After warnings that began before Halloween about supply chain issues that could leave Americans with few gifts under their Christmas trees, reports found shoppers actually received most of their gifts on time. But the images of dozens of container ships waiting to dock at California ports were jarring. Unsurprisingly, though, retailers proved how nimble and resilient they could be.

At some point we have to ask ourselves — and this is what the Federal Reserve, I think, has to struggle with: Do we have a supply problem or do we have a demand problem? Supply has done a really great job of keeping up with demand. It’s just demand has outstripped supply, even with supply up 30 percent.”

Matt Shay

President & CEO, National Retail Federation

Heading into 2022, the supply chain remains a concern. But experts believe stores and brands have exceeded expectations, given the many challenges they faced. And with further preparation companies will remain competitive, despite any supply chain hurdles.

Matt Shay, president and CEO of the National Retail Federation (NRF) said supply chain challenges have been talked about so much lately that the increase in imported goods over the last two years has been underreported. Despite nearly two years of a pandemic, Shay said American consumers continued to power the economy, helped by $5 trillion in fiscal stimulus and a “highly accommodative” monetary policy.

“In 2019, we brought in about 20 million containers and in 2021, we were at 26 million. So the supply on that basis is up by 30 percent,” Shay said in a recent episode of the NRF’s Retail Gets Real podcast. “At some point we have to ask ourselves — and this is what the Federal Reserve, I think, has to struggle with: Do we have a supply problem or do we have a demand problem? Supply has done a really great job of keeping up with demand. It’s just demand has outstripped supply, even with supply up 30 percent. That has to do more with fiscal stimulus and monetary policy than it does with supply chain problems.”

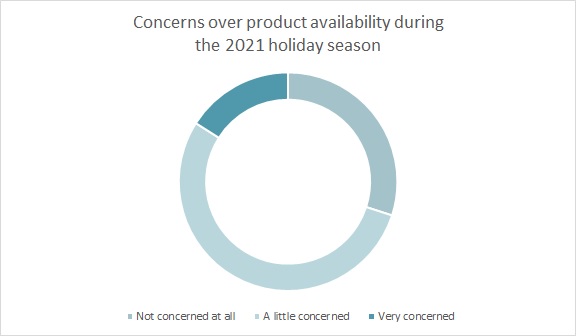

Still, over the 2021 holidays, consumers had their share of concerns about product availability. Fully 7 out of 10 shoppers were a little (54 percent) or very (16 percent) concerned about obtaining the gifts they wanted for the holiday season, according to the 2021 Cotton Incorporated Lifestyle MonitorTM Survey. And 7 out of 10 were a little (48 percent) or very (23 percent) concerned about shipping times for gifts.

During the holidays, apparel is one of the top gifts, purchased by nearly half (48 percent) of gift givers, according to the MonitorTM research.

Steve Rowen, managing partner at Retail Systems Research (RSR), said fashion and specialty retailers have been in “nothing short of a defensive crouch — battered by constant disruptions with no end in sight.” Rowen will be monitoring a panel at the upcoming NRF Big Show in New York. RSR worked with Blue Yonder on research around the supply chain, and the full findings will be presented at the show.

In a recent RSR newsletter, Rowen previewed the research and said retailers’ biggest internal roadblocks come from decades of focusing on efficiency at the expense of agility.

“However, while [retailers] cite this — in combination with too much reliance on shippers to self-manage their own disruptions — as their largest organizational inhibitors, it is only once we begin to look below that surface that we see the ensuing factors that have brought these issues about.”

Rowen says retailers are “thoroughly dissatisfied” with the technology solutions they’ve invested in to manage their supply chains. “Well over 50 percent say they are going to have to replace systems they’ve already installed. This is a far bigger problem than we even anticipated it could be.”

In addition, the NRF’s Susan Reda, vice president of Education Strategy, writes in the trade association’s blog that labor shortages at the dock and distribution levels have made for nail biting situations for retailers.

“Even when container ships make it into the ports, there aren’t enough dockworkers, trucks or drivers waiting in the wings to keep the supply chain cranking,” she states. “There are new concerns on the horizon as dockworkers and marine terminals get set for negotiations in the quest to hammer out a new labor contract; the current contract expires in July 2022.”

Retailers were helped this past holiday, though, when more shoppers decided to start their holiday shopping early. Shay said this was a continuance of a trend that began about five years ago and accelerated in 2020, primarily for health and safety reasons.

“Then, in the last couple of months of 2021, people were shopping earlier again, still partly out of concern about the health environment, but increasingly because of concerns about finding the goods they wanted,” Shay said. “So I think those changed behaviors are likely to sustain during 2022 and beyond. Because once consumers start to behave a certain way, they’re kind of like the object in motion that stays in motion. I think people will get used to it, it’ll become more habit forming. And so that extends the holiday season.”

Last holiday, 7 percent of shoppers said they planned to start buy holiday gifts in September, according to the MonitorTM research. Another 12 percent planned to start in October. The largest percentage (22 percent) said they would start Christmas shopping in November, while 9 percent expected to begin in December. A good 15 percent said they would shop for holiday gifts throughout the year.

To help both consumers and retailers, Reda says sourcing and supply chain networks should plan for digital transformation, giving them the potential to streamline business processes. This, she says, will help companies stay competitive.

“Nearshoring will become more prominent and on-demand sourcing will gain traction, as well,” she states. “The big unknowns: Will shoppers tolerate higher prices and potentially longer wait times for on-demand products?”

Despite the supply chain challenges the industry faced in 2021, Shay has a positive outlook for the New Year. He remarked how much healthier the retail industry is now as it still deals with Covid-19 compared to when the country was emerging from the Great Recession.

“I think how much more robustly members have recovered, and really been able to support their customers, new customers and gain in their market share,” he said. “So as we come into this new year, I’m optimistic that for a lot of those reasons — the investments that have been made, the creative thinking that’s taking place, the overall health of the industry, as well as managing the supply chain and demand — this will be another very good year for the industry.”