We’re at the precipice of the year-end holidays and the New Year sits in the wings, waiting to step into the spotlight. For retailers, it’s a time to examine what worked, while sussing out the trends that lie ahead – all in the never-ending quest to connect with today’s consumer.

Besides competition from new stores and brands, retailers need to consider new technologies – on top of world events that could impact everything from consumer sentiment to sourcing. There is a lot of movement on the retail playing field.

You have to understand why they buy from you –and not someone else or not at all. This is important in 2025 because retailers have realized that in order for stores to be successful, they must offer experiences that consumers actually want to have, and not the experiences retailers want them to have.

Nikki Baird, Vice President of Strategy and Product, Aptos

For starters, in-store shopping has seen an uptick. But it’s not a redux of the ‘80s shopping mall. It’s very nuanced, says Nikki Baird, vice president of strategy and product, at Aptos, a retail technology company. One thing she sees for 2025: Passive retail.

“I recently read an article that finding the ‘right’ thing for a shopper’s lifestyle is now actually more important to consumers than fast shipping,” Baird told the Lifestyle Monitor™ in an interview. “I think retailers will need to think about how to bring this into the store. If you go too deep in embracing a trend or consumer behavior in digital without thinking through the impact on stores, your stores feel isolated and disconnected.”

At the same time, Baird says stores need to have empathy for their shoppers.

“You can’t just understand your shoppers,” Baird states. “You have to understand why they buy from you –and not someone else or not at all. This is important in 2025 because retailers have realized that in order for stores to be successful, they must offer experiences that consumers actually want to have, and not the experiences retailers want them to have.”

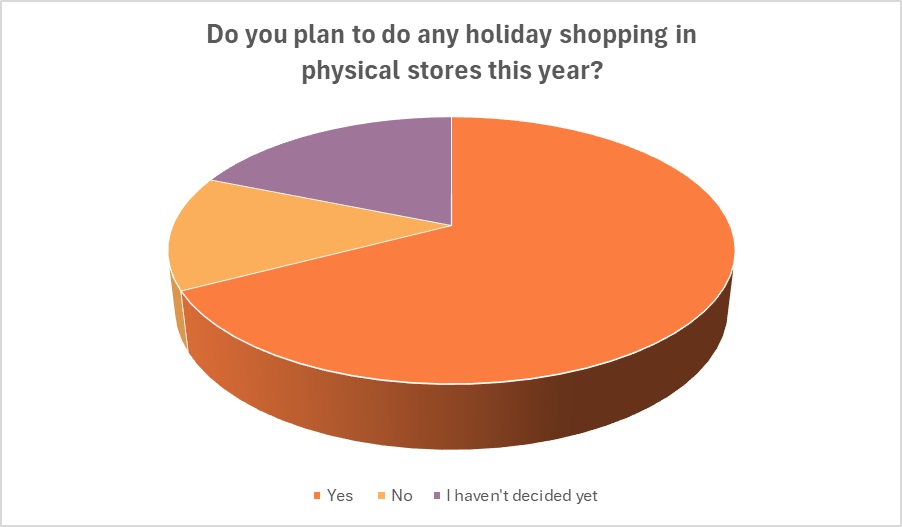

In-store shopping definitely holds relevance with today’s consumers. Consider that leading up to the holidays, nearly 7 in 10 shoppers (68 percent) said they plan to do holiday shopping in a physical store this year, according to Cotton Incorporated’s 2024 Lifestyle Monitor™ Survey.

Among those who have planned to shop in-store for the holidays, 50 percent said they planned to do so because they like to see/touch/feel clothing before buying it, according to the Monitor™ research. Another 45 percent said in-store shopping gives them gift ideas. This is followed by 41 percent who say it puts them in the holiday spirit, 39 percent who like to see/touch/feel non-clothing gift items before buying, 36 percent who like the holiday decorations and smells, 32 percent who feel they have a better chance of finding what they want in-store, 32 percent who say it’s tradition to shop in-store, 25 percent who say they like the social aspect of going into stores, 25 percent who say deals are better in-store, and 24 percent who just don’t like to pay for shipping.

Overall, 27 percent of consumers say they buy more apparel in physical stores now than in the past several years, according to the 2023 Global Monitor™ research, while 42 percent buy more clothing online now.

The appreciation for in-store shopping will lead to more physical brand experiences, says Brandon Kaplan, chief innovation officer and co-founder of Journey, a multidimensional design studio for brands.

“Brands have performance marketed themselves into a corner through incremental online efficiencies,” Kaplan told the Lifestyle Monitor™ in an interview. “Multidimensional experiences offer them new ways to connect with consumers. Now that people are coming back to IRL shopping, the in-person experience needs to be reinvigorated for a new generation of consumers. But brands can’t simply go back to what worked before, or dwell in the purgatory between digital optimization and what AI might mean. They must embrace connected and immersive multidimensional experiences that blend brick-and-mortar amenities with the best of digital and AI.”

Murali Gokki, managing director at Berkeley Research Group (BRG), a global consulting firm, told the Lifestyle Monitor™ in an interview that there are a number of retail trends taking center stage in 2025. Among them: omni-channel integration.

“Retailers are increasingly integrating multiple shopping channels, although many still struggle with full integration due to technological and logistical challenges,” Gokki says.

For sure, consumers have fully embraced omnichannel shopping. Consider that in addition to the above-mentioned who fully enjoy shopping in-store, 51 percent of shoppers said they planned to buy clothing gifts online this holiday season, according to the Monitor™ research. Further, 30 percent get their inspiration for apparel gifts from social media sites and 74 percent say they research gifts online before buying them in retail locations.

But that’s not all Gokki sees trending in 2025. “Buy now/pay later services are being widely adopted across all age groups. And the resale market, driven by environmental concerns and led by Millennials and Gen Z, is growing rapidly, with technology enhancing search, trust and transparency.”

Alex Nisenzon, CEO of Charm.io, an ecommerce intelligence platform, expects to see growth in the marketplace model.

“As consumers make more purchases online and, driven by high inventory holding costs, more traditional brick and mortar retailers will begin transitioning to marketplaces to increase efficiency,” Nisenzon told the Lifestyle Monitor™ in an interview. “In recent years, we have seen Macy’s, Nordstrom, Bloomingdale’s, Target and others announce their marketplace launches. This trend will continue as there are just too many benefits — as we all saw from the success of Amazon — in leveraging drop shipping and endless assortment, even if some of the more tailored marketplaces maintain a high level of curation to keep their brand integrity with customers.”

Artificial intelligence was on everyone’s minds at the start of 2024, and that will continue into the New Year, according to the experts.

“Hyper-personalization will grow as retailers leverage digitization and AI technology to offer mass-customization at scale, enhancing customer experiences through personalized recommendations, pricing and promotions,” Gokki says. He also sees social commerce as well as voice commerce – shopping via AI-powered voice assistants – growing in 2025.

Nisenzon agrees that AI-powered shopping will gain steam.

“While we are still in the early innings of AI chat-based shopping assistants,” Nisenzon says, “the recent announcement of Perplexity Shopping (Perplexity is an AI-powered search engine) is an indicator we may start to see some adoption as consumers become increasingly comfortable interacting with a chat system that can provide truly personalized recommendations and easy checkout experiences, without being limited to specific retail or brand assortments.”

Personalized AI could potentially help shoppers from ordering more than they need or want. As it stands, consumers in the U.S. order more clothing items than they intend to keep at least some of the time, according to Cotton Incorporated’s 2024 Online Shopping Survey (U.S), especially Gen Z (77 percent). The percentage decreases as shoppers age, as it’s 69 percent for Millennials and 44 percent for Gen X or older. Overall, online apparel shoppers purchased an average of 27 clothing items last year.

On the other hand, Baird says 2025 could present an AI backlash.

“We are just too close to a future where product images, models modeling the products and reviews praising the products are AI generated,” Baird states. “At what point does that become false advertising? I don’t feel like I’m going out too far on a limb to say that in 2025 a big retailer is going to get caught up in marketing completely ingenuine products.”

Besides AI blunders, world events stand to shake things up in the New Year. Gokki said BRG sees potential headwinds from transportation and logistics, global conflicts, inflation and tariffs.

“Potential negotiation pressure from longshoremen strikes and a shortage of teamsters could add to increased logistics cost and cause further challenges to ensure continuity of supply,” Gokki says. “Ongoing conflicts in regions like the Red Sea and Europe/Middle East are causing supply chain disruptions and higher commodity costs, pressuring retailers to adapt operational strategies. And inflation continues to be above the Fed target, which appears to be straining the consumer’s wallet. Potential tariff increases in 2025 could add more cost side pressure and impact consumer prices and/or retail margin.”

Bottom line: Enjoy the holidays and prepare, once again, to buckle up in the New Year.