Even though inflation has decreased steadily for six months, unemployment is at its lowest level in half a century and U.S. single-family housing starts increased by double digits in December, consumer confidence declined in January. And that may have an effect on how consumers shop for apparel in the coming months.

The customer’s wallet was definitely facing some pressure, so the need to stay focused on the value equation in the market was also very real

Paige Thomas, President & CEO, Saks OFF 5TH

“Consumer confidence declined in January but it remains above the level seen last July, lowest in 2022,” said Ataman Ozyildirim, senior director, economics at The Conference Board, in a statement. “Consumers’ assessment of present economic and labor market conditions improved at the start of 2023. However, the Expectations Index retreated in January reflecting their concerns about the economy over the next six months. Consumers were less upbeat about the short-term outlook for jobs. They also expect business conditions to worsen in the near term. Despite that, consumers expect their incomes to remain relatively stable in the months ahead.”

This dip in consumer confidence reflects data that shows 7 in 10 consumers are “very concerned” about the economy, according to Cotton Incorporated’s 2023 Inflation and Supply Chain Survey (Wave 4).

The Consumer Confidence Index now stands at 107.1, down from 109 in December. However, the Present Situation Index, which is consumers’ assessment of current business and labor market conditions, increased to 150.9, up from 147.4 last month. On the other hand, the Expectations Index, which is consumers’ short-term outlook for income, business and labor market conditions, fell to 77.8 from 83.4.

Despite these consumer concerns, the retail industry has been driving the economy, said the National Retail Federation’s Matt Shay, president and CEO, when he spoke on the NRF’s Retail Gets Real podcast in January.

“We’ve seen more than 30 consecutive months of year-over-year growth in retail sales,” Shay said. “That’s the part of the economy that’s really been a bright spot — fueled by pandemic savings but I think also retailers deserve a lot of credit for finding solutions to the challenges in an inflationary environment. They’re helping deliver goods to consumers in a way that make them still affordable and doing everything they can to hold costs down to deliver value in new ways.”

About half of all consumers (53 percent) feel like inflation and the economy are impacting them more severely than a few months ago, according to the 2023 Inflation and Supply Chain Survey. That’s resulted in 38 percent of consumers spending less on clothes in the past month.

Looking ahead, more than three-quarters (76 percent) of consumers say they plan to make an effort to reduce their spending on clothes in the coming months, with one quarter of consumers (25 percent) saying they will make maximum effort, according to the 2023 Inflation and Supply Chain Survey.

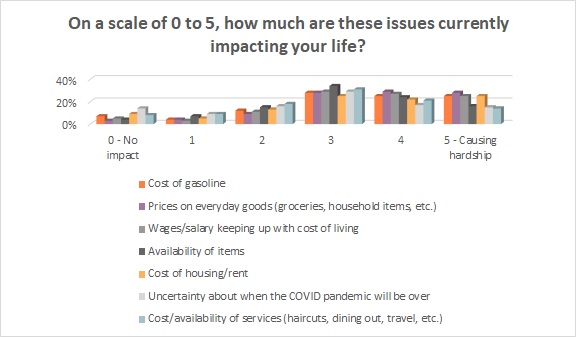

The increased prices on commodity goods seems to have consumers putting apparel purchases on the backburner. For example, 77 percent of shoppers say the cost of gasoline is having an impact on their life, with 24 percent of that group saying it’s causing severe hardship, according to the 2023 Inflation and Supply Chain Survey. Also, 85 percent say the price of groceries and household items is having an impact, with 27 percent citing severe hardship. And 71 percent say the cost of housing/rent is impacting them, with one-quarter (25 percent) saying it’s having a severe effect.

A handful of consumers (5 percent) feel like the economy has already improved and another 4 percent think it will improve within the next month, according to the 2023 Inflation and Supply Chain Survey. Others think it will improve by the spring (9 percent) or fall (10 percent). Unfortunately, the plurality (26 percent) feel like things won’t improve until sometime in 2024, with another 22 percent saying they don’t expect improvement for two (2025) or more years. Another 24 percent of consumers say they don’t know if it has improved.

In the meantime, consumers are shopping differently to make their dollars go further. More than half of all shoppers (53 percent) say they are buying less of the things they want, according to the 2023 Inflation and Supply Chain Survey. Another 46 percent are taking better advantage of sales, discounts and promotions. More than 4 in 10 (43 percent) are buying generic/store brand items, while 39 percent are shopping at lower-priced retailers. Beyond that, 32 percent say they are buying less of the things they need, while 29 percent are putting off purchases until things improve. Dining out (61 percent) and apparel for themselves (58 percent) are the top item consumers are buying less of or putting off purchasing.

Not everything is gloomy, though. The Wall Street Journal recently reported that in the face of all this austerity, some consumers have been engaging in “revenge spending,” or splurging on something for themselves after cutting back or buying generic or cheaper items for everyday living. This is leading luxury brands to offer more fashion items at lower price points.

That has benefitted luxury off-price stores like Saks OFF 5TH. At the recent NRF Big Show, Paige Thomas, president and CEO, said as the holidays approached, the store realized the drop-off in consumer purchasing was very real.

“The customer’s wallet was definitely facing some pressure, so the need to stay focused on the value equation in the market was also very real,” Thomas said. “As we saw in the holiday season, and as we’ve seen on an ongoing basis, it really is about great brands at incredible prices.”