The COVID pandemic forced consumers to shop differently when stores were shut down for months on end. The issue for retailers now, though, is figuring out how to fulfill the demands of today’s consumer while adapting to the pandemic changes that stuck, basically transforming retail for good.

At Shoptalk Europe 2023, BP’s Tracey Clements, senior vice president/CEO Europe of mobility and convenience, said consumers’ lives are totally different now compared to before the pandemic and that’s driving more change at retail at a more rapid rate. Going forward, stores can’t assume they know the answer, she said. And as Coresight Research, a research partner of Shoptalk Europe, states, this drives home the importance of customer foresight and insight for retailers.

The confluence of COVID and the rise in omnichannel really drove an acceleration in digital transformation. Retailers have to look for demand forecasting that can deliver consistent and accurate results at each of their locations and across all customer touch points.

Malysa O’Connor, Vice President of Product Marketing, Legion

While many shoppers began or increased their online shopping during the pandemic, emphasis has since shifted to in-store experiences for both consumers and retailers. Trigo’s Michael Gabay, co-founder and CEO, said stores need to provide “wow” moments, whether through personalization, experiential retail or services that are increasingly powered by technology.

Since the pandemic, consumers say they’re most likely to shop in-store when they need something to wear that night (72 percent), they’re unsure what will fit best (70 percent), they need help choosing an outfit (60 percent), or they’re shopping for a special occasion (58 percent), according to Cotton Incorporated’s 2023 Digital Innovations and Willingness to Pay Survey.

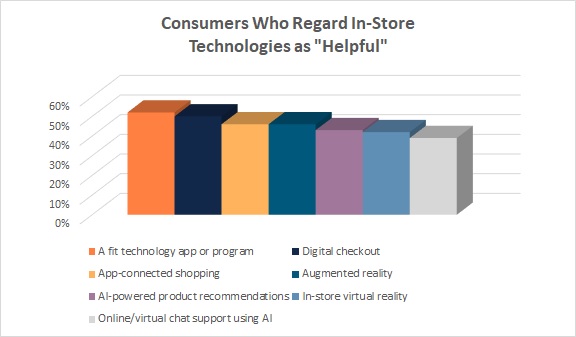

And these days, customers look to in-store technologies to make their shopping life easier. For instance, half of all consumers (50 percent) view digital checkout as very helpful, according to the Digital Innovations and Willingness to Pay research. And 46 percent find app-connected shopping beneficial, while 42 percent say in-store virtual reality is helpful.

Consumers say these new technologies offer convenience (51 percent), make it easier to find clothing they like (46 percent), and save money (36 percent), according to the Digital Innovations and Willingness to Pay data.

In a recent RetailNext webinar, Malysa O’Connor, vice president of product marketing for Legion, a workforce management firm, said changing consumer expectations over the last few years have impacted in-store foot traffic. That has left stores to figure out how to optimize labor to meet new consumer needs.

“Convenience and flexibility are really at the core of those expectations,” O’Connor said. “The confluence of COVID and the rise in omnichannel really drove an acceleration in digital transformation. Retailers have to look for demand forecasting that can deliver consistent and accurate results at each of their locations and across all customer touch points.”

O’Connor explained these “demand drivers” could translate as in-store returns for online purchases or self-service checkout. She adds that external data like weather and other events (say, long-term road construction) should also be measured to see how that could impact demand. “[Retailers] need to think about the way they plan, to make sure they’ve got enough people in the stores and enough people across all their channels.”

As helpful as digital innovations can be, they’re not all sunshine and roses. More than half of all shoppers (52 percent) get aggravated by technology errors, according to the Digital Innovations and Willingness to Pay research. Nearly four in 10 (39 percent) say prices will go up because of it and more than one-third (36 percent) say the tech is too invasive.

The retail strategy company Nextrday says digital innovations pose a risk to retailers, as well, in the form of accumulating technical debt. Since most retailers don’t have “the requisite talent to manage their sprawling digital landscape,” many are working with solution partners to adopt technologies like cloud, artificial intelligence (AI), automation and augmented and virtual reality (AR/VR).

“As convenience is the top priority for 90 percent of customers in choosing a retailer, this should form the top priority for every digital investment made by retail businesses,” Nextrday states. “According to Gartner, fulfillment execution powered by AI, collaborative ecosystems, and cost optimization are the key actions that retailers are taking to eliminate friction from the experiences they deliver to their shoppers. In addition, enabling associates to serve customers with speed and precision is yet another step towards elevating shopper experiences. This calls for AI-driven (Point of Sale) PoS systems that mitigate repetitive tasks and empower associates to provide special discounts, recommend new products and real-time offers to buyers.”

Finally, store locations may be considered essential to the future of ecommerce, as Thierry Gadou, chairman and CEO of the electronic shelf labeling company SES-Imagotag, told the Shoptalk Europe audience. He described online fulfillment from nearby stores as “local ecommerce” and pointed out that the low-carbon footprint of such a strategy also holds sustainability benefits. Gadou estimated that in the next 5-to-7 years, more than 50 percent of online orders will be fulfilled via physical stores.

As Coresight Research points out, the view of brick and mortar being “complementary – perhaps even necessary – to the future of ecommerce is a good sign for store-dominant retailers” especially those that were heavily impacted by the pandemic-led shift to online shopping.