Despite uncertainty before the holiday season, retail sales saw strong growth, according to the National Retail Federation (NRF). But spending wasn’t equal among age and economic classes. And that gap could widen in 2026, affecting retailers and brands. Analysts say AI, trade tensions and tariff talks will also weigh on consumers this year, although nobody can predict exactly how much. It just makes planning that much more of a fine art.

Gen X and Boomers are still the biggest purchasers on the traditional retail channels, like department stores. Those trends are hard to break. But Amazon has been growing. Even this year, in the last 3-to-6 months, there’s been a surprising increase in places like TikTok Shop. The growth is extending beyond just Gen Z and it’s starting to grow pretty rapidly.

Peter Volberding, senior director, data analytics, Pyxis by Bain & Company

CNBC/NRF Retail Monitor data shows 2025 holiday spending from November1 through December 31 grew 4.1 percent. December sales were up in six of nine categories on a yearly basis, including clothing stores. Clothing and accessories stores were up 2.05 percent month over month seasonally adjusted and up 6.11 percent year over year unadjusted, according to the NRF data.

Looking ahead, Oxford Economics’ Michael Pearce, chief U.S. economist, said his firm is forecasting the economy will grow about 2.8 percent over the year, up from 2.2 percent. He spoke at a session at the NRF Big Show earlier this month.

“It’s a relatively strong number, but it just does not resonate with a lot of people,” Pearce said. “That is because we’re seeing this bifurcation of the economy. We’ve got strong growth in the economy, but it’s not creating that many jobs. We’ve had tariffs put pressure on inflation. We know wealth is inequitably distributed. It tends to be older, richer households that own the wealth and are spending in the economy, while middle-income and lower-income consumers have been left behind.”

Bank of America Institute’s David Tinsley, senior economist, spoke at the same session, and added expected tax refunds and potential changes from the Trump administration regarding housing gives “some hope that this K-shaped economy narrows a bit this year.”

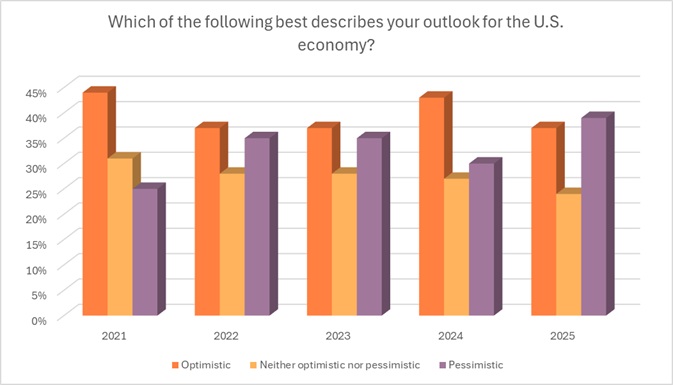

Despite this allusion to hopefulness, U.S. consumers are entering 2026 with concerns about finances and the economy. In Cotton Incorporated’s 2025 Lifestyle Monitor™ Survey of 6,000 U.S. consumers, 37 percent say they feel pessimistic about the economy, up from 30 percent in 2024 and the highest since 2021.

Just under half of U.S. consumers (47 percent) say their personal finances are a top concern in 2026, and 38 percent cite inflation and the economy, according to Cotton Incorporated’s 2026 New Year’s Survey, which interviewed 891 respondents.

The share of consumers who feel optimistic about their personal finances fell from 53 percent in 2024 to 48 percent in 2025, according to the Monitor™ Survey. Just under a quarter (22 percent) say they are pessimistic about their financial situation, the highest level in five years.

The dichotomy in spending and attitudes can be seen how and where consumers shop for apparel. Peter Volberding, senior director of data analytics for Pyxis by Bain & Company, spoke with the Lifestyle Monitor™at the NRF Show. He said there has been a retail channel shift among Gen Z and Millennials.

“Walmart, Costco and Amazon have seen the biggest shift, where apparel shopping is actually growing pretty rapidly away from some of the traditional fashion retailers,” Volberding told the Monitor™. “Gen X and Boomers are still the biggest purchasers on the traditional retail channels, like department stores. Those trends are hard to break. But Amazon has been growing. Even this year, in the last 3-to-6 months, there’s been a surprising increase in places like TikTok Shop. The growth is extending beyond just Gen Z and it’s starting to grow pretty rapidly.”

Nobody gets the “TikTok Made Me Buy It” trend more than Millennials and Gen Z. And right now, because the cost of owning a home or having kids may seem out of reach for many of them, they’re engaging in “doom spending,” said YPulse’s MaryLeigh Bliss, chief content officer, in an interview with the Lifestyle Monitor™ at the NRF Show. She explains this is a pattern that was seen among older Millennials, and is now being repeated by Gen Z.

“The desire to spend on a house or a car is there, but they just can’t afford it,” Bliss told the Monitor™. “So, that spending goes into smaller, immediate splurges. The mentality behind doom spending is, ‘I might as well buy it now, because I’m not even going to be around to enjoy something like a house later on.’ We see that really continuing to be a big portion of their spending going forward.”

Bliss added Gen Z has been behind the second-hand boom over the last few years.

“They’re still looking for deals, even though they have no hope for the future,” Bliss said. “They still have the budgets they have, and they are really discount focused because of how they’ve grown up, whether or not there’s going to be a recession. Their baseline price expectation is shaped by what is at Target and Amazon.”

It makes sense that young people are shopping for deals at discounters and the like, considering that 63 percent of those aged 13-to-34 feel clothing prices have increased faster than most other things, according to Monitor™ research. That sentiment, while significantly less at 54 percent, is also shared by most of those aged 35-to-70.

Because of this price sensitivity, a number of apparel shoppers say they will be prioritizing needs over wants this year. According to the Monitor™ survey of 500 shoppers, while 62 percent of shoppers say their purchasing habits will remain the same, nearly 3 in 10 (29 percent) say they’ll focus more on buying the clothes they need rather than what they want.

Another consumer priority will be comfort. More than half (52 percent) describe their clothing style for 2026 as “comfortable,” and another 45 percent describe it as “casual,” per Cotton Incorporated’s 2026 New Year’s Survey. Nearly 9 in 10 surveyed (89 percent) associate cotton and cotton blends with “comfortable” fabrics. That compares to 30 percent for polyester and poly blends, and 17 percent for rayon and rayon blends.

And speaking of comfort: the comfy wide-leg jean’s moment may (or may not?) be on thin ice. Bliss said in a panel discussion at the NRF Show that Gen Z is cycling through trends faster than ever.

“They’ll tell us things that were cringe last year – sorry, Millennials who just bought your first pair of wide-leg jeans – now, skinny jeans are back again,” Bliss related. “And we see 77 percent of 13-to-39 year olds agree the trend cycle moves too fast for them to keep up with. So, they pick and choose what they want. It can be a trend from 15 years ago or two years ago, and both are valid to them.”

Bliss added that young shoppers are turning into AI detectives, dubious of almost everything they see. For brands that want to connect, the operative word is transparency.

“Most young consumers think AI has a more positive effect on the world than a negative one, even though they see headlines that AI is taking their jobs and they’re skeptical of what they see online,” Bliss said. Indeed, 55 percent of surveyed shoppers 13-to-34 feel that the benefits of artificial intelligence outweigh the negatives, according to Monitor™ research. “The majority of them wish social media posts that use AI had a label identifying it as AI. If brands are able to bring that transparency to them, that’s really going to help win them over and get shopper attention.”