Tariffs, and the uncertainty around them, represent the latest challenge to the fashion industry and cotton supply chains. The corresponding implications for costs are just one factor decision makers are having to contend with. Examples of others include macroeconomic concerns, to shipping, and sustainability considerations. All imply evolving sets of challenges and potential opportunities for the cotton industry in 2025.

Bigger questions loom over the timing and volumes for buying decisions – is it better to pull orders forward in case there are further rate increases? Or is it better to delay orders in case tariffs are lowered?

Jon Devine, Senior Economist, Cotton Incorporated

The cotton industry provides critical economic support for millions of people across the globe. According to the International Cotton Advisory Committee (ICAC), cotton is grown in more than 75 countries and provides direct livelihoods for over 100 million households. The fiber plays a vital role in many national economies, particularly in developing countries, where it serves as a key agricultural export and source of rural employment.

And Jon Devine, Cotton Incorporated’s senior economist in the Corporate Strategy and Insights department, emphasized the series of economic challenges the global textile supply chain has been facing in recent years. From the first round of the trade dispute, the pandemic, stimulus that fueled a sharp rebound in consumer demand, the shipping crisis, then inflation and a corresponding spike in interest rates, the industry has dealt with a whipsaw effect on orders over the past several years.

Devine noted that after a period of drawdown, which featured a significant decrease in downstream order placement, orders began to resurface as inventories approached levels from before the pandemic. This, he said, suggested a return to normalcy.

However, before the industry could fully exhale, along came the second round of tariff disputes, which has injected another course of uncertainty for order placement. Devine says the back-and-forth on tariff rates has affected shipping costs and contributed to port congestion.

“Bigger questions loom over the timing and volumes for buying decisions – is it better to pull orders forward in case there are further rate increases? Or is it better to delay orders in case tariffs are lowered?” Devine asked. “The U.S. trade data have not been able to keep up with developments. Nonetheless, tariffs appear to be moving higher. Higher tariffs suggest higher sourcing costs, which could result in lower order volumes. It just may be some time until the dust settles enough for the data to be able to speak to the size of those potential changes.”

Global tariffs could affect apparel and footwear prices at the peak back-to-school and fall shopping seasons, although a recent Sourcing Journal report detailed how shippers are rushing to get goods to the U.S. before two tariff deadlines in July and August.

At the fiber level, Devine said there are ample available cotton supplies and prices have remained stable at lower levels.

But at the farm-level, Devine said growers are grappling with the pinch from higher input costs and low cotton prices. Meanwhile retailers and brands face sourcing questions, and debate if and how to pass on tariff costs to consumers. Further, recession concerns persist.

“Slower inflation implies a slower rate of price increases, not decreases in prices,” Devine said. “However, costs for non-discretionary items like housing and food remain elevated relative to where they were before the pandemic. This continues to pressure consumers’ ability to finance discretionary purchases, like clothing.”

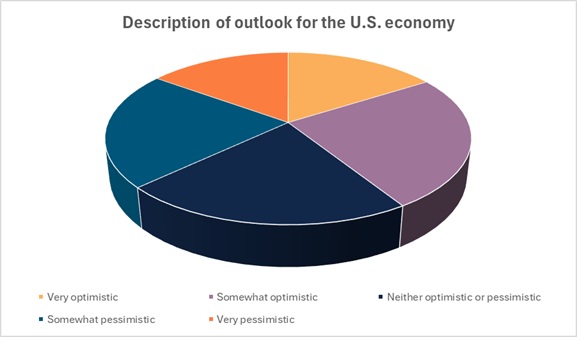

With consumer sentiment toward the economy remaining mixed, efforts to keep prices stable may play a role in supporting demand. Currently, 41 percent of consumers are somewhat (25 percent) or very (16 percent) optimistic in their outlook for the U.S. economy, according to the Cotton Incorporated 2025 Lifestyle Monitor™ Survey. That compares to 38 percent who are somewhat (22.3 percent) or very pessimistic (15.2 percent), while 22 percent remain neutral.

Consumers generally feel better about their own financial situations. Almost half (49 percent) are somewhat (31.3 percent) or very optimistic (17.8 percent), according to the Monitor™ research. That compares to 21 percent who are somewhat (14.3 percent) or very pessimistic (6.4 percent) about their financial status, with 30 percent remaining neutral.

Besides pricing concerns, consumers are looking for more transparency regarding their apparel. Consider that nearly 7 in 10 shoppers (69 percent) say it’s important to know where their apparel is made, according to the Sourcing Journal & Cotton Incorporated 2024 Industry Traceability & Recycling Survey. But far fewer – just 1 in 5 – consider it to be important to know the individual farm or facility where their clothing was produced.

But that’s not the case with makers. For companies that follow the source of raw materials, cotton is the most traced fiber (67 percent), according to the Industry Traceability & Recycling Survey. This is followed by synthetic materials (57 percent), recycled fibers (48 percent), and manmade cellulosics like rayon or viscose (47 percent).

Oritain, a global leader in product origin verification, observes that transparency within the cotton supply chain is showing signs of improvement, driven in part by growing consumer interest in where and how their products are made. Still, the company notes that challenges remain. Cotton is cultivated in more than 75 countries, each with unique environmental and labor practices, making consistency and traceability a complex task. Once cotton leaves the farm, it often moves through a multi-tiered supply chain where links between stages are not always direct. This fragmentation can make it difficult for brands to fully trace the fiber’s journey from field to finished product.

Oritain adds that the absence of global standardization in cotton production and manufacturing continues to pose hurdles, along with hesitations around adopting new systems. This is often due to concerns about cost, complexity, or disruption to established processes.

Cotton Incorporated is working with growers to improve fiber quality, make cotton easier to process and produce a more uniform product with enhanced qualities.

“This will make it a more versatile material suitable for a range of product categories,” said Cotton Incorporated’s Vikki Martin, vice president, fiber competition. “As a natural fiber, cotton fiber quality varies within the boll and across the plant. We are specifically working to improve the length uniformity of cotton to make it easier to process and potentially allow cotton to be spun into finer yarn counts.”

Martin explained that bale management systems in spinning mills can significantly aid in consistently producing the desired quality. For example, with the Engineered Fiber Selection® (EFS®) System Software, mills can better utilize their inventory and create laydowns using the quality of fiber needed to achieve the desired quality of yarn. This is a more sustainable approach to spinning, as mills can selectively purchase the qualities they need and maintain control, rather than having to overbuy on fiber quality to ensure they meet their yarn quality goals.

“Additionally, the EFS® System can capture the information of the bales being consumed in the laydown so that traceability reports can be provided to the yarn buyer detailing the origins that were used when their yarn was being spun,” Martin said. “Reports can include information about the shipment ID, contract, purchase order, invoice numbers, vendor code, bale ID, country of origin and, if available, the gin code. This kind of report provides a critical piece of information to help the supply chain better document the origin of materials and their manufacturing location.”

As the cotton supply chain evolves, ICAC emphasizes the importance of improving transparency, promoting sustainable agricultural practices, and supporting collaboration among stakeholders – to ensure cotton remains a viable and responsibly sourced material for the future.