In recent years, researchers have told us our collective attention span has shrunk to be less than that of a goldfish. Which maybe had a lot of people staring at their goldfish, wondering what their secret was. Enter the pandemic, and not only did consumers become overwhelmed with anxiety, but they were flooded with online content, making it even harder for brands to get their messages through. Making things tougher: When consumers finally could visit stores that had been shutdown, they weren’t fond of hanging around.

For retailers and brands, the playing field changed overnight, as did the opportunity to connect with shoppers. Sudden transformations to digital have not only become necessary for the short term, but vital to maintaining subsequent business.

“Very few companies have been left untouched by the COVID pandemic,” says Euromonitor International’s Lisa Holmes, global head of surveys, in the company’s webinar, “Coronavirus Impact on Companies, Employees and Consumers.” “Many, if not most, were really caught off guard by the pandemic when it came to their operational continuity. Only one-fifth had a business continuity plan in place prior to COVID and fully half had to actually create a continuity plan in response to the pandemic. Financial services companies were ahead of other sectors in having a business continuity plan. Very, very few retailers, and travel and tourism companies — which really, these are arguably the two sectors most impacted by the pandemic — had continuity plans in place.”

Netsurion’s Mark Cornwell, chief information officer, says prior to the pandemic, omnichannel models that retailers had been trying to put in place for five years weren’t gaining nearly as much traction as stores and brands would have liked.

[quote]

“The whole concept of buy online/pickup in-store (BOPIS), and using physical retail locations essentially as mini warehouses to provide fulfillment for online ordering have become less ‘nice to have’ and more of ‘must have,'” Cornwell says in an on-demand webinar titled “Digital Transformation of Retail Brands: Dealing with the Impact of COVID-19.”

“A lot more wireless technology is being deployed to the stores, so that the reliance on connectivity to the internet is far more important than it ever was before,” Cornwell says. “Five years ago there was a big push for digitizing the store, mostly around the customer experience, as a ‘nice to have’ way to attract customers. I think it’s becoming very much table stakes in terms of how customers expect to be able to interact with these retailers now. A lot of folks want to spend a lot less time in these locations. Get in, get out, pick up what it is they purchased online, maybe quickly browse but have a pretty seamless, non-face to face checkout opportunity.”

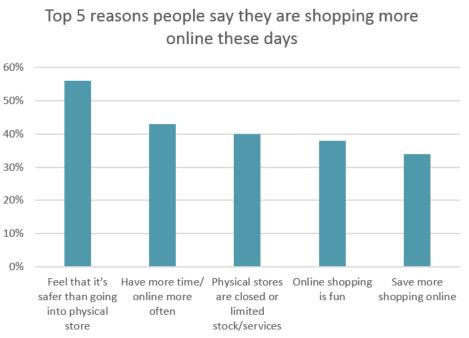

Since last month, 45 percent of consumers say they are shopping online more than they previously have, according to Cotton Incorporated’s November 2020 U.S. Coronavirus Response Survey, wave 4. The majority (56 percent) say this is because they feel safer purchasing online than going to a physical store.

Euromonitor International’s report, “Retail Innovation in 2020: What’s Here to Stay?” determined 73 percent of global retailers believe the shift to online sales will be permanent. And from 2019-to-2024, global online retailing will see absolute growth of $1.5 trillion.

That’s not to say shoppers are totally avoiding traditional storefronts to buy their clothes. While more than 4 in 10 shoppers (48 percent) say they are very comfortable buying clothes online and delivering to their home, according to Cotton’s November Coronavirus Response Survey, wave 4. A majority of respondents (59 percent) also say they are comfortable using retailers’ BOPIS/curbside pickup options. And another 72 percent are comfortable purchasing clothes in a physical store but had them delivered to their home. While over half (52 percent) say they are comfortable buying clothes in a brick-and-mortar location and completing the whole transaction in person.

Cornwell says touchless payment will become ubiquitous to the in-store experience.

“The contactless ability to make payments, whether it’s PayPal, mobile payments, or some other method to complete the transaction — that’s going to be accepted across all retail,” he states.

He adds that the need for always-on WiFi connectivity is critical for traditional stores that will need a solid internet connection for cloud-based inventory management or centralized back office systems.

Cornwell’s position is substantiated by a survey from The Everest Group, a global management consulting and research firm, which found that certain business components helped establish how some stores were better able to handle the COVID crisis than others.

“Factors like digital enablement, distributed operations, and prior experience with remote working models proved to be huge assets for business continuity and resiliency during the crisis,” the company writes in its Global CFO Survey 2020. “Going forward, organizations are evaluating the attributes they need to embody to be better prepared for future uncertainties.”

More than 50 percent of the CFO respondents to Everest’s survey say driving digital transformation is a top consideration in being “future ready.” Besides improving productivity and customer experience, executives say an organization that’s digitally enabled with minimal manual processing, offers information transparency, and has data insights from sophisticated analytics will have the speed and agility necessary for future retailing.

Nearly 7 in 10 shoppers (69 percent) say they plan to shop online just as much or more for clothes in the coming months, according to Cotton’s November Coronavirus Response Survey. That goes hand in hand with the 93 percent who say they expect to spend at least the same if not significantly more time online in the next few months.

Managing this expected growth in online shopping will likely prove to be Job One for retailers and brands. Euromonitor International’s Retailing Voice of the Industry Survey, July 2020, found that 40 percent of retailers expect to add more online services, like online styling and virtual try-on within the next 6-to-12 months. And among retailers that don’t currently sell on social commerce sites like Instagram Shopping, the survey shows 28 percent plan to expedite investments that will offer shoppers “the option to access their profile across stores and digital channels. A full 56 percent of retailer respondents indicate that their companies are seeking to sell through additional digital channels, such as through more marketplaces.”

As Netsurion’s Cornwell remarked: “There are a lot of changes coming. And more changes that come as innovation continues to evolve will surprise us in the next 12 months.”