed, with stimulus

supporting increased

spending on goods.

Concerns about having product on shelves evolved into concerns about

inventory accumulation.

Spending on Goods Surged After the Pandemic

Price Increases for Necessities Outpace Changes in Clothing Prices

The shipping crisis

made it difficult for

retailers to keep

up with consumer

demand.

As the effect of stimulus

dollars wanes and

consumers spend more on

services, demand for goods

like apparel could slow.

106

104

Retail apparel prices have been higher

year-over-year, but most of those gains

were due to reflating to make up for the

collapse with the onset of COVID.

108

110

112

114

116

118

120

CPI for garments, 1982-84=100

Clothing prices

up marginally

versus 2019

75

80

85

90

95

100

105

110

115

120

125

change in spending vs 2019 average, seasonally-adjusted

change in spending on goods

change in spending on services

Lodging

Spending on goods

25 points stronger

a�er COVID

Consumer Spending & Inflation

Communication

Not only does lodging, food, and energy represent much

larger shares of consumer spending, these categories have

also seen stronger price increases.

Higher prices for spending categories outside of apparel

could pinch income and challenge growth in consumer

apparel spending.

2%

Apparel less Footwear

Budget share Price Change

2%

12%

Shelter

33%

28%

Transportation

18%

20%

Food

13%

11%

Medical Care

8%

27%

Utilities

5%

9%

Recreation

5%

7%

Education

3%

2%

4%

INFO: [email protected] LIFESTYLEMONITOR.COTTONINC.COM

Source: Reuters, Bureau of Labor Statistics (BLS), Bureau of Economic Analysis (BEA)

©2022 Cotton Incorporated.