It’s no secret consumers took to their pajamas and loungewear all day long during the COVID-19 pandemic. Although it has been years since the World Health Organization called an end to the global public health emergency, that desire for comfort – especially in bottoms — has been a holdover among consumers.

People really want comfort in a way that maybe they didn’t before Covid hit. Now, comfort is a table stake for everybody, including in denim.

Heather Caldwell, senior manager, Lee

WGSN’s Sara Maggioni, head of women’s wear, told the Lifestyle Monitor™ in an interview that the post-pandemic shift toward looser silhouettes has had a knock-on effect on categories beyond loungewear, and volume remains key for bottoms.

“Comfort continues to be a top consumer priority and purchase driver, and has slowly infiltrated unexpected areas, such as tailoring,” Maggioni told the Lifestyle Monitor™. “It has become a bit of a ‘non-negotiable.’ From a trousers perspective, this is reflected in the popularity of wide-leg shapes in recent seasons, across different styles from casual to formal – as well as straight-leg silhouettes with relaxed fits, and more recently, barrel-leg and balloon pants. Even across our TrendCurve AI tool for A/W 26/27, the forecast is that looser silhouettes, in varied styles, maintain the highest share of the category mix and are mainly highlighted as risers or stable, while slim-leg profiles are forecast for decline, across both U.K. and U.S. markets.”

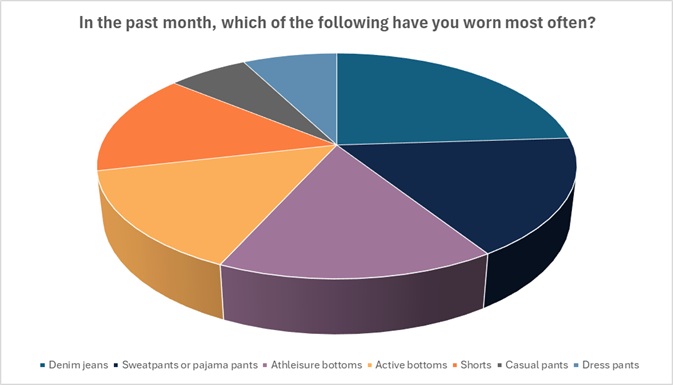

Among these many bottoms choices, the most popular with U.S. consumers this year is denim jeans. From March through September, nearly 40 percent of U.S. consumers say they’ve worn jeans most often, according to Cotton Incorporated’s 2025 Consumer Sentiment Survey (n=3,899 U.S. consumers, Waves 1-4). Besides denim, the top bottoms choices are sweatpants and pajamas (29 percent), athleisure bottoms (27 percent), active bottoms (24 percent), and shorts (23 percent), followed by casual and dress pants (both 12 percent).

When it comes to denim jeans, comfort and fit are king, with 93 percent and 92 percent of surveyed consumers, respectively, citing these features as extremely important for jeans, according to the 2025 Consumer Sentiment Survey.

At Boot Barn, denim has been a big focus for the brand, said Daniel Villegas, manager, creative and styling, in an interview with the Lifestyle Monitor™.

“Boots are our bread and butter, but denim is something where we went back to the drawing board and redesigned our in-house brands with longevity in mind – so we have key pieces and then our fashion seasonal pieces,” Villegas told the Lifestyle Monitor™. Boot Barn’s in-house exclusive brands are Shyanne and Idyllwind for women, and Cody James, Cody James Black 1978, Moonshine Spirit and Rank 45 for men.

Villegas said the most important thing for customers is fit and comfort. The most popular style for women is the Shyanne Celeste, which is a high-rise boot cut with simple styling and good stretch. For men, the Cody James Wyatt jean is a best-seller, given its durability as well as stretch that works for everyday or on the ranch.

At Lee, customers are looking for quality and timeless style, balanced with relevant trend, said Heather Caldwell, senior manager, in an interview with the Lifestyle Monitor™.

“Baggy and wide are still really trending, especially for women,” Caldwell told the Lifestyle Monitor™. “So, we will have new iterations of the barrel jean. And we’re introducing a barrel for men. Another trend that’s coming back a bit is some destruction and some neat embellishment. One of our most popular, fashion-forward styles has been a high-rise, button-fly wide leg that has a slouch. It’s a very drapey fit that’s been very, very popular.”

“The quality and the softness of the fabrics is key,” Caldwell said. “People really want comfort in a way that maybe they didn’t before Covid hit. Now, comfort is a table stake for everybody, including in denim.”

Durability is also a key feature, and Caldwell points out it goes hand-in-hand with a legacy denim brand like Lee. All of these features are important to U.S consumers today, who rate “fits me well,” and “comfortable to wear” as the top features (88 percent) when purchasing a new pair of denim jeans, according to the 2024 Global Denim Survey (n=1,379 U.S. consumers). That’s followed by quality (83 percent), long-lasting/durable (82 percent), affordable/value for the money (78 percent), and material/fabric (75 percent).

The majority of consumers (67 percent) say they prefer their denim jeans be made from cotton, according to Cotton Incorporated’s 2025 Lifestyle Monitor™Survey, which canvassed 500 respondents. Most shoppers (67 percent) also say denim jeans made from 100 percent cotton are the most sustainable or environmentally friendly.

A new sustainability initiative comes from the National Cotton Council (NCC) via its recently introduced “Plant Not Plastic” public awareness campaign. The NCC’s Marjory Walker, vice president of council operations, says the campaign is “designed to provide a straightforward message: choosing clothing made from natural fibers like cotton is an easy, effective way to reduce your personal contribution to microplastic pollution and its potential health impacts. We want to empower consumers to know their clothing choices can make a real difference, simply and affordably.”

Such initiatives should resonate with consumers, as WGSN’s Maggioni said they are increasingly scrutinizing their purchases, and they’re a lot more informed about their health, as well as “forever chemicals” and toxic components in clothing.

“Google searches for ‘cotton’ and ‘natural’ in apparel are increasing,” Maggioni said. “TikTok hashtags like #NaturalFiber and #Essentials are showing significant growth. This is something that really spans market levels, but it might play out differently. While at higher price points, shoppers are willing to pay a premium for certified sustainable products, innovative fabrics and solutions, natural dyes, etc., budget-conscious shoppers might instead focus more on versatility and cost-per-wear, favoring multi-seasonal, durable and easy-care products to justify a slightly higher cost.”

Besides denim jeans, consumers like wearing activewear and athleisure bottoms, and not just for exercise. Cotton Incorporated’s 2025 Global Activewear Survey (n=1,019 U.S. consumers) finds that among shoppers who have purchased activewear or athleisure apparel, 70 percent wear it around the house. They also wear it to run errands (64 percent), do house or yard work (58 percent), go shopping (45 percent), socialize (40 percent), work from home (37 percent), and sleep (27 percent).

But of course, denim is leading the bottoms trend right now. And Maggioni doesn’t see that changing anytime soon.

“Denim remains a crucial product category and is, in fact, experiencing a resurgence across both women’s and men’s markets, after having suffered a bit in the past few years as related to the pandemic,” Maggioni stated. “This revival is driven by nostalgia – especially 90s, Y2K, and 2010s – a renewed focus on separates, and a shift toward versatile, trans-seasonal dressing. It also taps into the consumer’s desire for reliable, durable, familiar styles – and denim is the linchpin of that.”