Consumers may seem like walking contradictions right now – saying they feel one way about the economy but acting differently with when it comes to purchasing. And that has helped lead economists to expect a positive holiday season, particularly in the gifting sector.

But first, back to the inconsistent consumer. The Conference Board’s Consumer Confidence Index showed a moderate decline in October to 102.6, from 104.3 in September. Further, the Conference Board said October marked the third consecutive month of decline. However, the National Retail Federation (NRF) forecasts holiday spending will reach record levels this season, growing between 3 percent-to-4 percent over 2022 to between $957.3 billion and $966.6 billion.

Despite an unpredictable economic environment, where consumers face several challenges, we expect strong e-commerce growth this season on account of record discounts and flexible payment methods.

Patrick Brown, Vice President of Growth Marketing, Adobe

Retail sales rose 0.7 percent in September, with reports noting consumers showing strength despite high interest rates and worries about the economy. Spending did slow, though, in October, with retail sales dipping slightly by .08 percent, according to the CNBC/NRF Retail Monitor. While there was weakness in gas, electronics, appliances, and furniture, the survey showed strength in sporting goods and hobby stores, as well as internet sales.

Last January at the National Retail Federation show, a group of economists had a very cautious outlook for the U.S. economy, amid worries about a recession. But at the end of the presentation, Morgan Stanley’s Sarah Wolfe, economist, said, “Overall, the consumer is what will pull us through in 2023.” And she was right. Consumers are spending despite their economic concerns.

The NRF’s Jack Kleinhenz, chief economist, says the story for the holiday season looks very good.

“In general, the average household remains on relatively solid financial footing despite pressures from still-high inflation, stringent credit conditions and elevated interest rates,” Kleinhenz states in the NRF’s November Economic Review. “Recent revisions to government data indicate that consumers haven’t drawn down as much of their pandemic savings as believed earlier, and savings are still providing a buffer to support spending.”

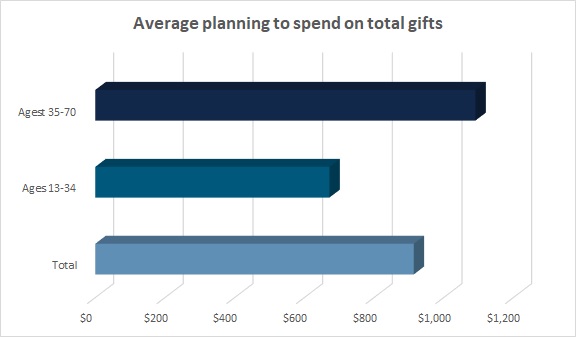

This holiday season, shoppers are expecting to spend $914 on gifts, according to the 2023 Cotton Incorporated Lifestyle Monitor™ Survey. That’s a very significant 38 percent increase over last year’s $661, and a 9 percent jump from $837 in 2021.

The Conference Board’s Dana M. Peterson, chief economist, says Americans are entering the holiday season in a cautious mood that may affect overall spending, but not gifts, per se.

“Planned spending on non-gift items fell materially this year,” Peterson notes. “Notably, food — a common non-gift holiday item — is expected to cost more this year compared to last, which may have lowered consumers’ desire to purchase non-gift items. However, consumers still seem to want to engage in some holiday cheer, as reflected in a rebound in gift spending after last year’s slump. The uptick in intended gift-giving is despite consumers’ expectation of higher costs for such items.”

That’s good news for retailers, apparel retailers in particular. On average, holiday shoppers plan to spend $321 on clothing gifts, similar to $323 in 2022, according to Monitor™ research. Nearly 8 of 10 consumers say they are spending more (22 percent, up from 13 percent in 2022), or the same (57 percent, down from 64 percent last year) on clothing gifts this year versus a year ago. Significantly more younger (ages 13-34) shoppers (27 percent) are spending more on apparel gifts than their older counterparts (19 percent).

On average, shoppers plan to purchase clothing gifts for about 4 people this season, the same as last year, according to the Monitor™ research. And the majority of consumers (68 percent, up from 62 percent in 2022) say they would like to receive clothing as a gift this season, as well.

When looking for inspiration for those clothing gifts, many consumers say they will be looking to social media sites like Facebook, Pinterest, and Instagram, according to the Monitor™ research. Of note, younger shoppers ages 13-to-34 are significantly more likely to seek gift inspo from social platforms than their older counterparts (33 percent versus 25 percent). In fact, the only factor that gives younger consumers more inspiration for clothing gifts is the person for whom they’re actually purchasing the gift (36 percent).

Among apparel gift givers who say they get their inspiration from social media, the majority turn to Instagram (68 percent), according to the Monitor™ research. That’s followed by TikTok (57 percent), Pinterest (52 percent), Facebook (49 percent), and YouTube (38 percent, down from 51 percent in 2022 and 63 percent in 2021).

Consumers who plan to buy clothing gifts this holiday season say they will be purchasing the majority of them in stores (57 percent) versus online (43 percent), according to Monitor™ research. And of the clothing gifts bought online, most will be purchased using a smartphone (58 percent), followed by a computer (30 percent, down from 37 percent in 2022), and then a tablet (12 percent).

Adobe expects U.S. ecommerce holiday sales to reach $221.8 billion this season, a 4.8 percent growth over 2022. The software company says discounts and the increased usage of Buy Now, Pay Later (BNPL) flexible spending methods will drive online spending as consumer look to stretch their holiday budgets.

“Despite an unpredictable economic environment, where consumers face several challenges, we expect strong e-commerce growth this season on account of record discounts and flexible payment methods,” says Adobe’s Patrick Brown, vice president of growth marketing. “Buy Now, Pay Later in particular has become increasingly mainstream and will make it easier for shoppers to hit the buy button, especially on mobile devices where over half of online spending will take place.”

Over one-third of holiday shoppers (36 percent) say they plan to use layaway or BNPL to buy holiday gifts this year, according to Monitor™ research. McKinsey says more than 50 percent of Gen Z say they think they will use BNPL in their holiday shopping.

“So for retailers, it will be really important this year to think about not only what you’re providing but also how to help consumers feel like they can afford it,” said McKinsey’s Tamara Charm, partner, and senior expert and co-leader of the firm’s agile insights group, during the McKinsey on Consumer and Retail podcast.

Despite the increase in holiday ecommerce, retailers should know that most consumers still want all the Christmas feels that come from shopping in-store. More than 7 of 10 holiday shoppers (72 percent) say they prefer to shop for gifts in-store because they enjoy the overall experience, according to Monitor™ research. Interestingly, men (77 percent) are significantly more likely than women (68 percent) to agree.

Just over one-fifth of apparel gift givers plan to do most of their shopping at mass merchants (22 percent) and online-only retailers (21 percent), according to the Monitor™ data. That’s followed by off-price stores (11 percent), department stores (8 percent), chain stores (8 percent), fast-fashion retailers (7 percent), specialty stores (6 percent), and sporting goods/outdoor stores (3 percent).

“We see a lot of enthusiasm to come into stores,” Charm says. We also see a lot of enthusiasm to look at apps and websites. Consumers are saying they plan to shop across all of those channels. And consumers are increasingly expecting that anything they want, wherever and whenever they want it, they can get. And they want retailers to understand who they are, when they’re shopping and where they might want to get something – and coordinate it all. That is a challenge for retailers, one wherein consumer expectations are sky-high.”

Simplrr’s Carolyn Clark, vice president of employee experience at the Redwood City, CA-based employee engagement software firm, says the many holidays and shopping events this time of year can have “profound implications” for store employees and, by extension, customers.

“During these peak shopping periods, employees often face intense pressure to manage increased workloads, which makes a robust EX (employee experience) critical,” Clark says. “Companies that invest in their employees’ well-being through comprehensive training as well as supportive and unified work environments enable their workforce to deliver exceptional service. This commitment to EX pays dividends in CX (customer experience), as happy, empowered employees are the bedrock of positive customer interactions. In turn, satisfied customers are more likely to make purchases and become repeat patrons, driving sales and fostering brand loyalty. Ultimately, the synergy between positive EX and CX during these high-stakes sales events can lead to significant uptick in profitability, illustrating that a company’s financial success is closely tied to how it treats its employees.”

The Monitor™ research indeed shows that consumers will be shopping every avenue possible this year, whether online or in stores. Nearly half of consumers (46 percent) say they will be one of those people taking advantage of late-night store hours in the last few nights leading up to the holiday.. That number increases to 51 percent among younger (ages 13-34) shoppers. Another twist: The majority of holiday shoppers (59 percent) say they like to browse for clothing in-store for the experience but make the purchase online. Among younger shoppers (ages 13-34), that figure jumps to 64 percent. Additionally, half of holiday shoppers (49 percent) plan to take advantage of ship-to-store options for gifts.

Almost three-quarters of all shoppers (72 percent) say they plan to do research online for their holiday gifts, according to the Monitor™ research.

Among consumers who plan to shop online, the biggest shopping holiday was expected to be Black Friday (57 percent), according to the Monitor™ data. Significantly more younger (ages 13-34) shoppers planned to shop online on Black Friday (65 percent) than those aged 35-to-70 (51 percent). The next most popular online shopping day is Cyber Monday (49 percent), followed by the week leading up to Thanksgiving (20 percent), National Free Shipping Days (19 percent), Christmas Eve (18 percent), Thanksgiving Day (17 percent), and Green Monday (the second Monday of December). Of note, 12 percent kicked off their shopping early over Labor Day weekend.

Black Friday is also most popular among consumers who plan to shop in-store (59 percent), according to the Monitor™ research. Again, younger shoppers ages 13-to-34 (65 percent) were significantly more likely to shop on Black Friday than their older counterparts (55 percent). The next most popular time to shop in-store is the week leading up to Thanksgiving Day (34 percent), Small Business Saturday (27 percent), Christmas Eve (31 percent), and Thanksgiving Day and the day after Christmas (both 23 percent). Again, another 21 percent shopped for holiday gifts over Labor Day weekend.

The International Council of Shopping Centers (ICSC) also found that 1 in 4 consumers kicked off their holiday shopping in August or earlier. And of those who shop earlier in the season, 51 percent are looking for early promotions.

“This year will continue the trend of consumers starting their holiday shopping earlier and spreading it out throughout the season,” says the ICSC’s Tom McGee, president and CEO. “While landmark holiday milestones like Black Friday and Thanksgiving Weekend remain important, it’s equally important for retailers to capture consumer interest throughout the season. Offering competitive promotions, free and reliable shipping and seamless omnichannel experiences throughout the holidays is a key part of that.”