Whether they work from home, go in to an office or school, attend events, or just want something new, U.S. consumers have continued to shop for new clothes to the point Q1 sales were up 8.6 percent over last year, led by gains in apparel, grocery and, furniture. But that doesn’t mean there aren’t pain points either online or in-store. So industry experts say brands and retailers should consider how collaboration can improve the shopper experience and drive sales.

Companies need to take a look at their tech stack. Are you understanding the interactions and journeys your users or prospective customers are taking on your digital platforms, wherever those might be? And can you determine where issues are arising and struggles are taking place? It can be challenging unless you have the right processes and technology.”

Asim Zaheer

Chief Marketing Officer, Glassbox

Trevor Sumner, CEO of Perch Interactive, a firm that focuses on in-store digital media and lift-and-learn, says collaborations between brands and retailers can take place via digital platforms right in store.

“It’s amazing to me how little data we have, where 85 percent of transactions occur,” Sumner said in a recent webinar, referring to the fact that the majority of retail still takes place in physical stores. He says retailers are now creating the “mallification” of stores. “Target is the ultimate example. You go to Target and they’ve done these partnerships to actually have stores within the store — almost like a mall, right? They have a Disney area for baby and kids. They’ve partnered with Levi’s to have a specific kind of jeans experience center. On top of all that, they’re building a set of private labels that are reinforcing key categories to drive trips to the store. And so as a brand, you wonder, ‘How do I stand out?'”

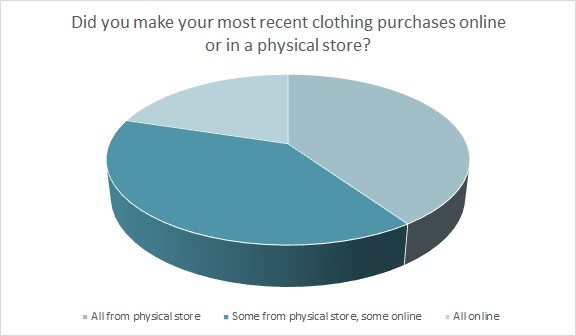

More than three-quarters of all shoppers (83 percent) say they’ve resumed shopping for clothes in physical stores since the start of the pandemic, according to the Cotton Incorporated Coronavirus Response Survey (Wave 11, May 11, 2022). When making their future apparel purchases, 48 percent of consumers say they will buy all or most of their clothes from a physical store, 24 percent said they would buy about half from a physical location and half online, and 28 percent said they would make all or most of their purchases online.

“So let’s talk about how some brands are trying to stand out,” Sumner said. “We’re seeing a lot of digital tools coming in-store. We’re seeing a lot of technology and custom fixtures. You can start building these beautiful experiences through a fixture where, the moment you pick up a product, the [digital fixture/sign] tells you about the various products in that line, it gives you ratings and reviews, it helps cross sell different products together. The days of traditional merchandising and trying to read four-point print are going away.”

Retailers that connect with consumers in more meaningful ways stand to do well, as 63 percent of consumers say they expect to spend the same (30 percent) or more (33 percent) money on apparel in the future, according to the Coronavirus Response Survey (Wave 11). About 8 in 10 shoppers (79 percent) said they expect to shop more online in this period, while 74 percent expect to shop more in brick-and-mortar stores.

Glassbox’s Asim Zaheer, chief marketing officer for the digital experience analytics platform, said in a CommerceNext webinar that most companies are prioritizing digital experiences. But, he says, problems still exist that can lead to a loss in not just a sale, but customer loyalty. He says collaboration between a retailer’s departments and IT teams can solve problems and improve experiences.

Zaheer described a situation with a retail client where ecommerce customers were trying to log in to shop but a password problem held them back. Additionally, there wasn’t a simple way for customers to notify the company that they wanted to reset their password. So, customer support flagged the issue that was taking place, the analytics team analyzed what was happening and notified the user experience team to make the change that alleviated the problem.

“These types of things have a significant impact to your user experience and can lead your customers or your prospects to your competition,” Zaheer said.

In another situation, Zaheer described a retail client that was rolling out a campaign for a new denim jean product. Unfortunately, when customers clicked on the jeans in the promotion, the garment wasn’t linked so shoppers weren’t able to just browse and buy a pair. The retailer was able to analyze customers’ journeys to see where they were struggling. From there, they identified the cause of frustration and modified the page.

“This was a simple example but very meaningful to the bottom line with this company,” Zaheer said. “Companies need to take a look at their tech stack. Are you understanding the interactions and journeys your users or prospective customers are taking on your digital platforms, wherever those might be? And can you determine where issues are arising and struggles are taking place? It can be challenging unless you have the right processes and technology.”

Be it through an in-store kiosk or a great online user experience, fashion retailers, and brands need to be able to reach and connect with their customers in multiple places. Nearly 3 in 10 shoppers (28 percent) say they get clothing ideas from in-store displays, while 27 percent cite brand/retailer websites and 11 percent say emails from brands or retailers, according to the Cotton Incorporated’s 2022 New Year Survey (January 12, 2022).

Sumner says ecommerce customer data is driving brick-and-mortar shopping, and retailers are investing heavily to make in-store customers more trackable. Conversely, he says, while store locations provide better browsing and discovery, the wealth of product content found online is missing. He says in-store kiosks can enroll shoppers in loyalty programs, provide interactive retail displays that educate shoppers about a product from the moment they touch it and offer discounts that can be redeemed in-store via QR codes.

“It’s an exciting time for retail,” Sumner says. “It’s an exciting time where things are changing rapidly and I think the way we work together is going to change rapidly. I think the people who are bold and get out there, get ahead of it, and align their needs with the needs of their retail partners are going to be in very powerful positions going into 2023.”