It’s the end of the year, time to take stock and… what’s this? Gap profits are up, Target’s Q3 profits dropped significantly, and potentially everyone is wondering how new tariff proposals will affect business in 2025. Talk about going out with a bang. While there are some surprises and uncertainty, brands, and retailers can take heart that some traditions will prevail and that there are areas of stability, especially for those who choose to work with natural fibers like cotton.

To be sure, there will be challenges though, as pointed out in a recent article from McKinsey on the state of fashion.

Cotton is unique and relative to many other types of fiber choices, because cotton is truly a global fiber.

Mark Messura, Senior Vice President, Global Supply Chain Marketing, Cotton Incorporated

“Although hard to predict, even in the best of times, the fashion industry is in for a particularly tumultuous and uncertain 2025,” the McKinsey article states. “A long-feared cyclical slowdown has arrived. Consumers, affected by the recent period of high inflation, are increasingly price sensitive. There is also the surprising rise of dupes, the acceleration of climate change and the continued reshuffling of global trade. Regional differences, which came into focus in 2024, will become even starker in the coming year.”

McKinsey’s report also points out that the climate crisis will drive consumer behavior. The firm advises that businesses must keep sustainability at the top of their agendas. “Those who choose to approach sustainability with a long-term mindset even while battling short-term problems will be rewarded with more efficient business operations and a competitive advantage.”

Climate change and its effect on cotton production was discussed at last month’s Sourcing Journal Fall Summit in New York. In a conversation between Sourcing Journal’s Peter Sadera, editor in chief, and Cotton Incorporated’s Mark Messura, senior vice president, global supply chain marketing, Messura said raw cotton is plentiful and prices are stable. Still, climate change is causing the sourcing objective to shift.

“The cost equation is changing and it’s not simply the cost of labor or goods. We’ve got environmental issues,” Messura stated. “We’ve got regulations outside of the U.S. that are going to shape the world demand for textiles and information reporting. So, the uncertainty in my mind is around the new definition for the cost of sourcing. And beyond just the raw materials with cotton or anything else, what other factors are going to affect the cost and that value equation when it comes to where products will be sourced with respect to cotton?

“Cotton is unique and relative to many other types of fiber choices, because cotton is truly a global fiber,” Messura continued. “There isn’t one company or factory that produces it. There isn’t a single brand that dominates the market. There are 64 countries that produce it, and it’s traded worldwide. This gives us some confidence and some stability in cotton.”

Messura added that, as of mid-November, cotton prices in the Far East were about 83 cents a pound, which is a 10 percent decrease from five months ago. While that’s not good for farmers, who are looking at hardship thanks to costs they bear with freight, shipping, etc., cotton prices are very competitive and should be for months, Messura said. Add to that a large global supply of the raw material, and he said the cotton market is very good for sourcing professionals.

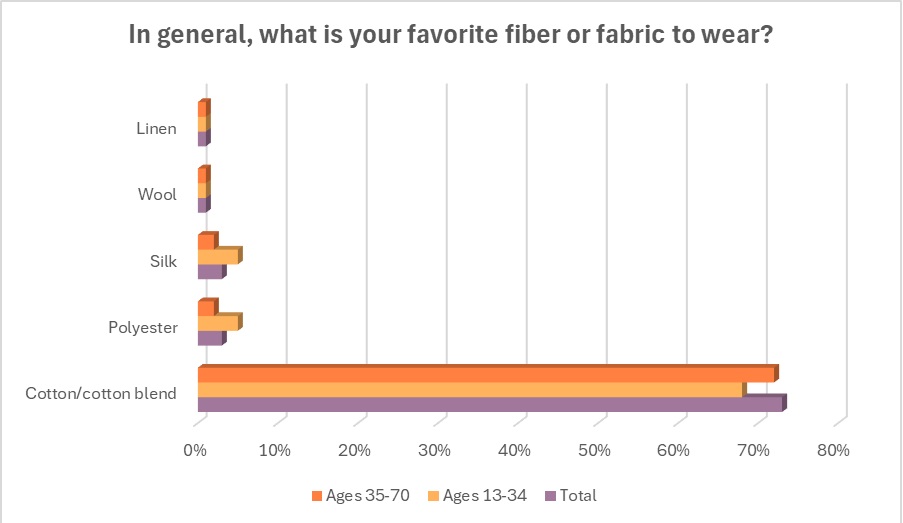

This coincides with consumers’ preference for cotton with today’s fashions. As of November, nearly three-quarters of shoppers (73 percent) say cotton or cotton blends are their favorite fiber or fabric to wear, trailed by polyester (3 percent), silk (3 percent), and wool (1 percent), according to the 2024 Cotton Incorporated Lifestyle Monitor™ Survey.

It follows then that more than three-quarters of shoppers (76 percent) say they most associate cotton and cotton blends with being stylish/fashionable, according to Cotton Incorporated’s Global Lifestyle Monitor™ Survey, 2023. Further, the majority of consumers (66 percent) say clothing made primarily from cotton is most fashionable. And nearly 6 in 10 shoppers (59 percent) say cotton/cotton blends are the fibers best suited for today’s fashions.

This popular fiber would work well then with what WGSN classifies as a top trend for the coming year: Day-jamas. The trend forecasting firm says day-jamas are an “upbeat revamp of the old sweat set that can take wearers from beach to bar to bed.” (Don’t mind the sand.) Some day-jama sets are infused with wellness ingredients like collagen or CBD, like this cotton-blend offering from HUE.

Cotton fabrics also work for another trend that Fashion Snoops (FS) says is taking hold: circular systems.

“As global systems show increasing fragility, there’s a collective pivot toward decentralized, self-sufficient solutions,” FS reports in its subscription newsletter. “This shift is amplified by growing environmental awareness and a desire for authentic cultural connections, driving communities to rediscover and reimagine local resources, traditions and production methods.”

For the fashion industry, this will mean more sophisticated and systemic localism, according to FS. That will translate into “nutrient design,” where products are made with only natural inputs, “ensuring their harmless return to the earth as food, not poison.”

Cotton is a natural fiber, and one that is biodegradable. It decomposes relatively quickly because it is made of cellulose, an organic compound that is the basis of plant cell walls and vegetable fibers. The fibers break down naturally in landfills similarly to other crops such as food and plants. On the other hand, synthetic fibers like polyester biodegrade much slower than cotton.

Consumers seem to appreciate natural fiber clothing today more than ever. Consider that fully 81 percent say they feel better quality garments are made from all natural fibers such as cotton, according to the Monitor™ research. And most consumers (55 percent) say if a garment has more cotton in it than other fibers, it is more comfortable, followed by softer (51 percent), better quality (44 percent), more natural (36 percent) and lasts longer (28 percent).

Better quality garments that last longer may be more sought after than before if incoming president Donald Trump’s proposed tariffs or tariff wars between the U.S. and tariff-targeted countries like China and Mexico come into play. Also speaking at the Sourcing Journal Fall Summit, Matt Priest, president and CEO of the Footwear Distributors and Retailers of America, said uncertainty surrounding tariffs is already affecting how his members do business.

“We surveyed our members and asked, ‘Are you thinking about front loading so you can bring product in because of the uncertainty around tariff rates?’” Priest related. “And 32 percent said they were, and another 37 percent said they were thinking about it. So, the vast majority of our members are thinking about bringing product in earlier. Also, we own and operate the Fashion Forward Association of New York (FFANY), and we have market week coming up here in December. Already I’m getting questions about, ‘How are we supposed to price out this product that’s going to be coming in next year if we don’t know what the tariff rates will be?’ So, we’re trying to figure out what companies are doing and provide as much insight as we can to help make those difficult decisions.”

The National Retail Federation (NRF) estimates Trump’s proposed new tariffs on imports could cost Americans $46 billion to $78 billion in annual spending power every year the tariffs are in place. In a recent study, the NRF examined how the proposed 10 percent-to-20 percent universal tariff on imports from all foreign countries and an additional 60 percent-to-100 percent tariff on imports specifically from China would impact six consumer product categories, including apparel. Bottom line for the fashion industry: Consumers, as a whole, would pay $13.9 billion to $24 billion more, per year, for apparel.

“Retailers rely heavily on imported products and manufacturing components so that they can offer their customers a variety of products at affordable prices,” said the NRF’s Jonathan Gold, vice president of supply chain and customs policy. “A tariff is a tax paid by the U.S. importer, not a foreign country or the exporter. This tax ultimately comes out of consumers’ pockets through higher prices.”

This would likely be a concern for most brands and retailers, considering consumers have already expressed the economy and household finances are top-of-mind – especially heading into the Christmas shopping period. This holiday season, most consumers (60 percent) say the current economic situation/inflation will affect their gift shopping, according to Monitor™ research. Most (51 percent) said they planned to be stricter with their budget (19 percent), cut back on holiday shopping due to limited funds (16 percent) or cut back because things are too expensive (16 percent), according to Monitor™ research. Consumers expect to spend an average of $844 on holiday gifts this season, an 8 percent decrease from 2023, but still up from 2022 ($661).

As tough as the market might already be, Qualtrics XM Institute found in a recent study on consumer trends that are shaping 2025 that consumers are also making it harder for brands and retailers to find out what they’re getting right or wrong, and how they can foster more loyalty.

“As we head into 2025, the five specific trends we’re going to call out in this year’s report are, first, that heightened expectations are fueling a decline in loyalty,” stated Qualtrics XM Institute’s Isabelle Zdatny, principal analyst, in a recent webinar. “Consumers are less willing to let bad experiences slide. Second, consumers are clear: Go back to the basics. Third, very scary one: feedback falls to a new low. Consumers are increasingly staying silent about their experiences. Fourth, AI hype has given way to AI skepticism. And then finally, consumers are putting companies in a tricky spot as they want both privacy and personalization. So, it’s going to make it pretty challenging for us to understand and actually improve those core experiences. Overall, consumer loyalty — harder to win, easier to lose.”

Of course, during the holidays, there’s one major go-to brands and retailers turn to to drive business: doorbuster deals and other promotions. Whether it’s online or in stores, these colossal sales could entice shoppers to spend more – or buy more items than they planned while being able to stay within their budgets.

“Retailers have used doorbusters since the 1980s to attract in-store traffic with significant discounts on popular holiday items,” wrote R.J. Hottovy, head of analytical research at Placer.ai., in a pre-Black Friday newsletter. “While this strategy waned in the late 2010s as promotions shifted online, the past few years have seen a revival of doorbusters and early morning Black Friday shopping.”

For sure, more than half of consumers who plan to buy holiday gifts (55 percent) expect to go deal hunting online on Black Friday, according to Monitor™ research. Further, 87 percent say stores should be open for in-person holiday shopping on Black Friday.

After all the holiday bedlam of trying to keep up with and please the customer, it’s on to the New Year to start all over again. As always, and as McKinsey states, “Leaders who move quickly to identify the bright spots will be primed for success, but only if they’re able to evolve. The old playbook is now obsolete; the industry will need a new formula for differentiation and growth.”