It seems you can’t watch TV, ride the subway or scroll a social platform without being hit with some sort of semaglutide or GLP-1 ad. And Americans are responding to the messaging, with spending on these weight loss meds increasing and the obesity rate decreasing. This trend is considered good news for health, but it’s also having an effect on plus-size apparel.

Sotira is a top distributor in the U.S. for brands, manufacturers, and retailers looking to offload overstock.

Mid- to bridge-level designers remain the best market for providing the most sustainable and quality-based natural fabric clothing for plus-sizes.

Martina Carello, founder, Colour Alchemist Canada

“A lot of retailers and brands are pulling their plus-size lines entirely,” said Sotira’s Amrita Bhasin, the firm’s co-founder, in an interview with the Lifestyle Monitor™. “From my vantage point, which is inventory forecasting and reverse logistics, we’re seeing plus-size is being liquidated – and it feels potentially prematurely. On top of that, in the last 6-to-9 months, we see SKU ranges are definitely getting smaller. The trends around this are accelerating faster than anybody has really planned for – especially on the production side. So, if we make any decisions now, we may see we need even fewer plus sizes in 9 months. Or brands and retailers may have regrets and feel like they pulled too much. We don’t know what’s going to happen.”

The issue for retailers is that despite weight loss drugs, most Americans are still overweight, meaning the “average” woman is still in the plus category. And they are finding their options more limited than before. Consider that the average dress size worn by American women is 16-to-18, according to the World Population Review. But FIT professor Mallorie Dunn told the Lifestyle Monitor™ in an interview that numerous major brands don’t fit the “average” woman’s waist of 38 inches, which corresponds with size 1X or 2X. She said brands from Chanel to American Eagle offered no product that fit the “average” consumer in research from last February and again last week.

Meanwhile, Dunn says that back in February, 86 percent of H&M’s stock fit the “average” or plus consumer, and that’s now down to 50 percent; Nike was at 82 percent and is down to 61 percent. Old Navy was at 76 percent but is at 61 percent now; L.L.Bean went from 63 percent to 46 percent. And Shein went from 10 percent to 0.3 percent.

WGSN’s Laura Yiannakou, women’s wear senior strategist for the trend forecasting and analytics firm, says the key takeaway for brands – including the plus-size market – is the urgent need to evolve beyond the current static sizing model, which cannot accommodate the consumers’ ongoing, rapid, and non-linear body shape and weight fluctuation. It should also be noted by retailers that research has shown the majority of people taking semaglutide-type drugs stop treatment within two years – thus, reversing their weight loss.

“Success will depend on brands thinking smarter and implementing more fluid fit solutions, which necessitates a strategic return to the design stage for problem-solving,” Yiannakou told the Lifestyle Monitor™ in an interview. “This includes, first, a greater investment in adjustable and flexible silhouettes; second, developing pragmatic ‘multi-size-fit’ base blocks such as M–XL for every day, and less critically fitted items like boxy tees and oversized sweaters; and third, prioritizing body comfort over bodycon, recognizing that how the wearer feels is as critical as how they look, especially for GLP-1 users who report sensitivity to temperature and fabric.”

Research shows comfort ranks highly among the plus community. Consumers who purchase plus-size apparel say they are very likely to look for stretch (72 percent), breathability (69 percent) and chafe resistance (62 percent), according to Cotton Incorporated’s 2024 Sizing survey of 974 U.S. consumers. That compares to 63 percent, 61 percent, and 51 percent, respectively, among those who don’t buy plus clothing.

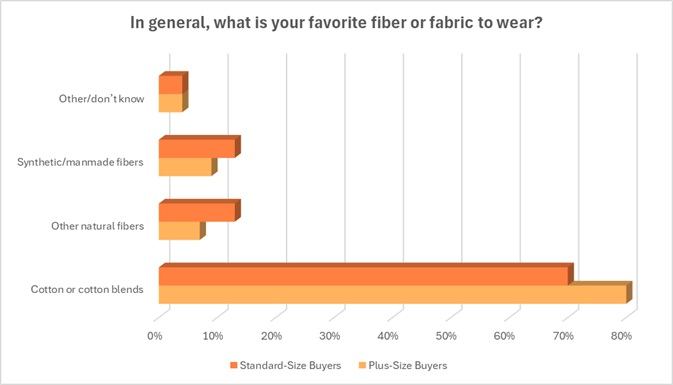

Plus-size shoppers also seek the natural comfort and breathability of cotton. Fully 8 in 10 plus shoppers say cotton or cotton blends are their favorite, according to the 2024 Sizing survey. That compares to 70 percent of non-plus shoppers.

Despite the changes brought by semaglutide, the global plus-size clothing market is expected to experience a 4.8 percent CAGR from 2025 to 2031, reaching an estimated $357 billion by 2031, according to Research and Markets. The firm says major factors for the forecasted increase include the growing demand for fashionable, cutting-edge plus-size consumer options and a focus on sustainability. “The use of eco-friendly materials and ethical production methods is becoming a key market driver.”

Swiss brand Sumissura produces made-to-measure clothing and already relies on natural fibers, according to Raquel Rodriguez, senior manager, public relations.

“Sumissura specializes in tailoring and uses high-quality fabrics, including premium cotton, structured denim, etc., that are available for all garments, regardless of the customer’s size,” Rodriguez told the Lifestyle Monitor™ in an interview. “There will never be a compromise on quality simply because the size is larger.”

Martina Carello, founder of Colour Alchemist Canada, a design studio for fashion startups and aspiring designers, said mid-range product offerings and more affordable small design companies have embraced the concept of inclusivity at a greater scale. She said they offer more natural fabrics and follow slow fashion trends.

“Mid- to bridge-level designers remain the best market for providing the most sustainable and quality-based natural fabric clothing for plus-sizes,” Carello told the Lifestyle Monitor™ in an interview. “Often, these are small designers who are purpose and ethics driven, put pride into the quality and inclusivity of their product, and win the most loyalty from the plus-sized consumer.”

The smaller brands may garner more loyalty from the plus community because as Dunn has found, most larger brands are decreasing their plus offerings.

“Gap is the only brand to go up – they were at 50 percent and are now at 89 percent,” Dunn said. But even brands that offer plus-size stock don’t always make it easily accessible. At H&M, only 14 percent is available in store. At L.L.Bean, it’s all online. “And while Gap is now leading the pack at 89 percent of stock fitting the average consumer, (none) is in store. The one positive is that it is completely equitable at Old Navy. The percentage they have online for the average shopper is also available in store.”

Although, Dunn added, in-store availability at Old Navy dips after 3X.

Nearly half (47 percent) of those who purchase plus-sized clothing say if more stores offered clothes that fit them well, they would shop more often, compared to 40 percent among all other consumers, according to Cotton Incorporated’s Sizing Survey research. This is worth noting because the majority of plus consumers like or love shopping, both in-store (73 percent) and online (70 percent). That’s just 7 percent less than non-plus shoppers.

Author Erin Zhurkin’s book Plus-Size In Paris was released two years ago at the peak of the body positivity movement and was based on her personal experiences living in the French city as a plus-sized American woman. She says the GLP-1 shots have definitely had an impact, from the runways to retail.

“There are many instances of plus-size models saying they can’t get jobs anymore because the demand for them has dwindled,” Zhurkin told the Lifestyle Monitor™ in an interview. “The runways now are showcasing unattainable bodies except for a few select designers like Ester Manas and Christian Siriano.”

Zhurkin agrees plus-size fashion options are decreasing, with in-store options capping at 3X. But she added it’s not all bad news. She does see better fabrics being used, in fact just recently receiving a soft cotton dress from Finland-based Kaiko. And there are major brands where plus shoppers can continue to turn.

“Torrid has stayed true to their brand’s mission of being inclusive no matter what,” Zhurkin said. “Target still has good options…I’m encouraged by the new Ashley Graham line with JCPenney. They are good, stylish clothes that make you feel empowered.”

As WGSN’s Yiannakou said, clothes and intimates that support, sculpt, lift, and promote wellness will be essential in 2026 and beyond.

“Mirroring this need for product fluidity, the body positivity message is shifting toward recognizing that bodies naturally change throughout life – through health journeys, medication, aging, and lifestyle,” Yiannakou said, “meaning fashion narratives must center on comfort and well-being, supported by diverse, authentic imagery that reflects real bodies.”