Gartner L2 recently noted that U.K. supermarket sales have been rebounding. Part of this is due to shoppers spending £85 million (over U.S. $104 million) more on private label groceries than they did the previous year.[quote]

Now, consider how aspects of the food industry mimic trends in fashion. Take, for example, a Vogue article from a few years back that compared locally-sourced, organically grown tomatoes to a handcrafted Birkin bag. It stands to reason that if shoppers are reaching for more private labels at the grocery store, they may very well do the same when apparel shopping — if the right price and perceived value are there. But before panic sets in, name brands should recognize that the growth of private labels doesn’t automatically mean doom.

It’s clear that private labels don’t suffer from the stigma they once did, when shoppers considered them the poor cousins to premium brands. Thanks to the Great Recession, consumers became trained to look for value. Further, more than 70 percent of consumers say the quality of private label products has improved over time, according to ChannelAdvisor. This presents retailers with an opportunity to claw back higher margins than they would with name brands.

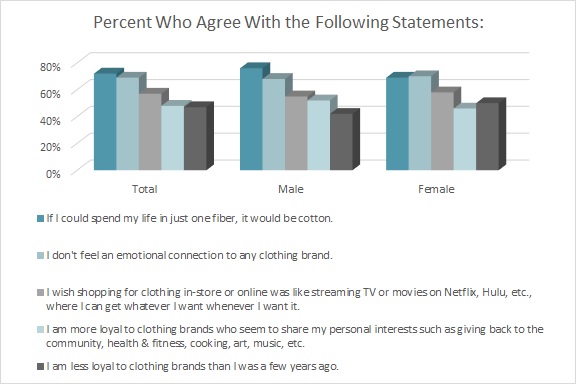

Stores are also taking advantage of the fact that nearly half of all apparel shoppers (47 percent) say they’re less loyal to clothing brands and retailers than they were a few years ago, according to the Cotton Incorporated Lifestyle Monitor™ Survey. From department stores to mass merchants to e-commerce giants, the private label rosters continue to grow.

A recent report from the Private Labels Manufacturers Association (PLMA) and Nielsen found private label brand sales (of all merchandise, not just apparel) accounted for $128.6 billion in the U.S. in 2018, an increase of 4.4 percent from the year before. This compares to growth of just 1.1 percent in sales of national brands across all retail channels, including mass merchants, club stores, dollar stores, grocery, and drug stores.

The PLMA/Nielsen data did not include results from such major retailers as Costco, Amazon, or Jet.com. It estimates that if these other sales were included, private label totals would have “conservatively” reached $170 billion last year.

That makes sense as consumers are most likely to purchase most of their clothes at mass merchants like Walmart and Target (24 percent), according to Monitor™ research. That’s followed by chain stores like JC Penney and Kohl’s (17 percent), department stores (13 percent), online (11 percent), specialty stores like Gap or American Eagle (10 percent), off-pricers (9 percent), and fast fashion stores (6 percent).

In the PLMA/Nielsen survey, two-thirds of respondents agreed with the statement that, “In general, store brand products I have bought are just as good if not better than the national brand version of the same product.” More than four in 10 said they buy store brands “always/frequently,” and 25 percent are buying more store brands now compared to five years ago.

CB Insights, a predictive technology firm, says apparel retailers are using private labels to “escape the industry apocalypse.”

“Apparel and accessories make up 20 percent of Target’s sales,” CB Insights stated. “Increasing these margins could make the difference between staying afloat and falling prey to the retail apocalypse that is gripping other retailers.”

Target offers 40 private labels, or what it calls, “owned brands.” This year in apparel, it launched Colsie, an intimates, lounge, and sleepwear line; Stars Above, a stylish sleepwear line; and Kona Sol swimwear.

Walmart has 319 private label brands across 20 categories, according to the data company ScrapeHero. Some of its newest names are Time and True, Terra & Sky, Wonder Nation, and George. Clothing, shoes, and accessories account for 28 of those labels, and 95 percent of these products are priced below $25.

But retailers should keep in mind that when consumers are buying apparel, price isn’t really the key draw. The Monitor™ finds that more than 9 in 10 consumers say fit and comfort (both 96 percent) are the most important factors they consider when deciding on an apparel purchase. That’s followed by quality (93 percent), price (92 percent), durability (90 percent), and style (86 percent).

As of June, ScrapeHero reported Amazon had 140 private labels in the U.S., and sales from the retail giant’s private label business could reach $25 billion annually by 2022. Clothes, shoes and accessories account for 87 percent of their private brands, trailed significantly by household goods (4 percent) and furniture (3 percent). Amazon’s private label brands include Daily Ritual and Cable Stitch for women, Goodthreads for men, and Spotted Zebra for kids.

ScrapeHero finds women’s apparel brands account for more than 41 percent of Amazon’s private label brands. It speculates the company is likely investing so heavily in women’s fashion because higher income women constitute an important segment of its customer base.

However, Amazon does not have any apparel brick and mortar stores. That places it at a disadvantage, as more than 7 in 10 consumers (71 percent) prefer to make their apparel purchases in a physical store, according to Monitor™ research. This is because they want to make sure it fits (74 percent), try on the clothes (73 percent), see an item in person (67 percent), feel the fabric (53 percent), and avoid shipping costs (44 percent). Another 29 percent say it’s easier to buy in-store, 27 percent like the shopping experience, and 24 percent like the instant gratification.

While plenty in retail admittedly fear Amazon’s e-commerce reach, 68 percent said they’re not currently negatively affected by the company’s private labels, according to a study by Feedvisor. Also, competitors like Walmart, with its 11,389 stores in 27 countries, have the upper hand when it comes to apparel shopping.

Which circles back to the food industry. In addressing the rise of private labels in food items, Observa, a retail insights and analytics company, says the “increased pressure on brands means they need to strategize on how to maintain their market share.” The company points out that private labels are risk averse and typically don’t market their items. Applying that logic to apparel, name brands should steer clear of the same basics a house brand offers. Instead, they should offer stylish and innovative pieces that draw attention to their name.

Further, Observa points out that 76 percent of purchasing decisions are made in-store. This gives brand names the opportunity to draw consumer attention with both new product and in-store marketing. Name brands can also use social media and other online campaigns to reach a younger consumer. Finally, Observa recommends advertising why the name brand is better right on the label — or, in fashion’s case, the hangtags.