KEY INSIGHTS

- Educate shoppers on the health and comfort benefits of baby care products to encourage higher consumption.

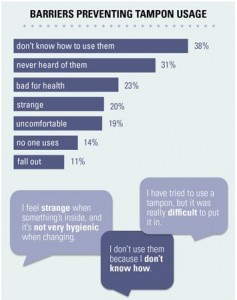

- Market to first-time tampon users through informative promotions.

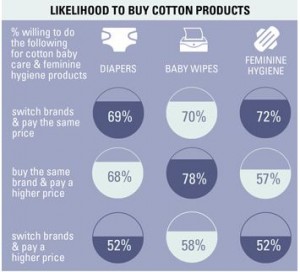

- Increase cotton offerings in hygiene products to meet the needs of female consumers – the majority are willing to pay more for cotton.

China is one of the world’s largest consumer hygiene markets. It accounts for more than one-tenth of the world’s infant/toddler population and nearly one-fifth of the world’s potential feminine hygiene population. With economic growth and disposable income projected to nearly double in the next ten years1, hygiene product consumption is poised to increase as consumers have more to spend on personal care. Pad and pantiliner sales in China are projected to total about 140 billion units and diaper sales 29 billion units in 20162 – double the sales volume of five years earlier.

Cotton Incorporated’s Chinese Hygiene Product Study reveals that brand loyalty is extremely strong in these growing markets, with the top three most purchased brands accounting for the majority of consumers’ diaper (68%), feminine hygiene (58%), and baby wipe (57%) purchases. Although brand loyalty is strong, research reveals a number of market opportunities for established brands and new entrants to differentiate their offerings and increase consumption in the Chinese baby care and feminine hygiene markets.

GETTING A FULL NIGHT’S SLEEP

In a market where kaidangku, open-crotch pants, were once the norm, disposable diaper usage is increasing in urban Chinese cities and middle class homes. More than 7 in 10 moms say they use diapers on their children at night, and about half do so during the day. Focus group research cited convenience and better sleep quality as top reasons moms use diapers; while cost and health concerns, especially among third generation caregivers, remain barriers to diaper usage. Another common complaint among moms was that diaper options are limited. In fact, almost 9 in 10 moms (87%) say they use the same type of diaper during the day as at night. Consequently, offering a nighttime diaper alternative that absorbs more liquid could yield strong brand loyalty for those able to appeal to moms’ desires for convenience and a full night’s rest for them and their children.

INCREASING BABY WIPE USAGE

Baby wipe and diaper usage do not go hand in hand in China, indicating baby wipe brands have an opportunity to increase consumption through targeted marketing and consumer education. While the majority of moms use wipes to clean after bowel movements, less than half use them after urination. Instead, focus group research reveals moms tend to wash children with a wet cloth or change diapers less frequently to reduce cleanups. Nevertheless, avoiding skin irritation is the number one purchase driver for baby diapers and wipes. Brands should consider marketing the skin-related and hygiene benefits of using wipes after urination. This approach could help increase baby wipe consumption and sales for brands willing to educate their customers.

Pads are the most commonly used feminine hygiene product in China and are used during each phase of menstruation; however, only about 2% of women use tampons. The majority say they do not use tampons due to inexperience with the product. These are more frequent responses in lower tier cities where tampon availability is extremely limited.

Although tampon usage is rare in Asia, the Japanese tampon market is relatively strong due to several successful brand marketing campaigns to educate the Japanese consumer and spur tampon consumption2. Because more than 1 in 4 non-tampon users (27%) say they would be likely to try tampons if they were educated on how to use them, pairing tampon marketing with an educational campaign may be as effective among Chinese consumers as it was in other developing markets. Likelihood to try tampons if educated also rises among those who say they do not use tampons because they have never heard of them or they do not know how to use them (33%).

Cotton hygiene offerings remain limited in China despite consumer preference for cotton. About 7 in 10 women prefer their baby care and feminine hygiene products be made from cotton. When asked to compare cotton hygiene products to non-cotton options, the majority said cotton would perform better in terms of the factors most important to purchases. Regarding baby care products, about 3 in 4 moms said cotton diapers and wipes would perform better than non-cotton options in terms of preventing irritation, absorbency, and being natural. In addition, more than 8 in 10 women said cotton feminine hygiene products would perform better than non-cotton options in terms of preventing irritation, being soft and comfortable, absorbency, and being natural.

In fact, the majority of women say they would pay more and switch brands in order to purchase cotton diapers, wipes, and feminine hygiene products. Desire for cotton may trump brand loyalty and price consciousness because Chinese women feel cotton products are better suited to meet their primary needs. Cotton offers established brands and new entrants the opportunity to differentiate their products in this highly competitive market while meeting their customers’ primary needs, consumer fiber preferences, and corporate sustainability initiatives.

About the Research Cotton Incorporated’s 2015 Chinese Hygiene Product Study was based on qualitative focus groups conducted among feminine hygiene and baby care product users in Shanghai, Shenzhen, and Chengdu, and a quantitative study of 1,000 feminine hygiene and baby care product users conducted in 16 cities covering all four city tiers and regions. Other sources: Euromonitor International1, INDA2