Making it Work for You

It was nearly two months ago (yes, it does it seem much longer) that states began closing bars and restaurants, and banning gatherings of more than 50 people in an effort to “flatten the curve” of the spreading coronavirus. While some stores quickly put items on sale, it became clear right away that the situation was calling for something beyond low prices to get people to open their wallets for items that weren’t toilet paper, hand sanitizer, and alcohol.

For those with small children at home or trying to do the homeschooling as well as their job, it can be very difficult and distracting. That’s why it’s really important to have best in class abandonment campaigns, understanding how each customer needs to be communicated with and making sure your [follow-up] messages are in real time as much as possible.

Kara Holthaus

Vice President of Client Services, SmarterHQ

The U.S. Commerce Department reported March retail sales decreased a record 8.7 percent from the previous month, and 6.2 percent year-over-year. Sales at clothing and clothing accessories stores dropped 51 percent from March 2019.

Fashion marketers have had to scrap planned campaigns to cram for perhaps the biggest test of their careers: promoting ecommerce to dumbstruck consumers who may or may not still hold a job, while being sensitive to the fact that everyone is dealing with a global pandemic.

Considering states have differing timelines for reopening businesses, and customers may not yet feel comfortable with shopping in stores, it becomes more important than ever to get the ecommerce message right.

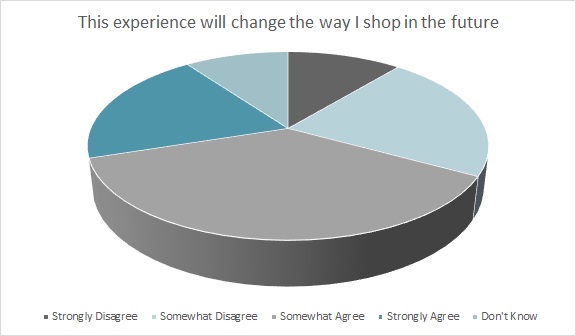

More than half of all consumers (57 percent) say this experience will change the way they shop in the future, according to the Cotton Incorporated 2020 Coronavirus Response Consumer Survey (Wave 1; March 20-25).

The Salesforce Q1 Shopping Index, powered by Commerce Cloud, found that ecommerce revenue grew 20 percent in the first quarter of this year, compared to 12 percent growth in Q1 2019. Sites that offered buy online, pick up in store (BOPIS) grew digital revenue by 27 percent in Q1, compared with 13 percent for sites that don’t offer BOPIS. Digital purchases of essential goods including food and personal care items surged 200 percent between March 10 and March 20 as stay-at-home directives were put in place. But consumers also bought non-essentials like athleisure/activewear, which saw a 31 percent increase year-over-year.

SmarterHQ’s Kara Holthaus, vice president of client services for the multi-channel behavioral marketing platform, said in a webinar that while some consumers were turning to ecommerce for retail therapy, stores and brands did not see the big shift of in-store customers to online that many may have expected.

“It’s more important than ever to send the right message, not the wrong or generic one,” Holthaus said.

During the webinar, SmarterHQ asked attendees to answer poll questions, one of them regarding if they prioritized personalized messages during the early weeks of the shutdown. Less than half (44 percent) said they sent more personalized messages, 13 percent said they sent fewer and 44 percent said their messages stayed the same. However, 100 percent of participants said they adjusted their messaging strategy based on the unique situation and changing behaviors during the pandemic.

More than 7 in 10 consumers (71 percent) say they’re spending more time online than before the pandemic, whether it’s significantly more (46 percent) or somewhat more (25 percent), according to the Coronavirus Response Consumer Survey. Another 25 percent say they’re online about the same amount of time as before.

However, just 14 percent of consumers say they’re spending more money on apparel, according to the Coronavirus Response Consumer Survey. Instead, 43 percent say they’re spending less, while 39 percent are spending about the same. It’s probably no surprise that 57 percent of consumers are spending more on groceries, and 48 percent have increased their spending on household items such as toilet paper and cleaning supplies. Another 26 percent have increased spending on food/product delivery services like GrubHub and Postmates. And 26 percent have added to their online services budget, for things like video streaming or virtual exercise programs.

Edited, the retail analytics company, recommended four style stories to help retailers and brands adapt their message strategy when reaching out to consumers during the pandemic. Its “Work-From-Home” story promotes workwear that functions for online video calls, as well as basics that probably have healthy stock levels. The “Relax & Recharge” story includes loungewear for Netflix bingeing, his and her looks for partners that live and now work together, as well as trendy, yet cozy looks. “Keep Moving” promotes activewear for those keeping up their workouts at home. Edited also recommends offering online workouts to keep customers returning to a retailer or brand’s site. Finally, “Stay Connected” is about focusing on family and friendship, so brands can promote clothes for playing in the backyard, or outfits or lingerie for video date nights — for those who are separated during self-isolation.

Among those who are shopping less online, 61 percent say it’s because they have less money or are worried about money, according to the Coronavirus Response Consumer Survey. Additionally, 78 percent somewhat (35 percent) or strongly (43 percent) agree with the statement, “I am trying to limit the money I’m spending right now.”

Nearly 8 in 10 consumers (78 percent) feel that a global recession is likely, either somewhat (31 percent) or very likely (47 percent), according to the Coronavirus Response Consumer Survey. Additionally, most consumers (70 percent) expect to see a decrease in their personal finances.

That’s why Holthaus says sensitivity is paramount in any messaging right now.

“Being able to change copy, and having that empathy and sympathy coming through in your emails is going to be key to continuing those relationships throughout this crisis, as many people are struggling due to loss of income and the gravity of the situation as a whole,” she said. “You don’t necessarily have to pause everything, but it’s critical to make adjustments.”

Consumers also say they’re shopping online less because they have less time (17 percent), according to the Coronavirus Response Consumer Survey.

“Distraction is definitely at an all time high,” Holthaus said. “For those with small children at home or trying to do the homeschooling as well as their job, it can be very difficult and distracting. That’s why it’s really important to have best in class abandonment campaigns, understanding how each customer needs to be communicated with and making sure your [follow-up] messages are in real time as much as possible.”

SmarterHQ also says it’s important for brands to optimize and stay flexible so that they can pivot as often as necessary. “We’re seeing things change every day as this goes on, especially on the inventory front with excess in certain areas, and struggles and shortages in other areas. It’s going to be critical for your team to reuse as much of the templates they build as possible and let that dynamic content work for you, versus going back to your creative team for every single campaign.”

Brands and stores need to leverage in-store date from pre-pandemic visits. They can introduce in-store consumers to online and loyalty benefits, and educate them on the perks of connecting digitally. Additionally, stores can use in-store data to cross-sell and recommend items that are similar or complement their recent in-store purchases. Brands can also use messaging if there are interruptions in their delivery cycles, as well as keep customer informed about returns and store re-openings.

Product recommendations are a quick way to personalize email blasts as well as offer relevancy and convenience on a brand’s site. Customers can be steered toward products with high inventory levels or higher margins. Also, wish lists can engage customers to let them know a product is back in stock, has gone on sale or is available in-store when stores re-open.

“I think consumers are craving that personalized content and they’re reacting, so far, in a very positive way to keep that engagement going and encourage that relationship to continue throughout this crisis.”