As consumers become more aware of sustainability, some fashion brands are making concerted efforts to not just be seen as an eco-conscious brand, but to change their practices and supply chains to reach legitimate sustainability goals.

Consumers — especially Millennials and Gen Z-ers — increasingly feel uncomfortable about sustainability issues such as wasteful packaging and the thousands of vans needed to be able to deliver your tube of toothpaste within 24 hours.”

Greg Petro

CEO & Founder, First Insights

Mavi, a global jeans and apparel brand, is taking a multi-faceted approach to reaching its targets. Fibers used in its All Blue collection include organic, recycled, or Better Cotton, as well as upcycled materials. The sales of the sustainable All Blue products accounted for about 10 percent of total revenues in 2021, according to Mavi’s Cüneyt Yavuz, CEO, in an interview for the Lifestyle Monitor™ Survey. He says the company is aiming for its entire denim collection to consist of sustainable All Blue products by 2030. With its “right price/quality balance,” Yavuz says the collection helps consumers make more informed choices.

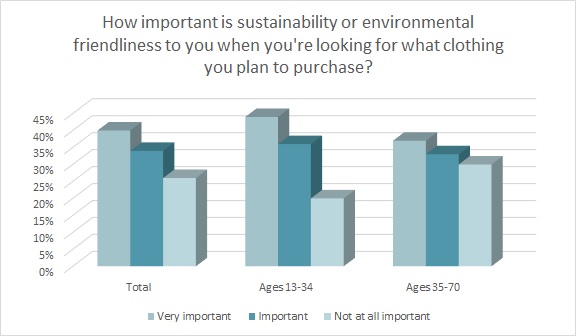

This approach to fashion is in step with today’s shoppers: Three-quarters of consumers (75 percent) say sustainability is important when looking at the products they plan to purchase, according to the Cotton Incorporated Lifestyle Monitor™ Survey.

Further, the majority of consumers say cotton clothing is the most sustainable (78 percent), highest quality (71 percent), and lasts the longest (59 percent) compared to manmade fiber clothing, according to the Monitor™ research.

In keeping with its sustainability approach, Mavi is also looking to achieve 100 percent traceability in its supply chain by 2030. Already, it has launched a Life Cycle Assessment (LCA) study on 43 of its denim styles to examine the carbon footprint, water consumption and environmental footprint the products have during their production stages.

“Additionally, by 2025 we will conduct environmental audits at all critical suppliers and wet process sub-manufacturers, and by 2030 we will ensure all strategic suppliers and wet process sub-manufacturers comply with the ZDHC (Zero Discharge of Hazardous Chemicals) MRSL (Manufacturing Restricted Substances List),” Yavuz says in an interview for the Monitor™ Survey. “ERAK and TAYEKS, the two major suppliers of Mavi that account for nearly 75 percent of the denim, have practices in place to improve energy efficiency and water use. In 2020, ERAK consumed 26 percent less water and 24 percent less energy year-on-year, while laser and sustainable washes and treatments accounted for 54 percent of denim production, thanks to the upgraded machinery park.”

When asked what “sustainable” means when shopping for apparel, nearly half of all consumers (47 percent) say it means long lasting or durable, according to the Monitor™ research. That’s followed by environmentally friendly (22 percent), renewable/reusable (19 percent), and natural/safe (6 percent).

TomboyX, the Seattle-based apparel brand “for any body,” recently received official certification as a B Corp company. This certification confirms the brand is meeting the business, legal, and environmental standards necessary to be certified. The brand joins companies such as Athleta, Frank and Oak, and Patagonia in becoming certified.

TomboyX manufactures a full range of underwear styles, bras, lounge and sleepwear, activewear and swimwear, all with a focus on inclusivity and sustainability. The company produces its products with cotton from Better Cotton Initiative-certified suppliers.

“We’ve incorporated BCI-certified suppliers into our supply chain, which helps us guarantee that the cotton we’re using comes from a sustainable and farmer-centric process,” the TomboyX company states on its sustainability web page. “We’ve also obtained OEKO-Tex certification for all of our cotton products. This means that every single cotton-based textile and treatment we use is guaranteed safe, responsible and sustainable.”

Another sustainability initiative involves circular fashion — clothes that can be reused or recycled to new clothing. While the term isn’t well known among consumers (25 percent), when it’s explained, most shoppers (74 percent) say they would be interested in circular initiatives within the apparel industry.

Reformation is already getting a jump on a circular strategy. The LA-based brand has partnered with SuperCircle, a fiber-to-fiber recycling program, to collect clothing donations that will be recycled and made into new apparel. Consumers who donate their worn garments earn credit for new Reformation clothes.

Retailers are also making headway with their sustainability targets. Neiman Marcus Group (NMG) has released a new set of goals for workforce diversity and climate change, according to a report in the Dallas Morning News. Among them, NMG plans to reduce emissions from its facilities and procure renewable energy. It also plans to increase revenue from sustainable and ethical products and “identify a list of those suppliers by 2025 to help shoppers at Neiman Marcus and Bergdorf Goodman make informed buying decisions.”

The National Retail Federation’s Scot Case, vice president of CSR and sustainability, explained how more U.S. retailers see the transition to renewable energy as a way to reduce their part in climate change.

“Renewable energy — electricity generated from sources like solar, wind and hydroelectric dams — avoids the polluting climate change emissions created by generating electricity from fossil fuels like coal, oil and natural gas,” Case states. He says the Environmental Protection Agency’s Green Power Partnership program has identified retailers that are now only buying green power, including H&M and REI. Further, the EPA ranks Walmart as the fourth largest purchaser of green power in the country.

Walmart’s Project Gigaton is evaluating sustainability within its supply chain and network of suppliers, according to the NRF’s Jennifer Overstreet, senior director, content strategy. It’s looking to reduce emissions by one gigaton by 2030. And the retail giant is looking to cut emissions to zero across the company’s global operations by 2040.

Meanwhile, First Insight’s Greg Petro, CEO and founder, points out that Amazon may be threatened by consumers’ sustainability concerns.

“Consumers — especially Millennials and Gen Z-ers — increasingly feel uncomfortable about sustainability issues such as wasteful packaging and the thousands of vans needed to be able to deliver your tube of toothpaste within 24 hours,” Petro states in his Forbes blog. He points to a survey by International Post Corporation that found 44 percent of ecommerce shoppers globally say they’ve changed their online shopping behaviors due to sustainability concerns.

That might be why a newer entry into the retail arena, Toward, is taking an unusual approach to business. The online apparel retailer is limiting the number of orders customers can place to 12 per year, as reported by Rivet. The aim is to mitigate the environmental footprint caused by the shipping process.

Euromonitor International’s Maria Coronado Robles, sustainability insight manager, said in a recent webinar that consumers are increasingly embracing and adopting life that is more compatible with the planet.

“However, when it comes to action, there are some barriers that affect purchasing decisions such as high prices, skepticism about certain product claims, perceptions, satisfaction with available products or lack of knowledge about what actually makes the product sustainable,” Robles said. “So companies need to adjust their strategies when deciding what products to launch as well as where and how to present them to consumers. Brands need to understand the dynamics of broad claims across different markets, alongside consumer perception and preferences. All this information together helps head up an innovative product portfolio,” and help consumers buy from brands that align with their values.