Despite fears that supply chain disruptions and inflation could hamper holiday sales, retailers enjoyed a very strong season in the last quarter of 2021. But instead of putting their feet up and relaxing, the smart apparel brands and stores will take the best trends of last year and incorporate them into their businesses now and throughout the coming year.

Despite supply chain challenges, retailers kept their shelves stocked and consumers were able to fill their carts both in-store and online. Holiday spending during 2021 reflected continued consumer demand that is driving the economy and should continue in 2022.”

Jack Kleinhenz

Chief Economist, National Retail Federation

The National Retail Federation (NRF) reported retail sales during 2021’s November-December holiday season grew 14.1 percent over 2020 to $886.7 billion. The total beat the NRF’s October prediction of increases between 8.5 percent and 10.5 percent over last year. December’s sales alone were up 16.9 percent year-over-year. Clothing and clothing accessory stores saw sales jump 33 percent over holiday 2020.

“Worries about inflation and COVID-19 put pressure on consumer attitudes but did not dampen spending, and sales were remarkably strong,” said the NRF’s Jack Kleinhenz, chief economist. “Even though many consumers began shopping in October, this was the strongest November and December we’ve ever seen. Despite supply chain challenges, retailers kept their shelves stocked and consumers were able to fill their carts both in-store and online. Holiday spending during 2021 reflected continued consumer demand that is driving the economy and should continue in 2022.”

While spending may continue, the Mastercard Economics Institute expects consumers to begin to spend more on travel and services, which have been greatly hampered since the pandemic began. Significant consumer savings and mobility restrictions caused a “massive 27-year rewind in services,” while the share of spending on goods jumped from 39 percent to 47 percent.

“As borders open and people begin to travel again, consumers will return to pre-crisis spending on experiences versus ‘stuff,’” the Mastercard Economics Institute reports.

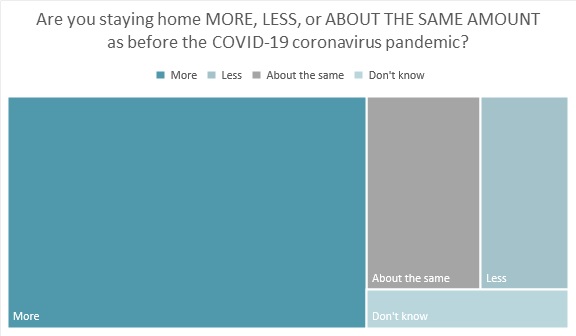

Certainly, since COVID-19 hit the U.S., most consumers (64 percent) say they have been staying home more than before the pandemic, according to Cotton Incorporated’s 2021 Coronavirus Response Consumer Survey, Wave 9, December 8, 2021. But the majority (58 percent) now feels “very or completely safe” resuming normal, pre-pandemic activities.

Nonetheless, Kleinhenz stated, “We should be prepared for challenges in the coming months due to the substantial uncertainty brought by the pandemic.”

Of course, the ever-present pandemic had an effect on holiday shopping and The NPD Group says brands and retailers will “need to be nimble” to prepare for how it could impact them in 2022. For starters, the industry should be prepared for more supply chain issues.

“While it’s apparent that some inventory replenishment is centered firmly on current consumer demand, that demand could easily pull back in the next few months,” said Marshal Cohen, chief industry advisor for NPD. “Retailers and brands must continue to carefully track the needs and shopping behavior of their customers, in order to keep the balance between supply and demand on an even keel.”

The uncertainty bred by the pandemic and questions about “returning to normal” likely means the “COVID lifestyle” will continue, according to The NPD Group. This means that the apparel industry should expect consumers to continue to wear and replace bedroom slippers and “other comfortable clothing that’s more appropriate in the home environment more often than the pro-forma suits and shoes worn in the office.”

Most consumers (69 percent) say they’re wearing comfortable clothes more now than before the pandemic, according to the Coronavirus Response Survey (Wave 9). And when asked which type of apparel they’re most likely to purchase in anticipation of resuming activities, shoppers’ top three choices are T-shirts (37 percent), denim jeans (33 percent), casual shirt/blouses (30 percent), and athleisure shirts, pants or shorts (27 percent).

Incidentally, shopping for clothing in store is the top activity U.S. consumers are participating in these days (60 percent), more than seeing family and friends without masks (49 percent), going to bars or restaurants (49 percent), or going to work in person (49 percent), according to the Coronavirus Response Survey (Wave 9).

While 40 percent of consumers say they have a stronger preference now compared to before the pandemic for clothes shopping in a physical store, 36 percent say they prefer buying clothes online, according to the Coronavirus Response Survey (Wave 9). Either way, the clear majority (73 percent) says this experience will change the way they shop in the future.

Salesforce’s Caila Schwartz, senior manager, consumer strategy and insights, says new fundamental changes during the holiday shopping season are expected to continue into 2022. She says the supply chain challenges sparked global early bird shopping, resulting in a 16 percent year-over-year increase in online sales during the first week of November. But, she adds, retailers realized 23 percent of their holiday sales in the last two weeks of the year thanks to buy online/pickup in-store (BOPIS) options that extended the holiday shopping window.

“U.S. retailers that offered BOPIS grew nearly two times faster than their non-BOPIS peers over the last two weeks of the season,” she states. “In 2022, retailers must identify and eliminate points of friction across the store by embracing digital shopping experiences. And they will be rewarded: 60 percent of digital orders will have some tie to brick-and-mortar locations that either help create demand or fulfill orders.”

Schwartz adds that for the first time, credit card use declined among web shoppers as they opted for mobile wallets like Apple Pay (up 68 percent over 2020) and financing tools like buy now/pay later (up 29 percent over last year).

“As consumers find new favorite products and more novel ways to pay, it’s more important than ever for retailers to provide alternative payment options while continuing to smooth the checkout funnel for a frictionless experience,” Schwartz states.

While the onus is on stores and brands to work harder, move faster and meet customer expectations at any given moment, the NRF’s Matt Shay, president and CEO, expects today’s retailers can meet the challenge.

“We’ve seen consumer behavior evolving over the past several years and many of the changes we’ve witnessed during the past two years have been an acceleration of existing trends — whether that be methods of engaging with retailers through using social media, creating communities online, fulfillment options (same-day delivery, BOPIS) or payment options,” Shay stated at the recent NRF Big Show in New York. “There are a lot of initiatives underway and we’re confident that retail is going to continue to step up and meet the biggest challenges of today.”