KEY INSIGHTS

- Deliver more personalized shopping experiences, such as online fit/sizing specialists, to increase sales and loyalty from Millennial shoppers.

- Expand performance technologies, such as easy care and odor resistance, in cotton underwear to capitalize on athleisure.

- Increase cotton-rich underwear to meet consumer quality and comfort expectations.

How can brands and retailers inspire impulse purchases, excitement, and new customers when consumers consider underwear shopping to be a necessary evil (63%), mainly purchase for replacement (76%), rarely change styles (70%) or brands (59%), and four brands account for 70% of the underwear consumers purchase most often? Today’s evolving market dynamics may provide the possibilities brands and retailers are seeking. The rise of Millennials, athleisure, and inferior quality fabrics each present opportunities for retailers and brands to boost underwear sales and increase market share.

MOTIVATING MILLENNIAL SHOPPERS

Millennials are more excited by underwear shopping and are more receptive to new and different offerings than other generations. More than 4 in 10 Millennials (43%) say they are the first to buy a new product on the market; significantly higher than shoppers in general (36%).

Millennials’ demand for newness and innovation remains a challenge for retailers and brands accustomed to developing long-term relationships with shoppers focused on replacing old items. However, meeting this challenge may prove rewarding for brands as Millennials spend about 27% more per pair than the average shopper ($15 versus $12) and say they shop for underwear about five times per year – double the average consumer.

Since projections indicate that Millennials will account for one-third of all retail spending by 20201, established retailers and brands as well as new market players can benefit by building engagement with this large, influential consumer segment – the largest generation to date. Millennials are more likely than average shoppers to say they would shop for underwear at a store offering in-store or online fit/sizing specialists as well as education on caring for their products and performance features. Instituting one or more of these customized services could establish a solid foundation to build a loyal Millennial customer base among these 38 billion potential customers.

PRIORITIZING PERFORMANCE FEATURES

Intimate apparel brands can capitalize on the athleisure trend by increasing consumer access to performance features in all underwear. More than 9 in 10 consumers say they wear activewear for purposes other than exercise, so it is not surprising that demand for athleisure is finding its ways into the underwear market. Three in four consumers say they are likely to wear active underwear for non-active occasions, indicating consumers are looking for underwear that can fit into their complex lifestyles.

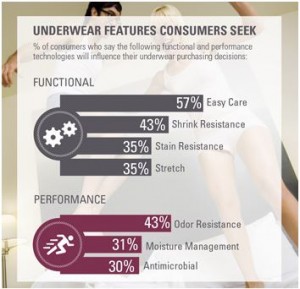

Although active underwear is still a niche market, consumer use is nevertheless expanding, possibly due to performance technologies offered. According to Cotton Incorporated’s 2014 Intimate Apparel Audit, 64% of active underwear at retail is marketed with a performance feature, almost double non-active underwear (33%). Top performance technologies likely to influence underwear purchasing were functional technologies, like easy care and stretch, as well as performance technologies, like odor resistance and moisture management. Nearly one-third (31%) of underwear is marketed as having stretch properties, but less than 3% is marketed with the remaining features consumers say would motivate their underwear purchases. Major players, such as Jockey and Hanes, have already begun offering moisture management and odor resistance technologies in their cotton underwear. Increasing performance offerings in non-active cotton underwear has the potential to help brands change their basics into today’s lifestyle trends.

Although active underwear is still a niche market, consumer use is nevertheless expanding, possibly due to performance technologies offered. According to Cotton Incorporated’s 2014 Intimate Apparel Audit, 64% of active underwear at retail is marketed with a performance feature, almost double non-active underwear (33%). Top performance technologies likely to influence underwear purchasing were functional technologies, like easy care and stretch, as well as performance technologies, like odor resistance and moisture management. Nearly one-third (31%) of underwear is marketed as having stretch properties, but less than 3% is marketed with the remaining features consumers say would motivate their underwear purchases. Major players, such as Jockey and Hanes, have already begun offering moisture management and odor resistance technologies in their cotton underwear. Increasing performance offerings in non-active cotton underwear has the potential to help brands change their basics into today’s lifestyle trends.

COMMITTING TO COTTON

Marketing to Millennials and offering performance technologies in cotton underwear have the potential to help a brand distinguish itself in today’s competitive market. However, it is still important to continue to meet consumers’ primary underwear requirements. Consumers say they have a similar commitment to purchasing cotton underwear as they have to the styles and brands they prefer to buy with two-thirds of shoppers (67%) saying it is important that their underwear be made of cotton.

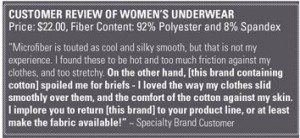

Despite preferences, retailers and brands have replaced cotton with manmade fibers. About half of consumers say they are concerned about the increase in manmade fibers in their underwear (54%) and say they will be more likely to check fiber content labels for cotton in the future (49%). Furthermore, consumers say cotton is the most likely to satisfy their underwear needs.

The majority of consumers say cotton underwear is the most sustainable (81%), comfortable, soft, breathable (80% each), best-fitting (68%), versatile (64%), and durable (59%), when compared to polyester, rayon, and nylon underwear. Consumers see the movement away from cotton as a movement away from the fundamental quality, comfort, and versatility requirements that prompt their underwear purchases. By including new technologies in cotton underwear, brands and retailers have the opportunity to meet consumer needs for both comfort and performance.

About the Research:

Cotton Incorporated’s 2014 Intimate Apparel Survey includes responses about shopping and preferences of 1,500 men and women ages 18 to 70, who were primary shoppers for their underwear, undershirts, and bras. Cotton Incorporated’s 2014 Intimate Apparel Audit consists of analysis of data collected from nearly 15,000 intimate products from 24 key brands and retailers. External data source: McKinsey1