When it comes to sustainable shopping, consumers have preferences regarding what they’d like to buy. And industry experts say opportunity awaits the retailers that truly hear and respond to customer concerns, especially the Millennial and Gen Z generations.

Brands and retailers must listen to the voice of the customer on issues as critical as sustainability. Consumers want more than performative measures from retailers and brands when it comes to ESG (environmental, social and governance) priorities, which will only become more important as Gen Z grows in influence.”

Greg Petro

CEO, First Insight

“As consumers, they often put their wallets where their values are, stopping or initiating relationships based on how companies treat the environment, protect personal data, and position themselves on social and political issues,” states the Deloitte Global 2021 Millennial and Gen Z Survey, “A Call for Accountability and Action.” The firm says it’s not unexpected that those two age groups “are actively seeking to influence policy and business actions on matters that are important to them, including environmental issues, inequality and discrimination. They see each at a tipping point and seem eager to provide the necessary push to hold institutions accountable, in order to bring about change.”

While younger consumers are more concerned about sustainability, they’re not alone. First Insight partnered with the Baker Retailing Center at the Wharton School of the University of Pennsylvania on a consumer sustainability report. It found that “a profound sustainability knowledge gap exists” between the nation’s top retail executives and consumers. This, writes First Insight’s Gretchen Jezerc, senior vice president of marketing, “presents opportunities for retailers not only to bolster their reputations and enhance consumer loyalty, but also to increase profits.”

The First Insight/Baker Retailing Center report found two-thirds of consumers say they would pay more for sustainable products, while two-thirds of retailers believe consumers would not be willing to do so. It also found nearly three-quarters of consumers value product sustainability over brand name. Ironically, 94 percent of retailers believe the opposite, saying brand name would be more important to consumers.

“This report clearly demonstrates that retailers are leaving money on the table,” states First Insight’s Greg Petro, CEO. “Brands and retailers must listen to the voice of the customer on issues as critical as sustainability. Consumers want more than performative measures from retailers and brands when it comes to ESG (environmental, social and governance) priorities, which will only become more important as Gen Z grows in influence.”

In apparel, natural fibers are inherently perceived as more sustainable than synthetics, according to the Cotton Council International (CCI) and Cotton Incorporated 2021 Global Sustainability Study. The data shows “made with natural fibers like cotton” is a top consideration (43 percent) when consumers are determining the sustainability/environmental friendliness of an apparel item. Boomers are most likely to feel that way (56 percent), followed by Gen X (49 percent), Millennials (37 percent), and Gen Z (34 percent).

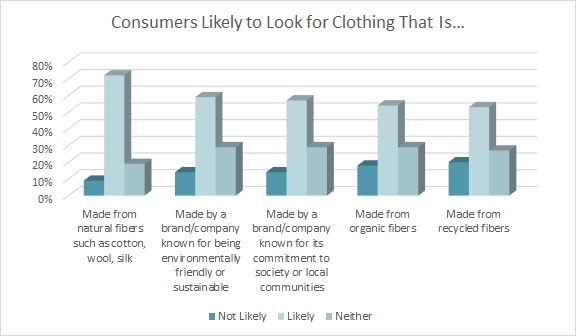

Most consumers (72 percent) are likely to look for apparel that is made from natural fibers such as cotton, wool, silk, etc., according to U.S. Sustainability Research. Boomers (80 percent) are especially likely to look for clothes made of natural fibers. They’re followed by Gen X (75 percent), Millennials (70 percent), and Gen Z (63 percent).

Not only are consumers seeking natural fibers, they’re going out of their way to actively avoid certain textiles. About two-thirds of all consumers (64 percent) check the fiber content label before purchasing a garment to eschew clothes made from rayon, according to the U.S. Sustainability Research. Fibers such as viscose, lyocell, and modal are manmade fibers that start out as trees, and are then processed and chemically converted into rayon fibers. Every year, more than 120 million trees are cut down to produce rayon fiber. Concern about deforestation issues caused by rayon production (78 percent) is the number one fiber production related issue among consumers, especially among Gen X (83 percent). They’re followed by Millennials (81 percent), Gen Z (70 percent), and Boomers (56 percent, according to the U.S. Sustainability Research.).

While consumers say they prefer to avoid synthetics, just 29 percent say they regularly buy clothes made from sustainable, environmentally friendly, or natural materials, according to the U.S. Sustainability Research. Millennials (39 percent) made the biggest effort to buy eco-friendly clothes, followed by Boomers (27 percent), Gen X (24 percent), and Gen Z (21 percent).

But the dichotomy between what shoppers say they want to buy and what they end of purchasing may likely be due to a couple of factors: where they shop and the most popular type of fabrics used by today’s apparel brands. The top stores for clothes shopping are mass merchants like Target and Walmart (23 percent), according to the Cotton Incorporated Lifestyle Monitor™ Survey. That includes 19 percent of those aged 13-to-34 and 26 percent of those aged 35-to-70. Fast fashion stores like Zara, H&M, and Uniqlo are also popular among Gen Z and Millennial shoppers (11 percent). These stores are all known for their low-priced garments.

Now consider that most apparel today is made with polyester, which is derived from petroleum. As CFDA points out, polyester has “significant negative environmental impacts during production, use and disposal.” To wit, the Materials Systems Laboratory at Massachusetts Institute of Technology reports, polyester requires a large amount of energy to produce: In 2015, production of polyester textiles emitted 706 billion kg (or 778.2 million U.S. tons) of CO2e, or greenhouse gas emissions. That compared to 107.5 million tons of CO2e for cotton. Further, polyester microfibers are contributing to the microplastic pollution in the planet’s oceans and waterways.

A recent YPulse sustainability report found more than a third of Gen Z and Millennial shoppers say they “have changed the products they buy because of climate change, and nearly a third have changed the way they shop, as well.” But these younger consumers want brands to get involved in making a change. YPulse found 58 percent of Gen Z and 47 percent of Millennials want brands to create more eco-friendly products. Gen Z (51 percent) and Millennials (42 percent) also want brands to use eco-friendly business practices.

“Gen Z and Millennials want brands to help them be environmentally responsible when shopping. Over a third tell us they seek out eco-friendly products already,” the YPulse report states. “But their responses also show something else: Gen Z is more likely than Millennials to think brands should be taking many of these eco-friendly actions. Our data shows the younger generation doesn’t have the spending power to purchase all of the eco-friendly products they want, with 50 percent saying ‘I’d like to buy more eco-friendly products, but I care about price more.’ But clearly they are interested in environmentally conscious items and ultimately they want brands to provide them more eco-friendly options that are accessible to them.”

“Given that Gen Z (and their kids’ generations) will be the ones who will feel and see the long-term effects of climate changes, it makes sense that they would be the most concerned with how the crisis will impact their futures.”