The wellness economy is one that “enables consumers to incorporate wellness activities and lifestyles into their daily lives,” according to the Global Wellness Institute (GWI). That includes physical activity, spas, and wellness tourism.

In its 2025 report, the GWI says the global wellness economy doubled since 2013, reaching a new peak of $6.8 trillion in 2024. And that could mean strong business for apparel makers supplying these sectors. Especially when it comes to natural fibers like cotton that have their roots in sustainability.

Cotton is a preferred fiber for many of our customers because it’s soft, breathable and gentle on the skin, making it ideal for extended wear.

Spokesperson from Ja-Vie

“Cotton sweats in our collection have a soft brushed quality that feels like cashmere and is easy care and practical at the same time,” said designer Norma Kamali, in an interview with the Lifestyle Monitor™. “Cotton is a lifestyle. It can be casual, and it can be embroidered and luxury as well.”

Cotton pieces from the Norma Kamali Sweats Collections that would work for wellness travel or cozy muscle recovery activities include a “cocoon” cardigan, boyfriend puff jog pants, an oversized shawl wrap, and the classic bomber 1980s sweatshirt.

“The sweats collection is actually ready-to-wear and can be worn with boots or heels and be dressed up or for traveling, not as sweatpants that you sweat in, but respectful travel clothing,” Kamali said. “However, in the end, for the styles you want to sweat in or feel cozy wearing on a wintery or rainy day there is nothing better than cotton brushed terry.”

The most popular workout for U.S. consumers falls under the “light workout” category, as 75 percent say they engage in walking for exercise on a regular basis, according to the 2025 Global Activewear Survey (n= 1,019). That’s followed by cardio training (treadmill, stationary bike) at 54 percent, weight training (40 percent), running (33 percent), hiking (27 percent), swimming (24 percent), yoga/Pilates/barre (24 percent), dancing (22 percent), team sports (20 percent), and cycling or mountain biking (19 percent).

The GWI notes the U.S. is the largest market for physical activity[1], accounting for $407 billion in 2024, followed by China ($165 billion), the U.K. ($58 billion), Germany ($45 billion), and Japan ($37 billion.) The GWI breaks the sector down into three categories: sports and active recreation, fitness, and mindful movement.

Sports and active recreation – which includes activities like outdoor running, hiking, cycling and pickleball – account for the most spending at $288 billion[2], according to the GWI. But participation dropped during the pandemic and hasn’t fully recovery. Instead, growth has been achieved through an increase in spending by each participant. The fitness category, with a market size of $206 billion, includes gyms, fitness studios and hotel facilities. It has seen participation return to pre-pandemic levels, but it also counts streaming services, apps and at-home workouts. Mindful movement, while the smallest category at $47.7 billion[3], has seen a healthy 6.9 percent growth since pre-pandemic. The GWI reports yoga has grown rapidly in popularity since COVID, and Pilates “has also exploded in popularity in recent years.”

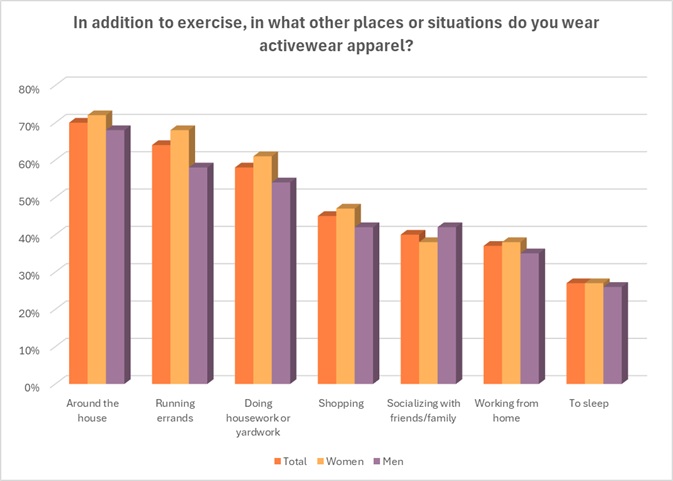

Although COVID forced a decrease in sports apparel and footwear spending, the GWI report says the category has now exceeded pre-pandemic spending levels, reaching $407 billion globally in 2024. “It is important to keep in mind that activewear/sportswear is increasingly popular worldwide as daily clothing for an aspirational lifestyle (not just for sports/fitness purposes), and this trend has accelerated since the pandemic,” the report states.

The majority of consumers say activewear made of cotton is best suited for hanging out at home (81 percent), running errands (80 percent), and socializing (77 percent), according to the 2025 Global Activewear Study. And most shoppers (77 percent) say cotton activewear has met their expectations for exercising, as well. And despite all the activewear made of petroleum-based synthetics, most consumers prefer their activewear be made of cotton (51 percent), followed by polyester (31 percent), rayon/viscose/Tencel (15 percent), or rayon from bamboo (3 percent).

The wellness movement also has participants thinking about muscle recovery. Here, certain garments can come into play. In a Science Direct article, author Jonathan M. Peake of the Queensland University of Technology in Brisbane, Australia, presented established and emerging strategies for post-workout recovery – including the use of compression garments.

Nevada-based Ja-Vie makes an array of compression socks that combine function and fashion.

“Ja-Vie socks are designed at the intersection of comfort, support and everyday wellness,” said a Ja-Vie spokesperson in an interview with the Lifestyle Monitor™. “Our compression socks are made to be worn throughout daily life – whether someone is working long hours on their feet, traveling, or simply prioritizing circulation and comfort as part of a healthy recovery and post-activity routine. Cotton is a preferred fiber for many of our customers because it’s soft, breathable and gentle on the skin, making it ideal for extended wear. In a wellness context, cotton helps regulate moisture and temperature while reducing irritation — especially important for people with sensitive skin or those wearing compression socks for many hours a day. We blend cotton with performance fibers to maintain compression, durability and stretch, without sacrificing comfort.”

[1] Global Wellness Institute. Global Wellness Economy Monitor 2025. Global Wellness Institute, Nov. 2025, p. 63. globalwellnessinstitute.org, https://globalwellnessinstitute.org/2025-global-wellness-economy-monitor/

[2] Global Wellness Institute. Global Wellness Economy Monitor 2025. Global Wellness Institute, Nov. 2025, p. 64. globalwellnessinstitute.org, https://globalwellnessinstitute.org/2025-global-wellness-economy-monitor/

[3] Global Wellness Institute. Global Wellness Economy Monitor 2025. Global Wellness Institute, Nov. 2025, p. 65. globalwellnessinstitute.org, https://globalwellnessinstitute.org/2025-global-wellness-economy-monitor/