When considering new apparel purchases, consumers have much to contemplate style, fit, quality, price and comfort among them. Delivering all that in a seamless fashion be it online, in-store or a hybrid of the two is all part of the new customer experience (CX). And some companies are closely examining CX indicators to help meet customer expectations and spur business in this new, pandemic-driven retail environment.

It’s how you communicate with potential customers, set expectations about your products or services, and all the little ways they interact with you before you ever make a sale.”

Michelle Brigman

Senior Director of Strategic Alliances, Medallia

Medallia, a customer experience solutions company, says even though the purchasing journey is more complex than ever, with consumers interacting with brands across multiple channels, now is an opportune time to connect with today’s shoppers. While some information can be gained from passive surveys, the firm says the “richest customer signals” are found in the indirect and observational data shoppers share every day.

“We help understand the drivers of customer satisfaction, including customer sentiment, key topics and themes,” says Medallia’s Naavica Adunur, product marketing manager, in “Discovery Day: Using CX Indicators to Drive Business Outcomes,” a company webinar. “Predictive and prescriptive AI [artificial intelligence] models take analysis a step further beyond what manual analysis could do alone, to identify customers in need of attention and prescribe the next best action to take in order to improve loyalty, increase sales and reduce churn.”

Medallia analyzes social media data and third-party reviews, and has added voice, video and digital behavior capabilities. Medallia’s Vignesh Aiyer, solutions consultant, says the voice and video capabilities that ask consumers things like, “what could we do better” garner six times more unstructured feedback. Respondents who can also leave text feedback, and a new capability called Common Boost gives respondents “helpful encouragement” as they’re typing to “ensure they’re leaving a robust text response.”

Aiyer says brands can now identify technical or navigation issues, frustration, and engagement within a platform. Among other things, AI can recognize themes and how often a topic is brought up, as well as the sentiment associated with it. This helps employees understand what’s happening and take action more quickly, even during a call or text chat.

It’s this kind of action that can make a positive impression with consumers, establishing the difference between a good or bad shopping experience. And the clear majority of consumers (87 percent) say having a fun/enjoyable experience is important when shopping for clothes, whether online or in-store, according to the Cotton Incorporated Coronavirus Response Survey (Wave 9, December 2021). Half of these shoppers (50 percent) classify a good experience as being “extremely important.”

Whether they’re buying from a social media page, a brand’s website or a physical store, nearly 7 in 10 consumers say they consider clothes shopping to be a fun, social activity (69 percent), according to the Cotton Incorporated Coronavirus Response Survey (Wave 10, March 10, 2022). And 87 percent rate customer service as important when clothes shopping — again, whether in a physical store or a digital platform, according to the Coronavirus Response Survey (Wave 9).

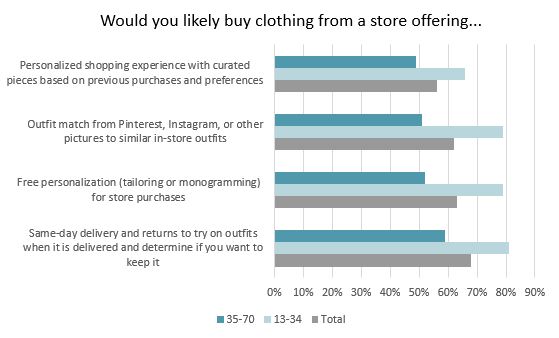

Although most consumers already enjoy shopping for clothes, that doesn’t preclude them from having suggestions about how to make the experience better. For example, 68 percent of people would buy from a store that offers same day delivery and returns, allowing shoppers the opportunity to try on an outfit when it’s delivered to determine if they want to keep it, according to the Cotton Incorporated November 2021 Lifestyle Monitor™ Survey. Another 62 percent would shop stores that offered the ability to match a picture of an outfit seen on social media to a similar outfit offered at that store. And 56 percent would like a personalized shopping experience with collections pulled together based on their previous purchases and preferences.

SAP’s Esteban Kolsky, chief evangelist for CX, says today’s customers are now more connected and better equipped, putting them in a position to demand experiences.

“We moved from one-sided relationships to two-sided interactions, and we brought sentiments and feelings to the whole thing,” Kolsky states in SAP’s The Future of Customer Engagement and Experience. “The most important lesson was: experiences are not managed or designed by the company. They are what customers undergo (experience) when proper interactions happen.”

And Shayonie Mila Kundu, product specialist, global solution marketing for SAP customer experience, says in SAP’s Future of Customer Engagement and Experience that companies who succeed in 2022 “will bridge the online and offline divide, fully integrating systems and software to create an omnichannel experience that encompasses their entire brand — from brick and mortar to ecommerce stores. “

Bridging that online/offline divide is crucial, as the pandemic shifted shopper habits, essentially evening out where they shop. During the pandemic, just 20 percent bought all their clothes in a physical store, according to the Coronavirus Response Survey (Wave 10). When the pandemic is over, 28 percent of consumers say they expect to buy all their clothes from brick-and-mortar stores, which is significantly less than pre-COVID (41 percent). About one-quarter (24 percent) anticipate buying mostly in-store with a few items purchased online. But more (27 percent) expect to buy half their clothes online and half in-store. As well, markedly more (17 percent) will be buying mostly online with a few items purchased from a physical store. Only those who expect to buy all their clothes online remains almost unchanged (5 percent).

In a recent ebook titled “Expand Your Thinking Around CX Strategy,” Medallia’s Michelle Brigman, senior director of strategic alliances, says, “it’s not trite to say that CX is everything.”

“It’s how you communicate with potential customers, set expectations about your products or services, and all the little ways they interact with you before you ever make a sale,” Brigman states. “Beyond the sale, there’s the post-purchase period and how customers feel when interacting with your contact center agents. Then, there’s how a customer feels when they shop your brand. There’s a tendency to focus CX efforts just on obtaining customers, when what businesses should really be doing is thinking holistically about the entire customer journey and addressing challenges before they arise.”